👋 Hi, I’m Jake

I’ve SOLVED COMPLEX PROBLEMS for FAST PACED TEAMS with GREAT DESIGN since 2016

👋 Hi, I’m Jake

I’ve SOLVED COMPLEX PROBLEMS for FAST PACED TEAMS with GREAT DESIGN since 2016

jake

jake

developer

developer

you

you

studio

rog

studio

rog

studio

rog

Selected Work

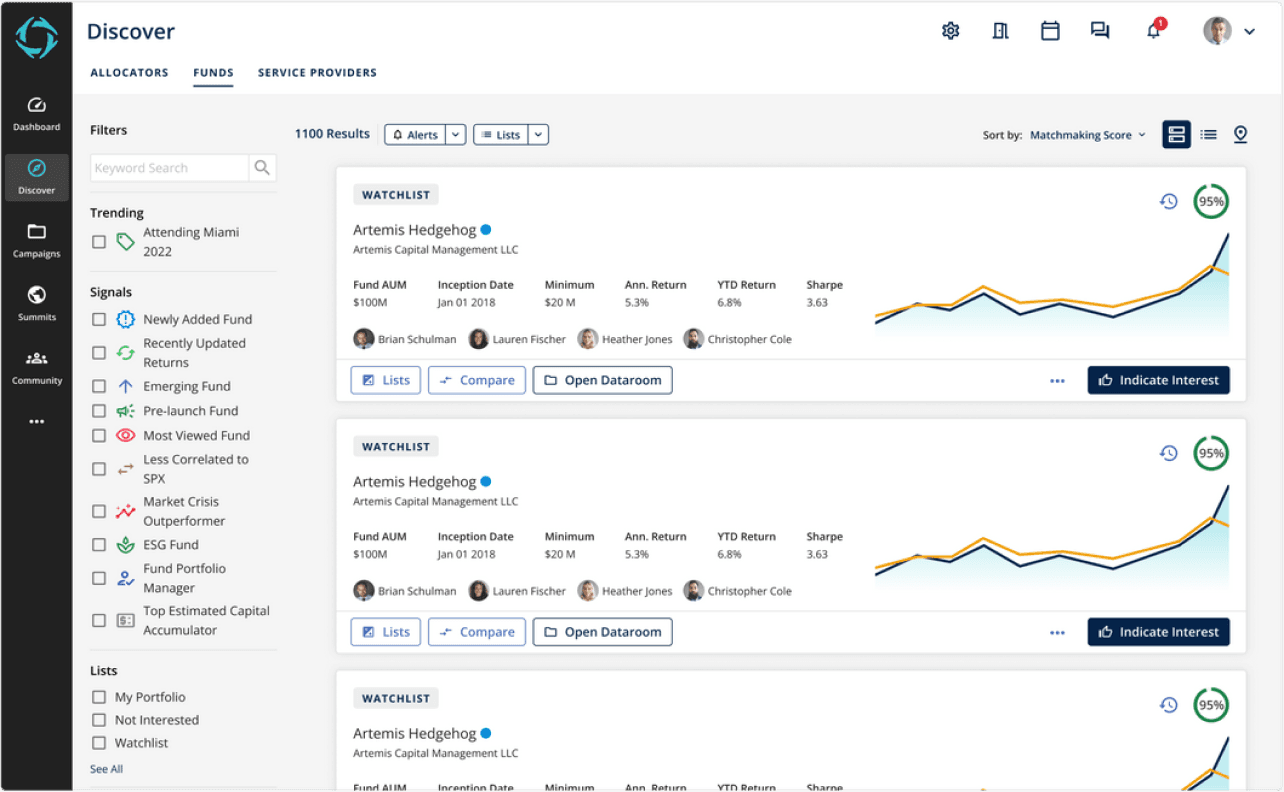

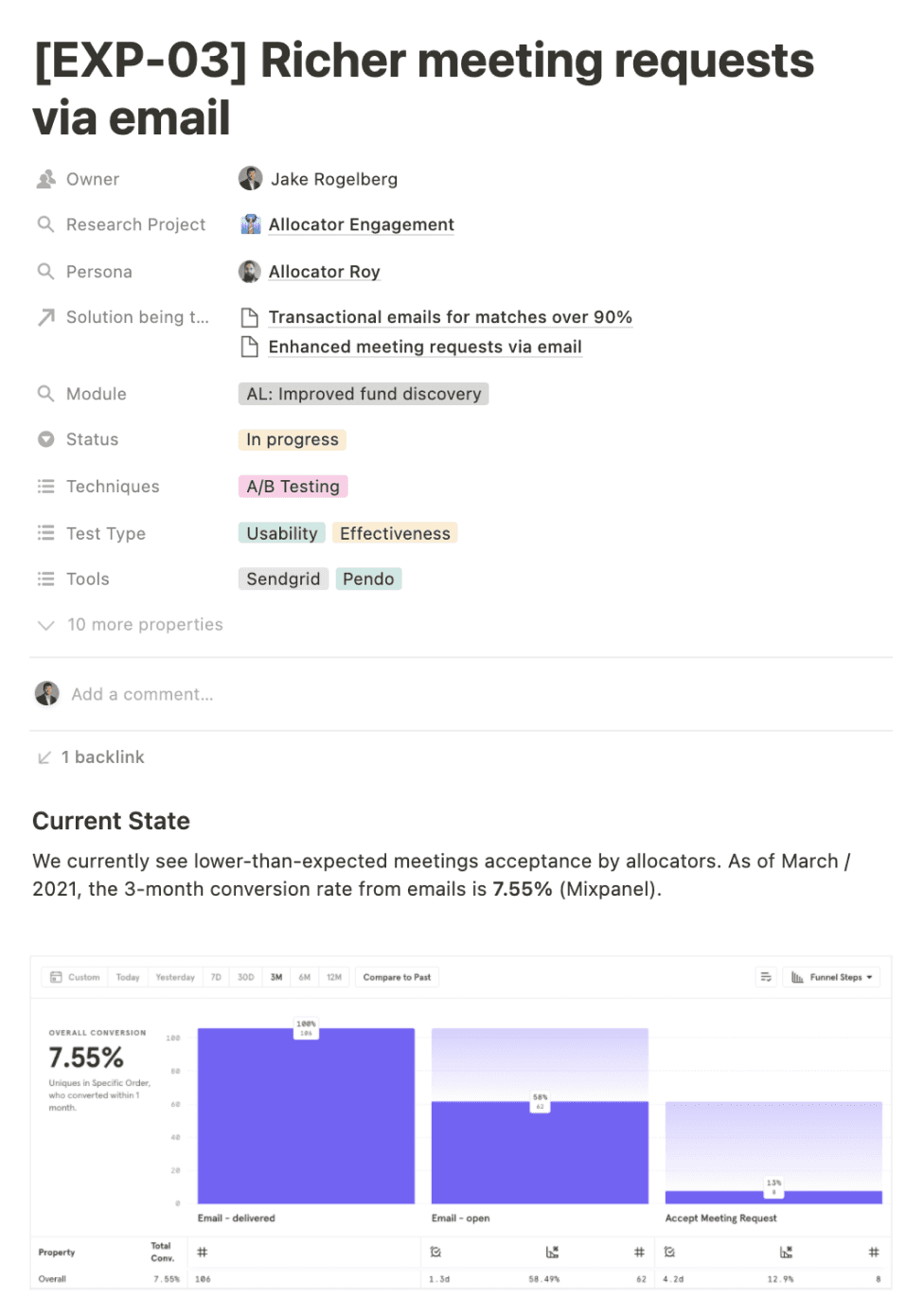

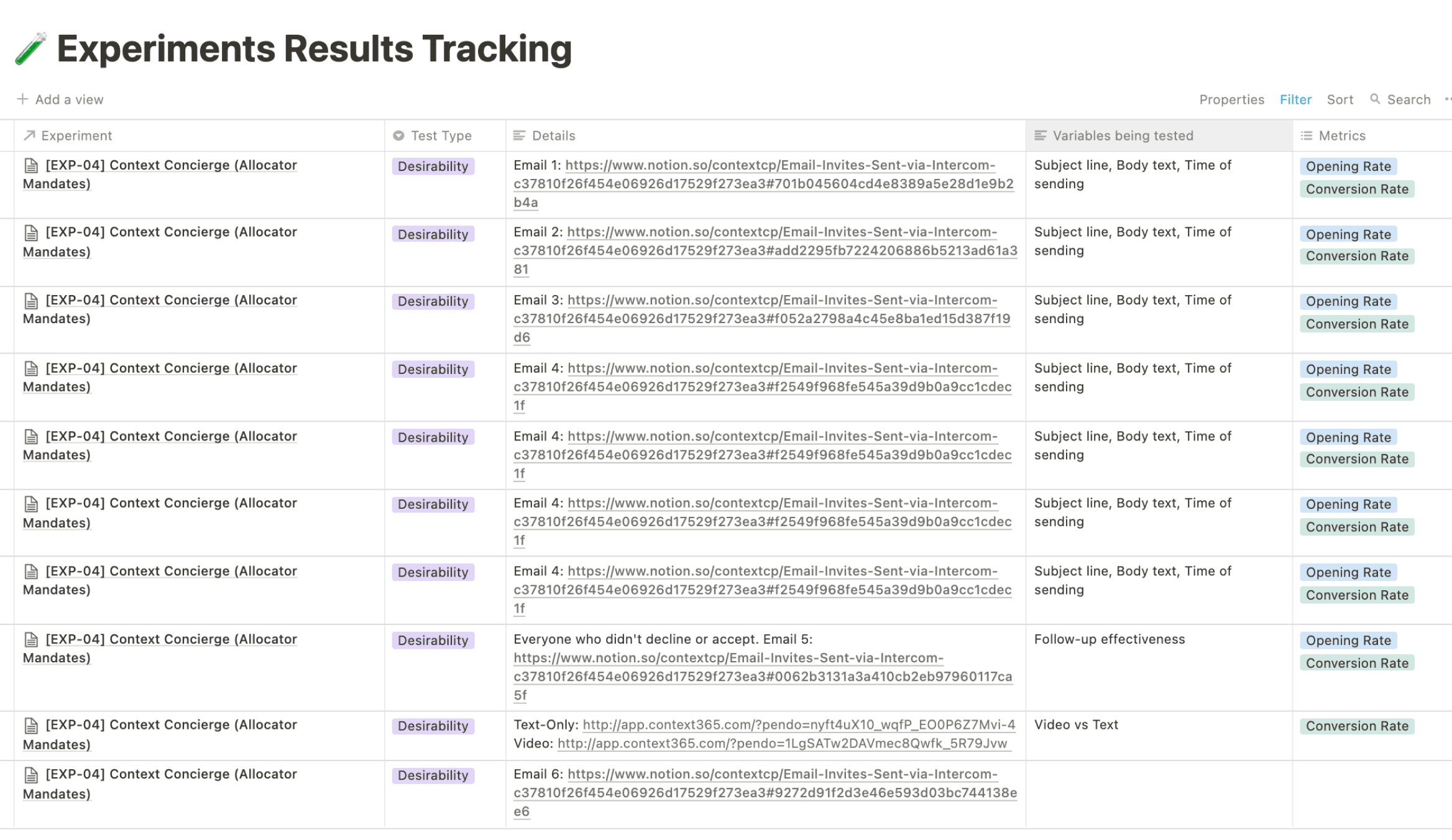

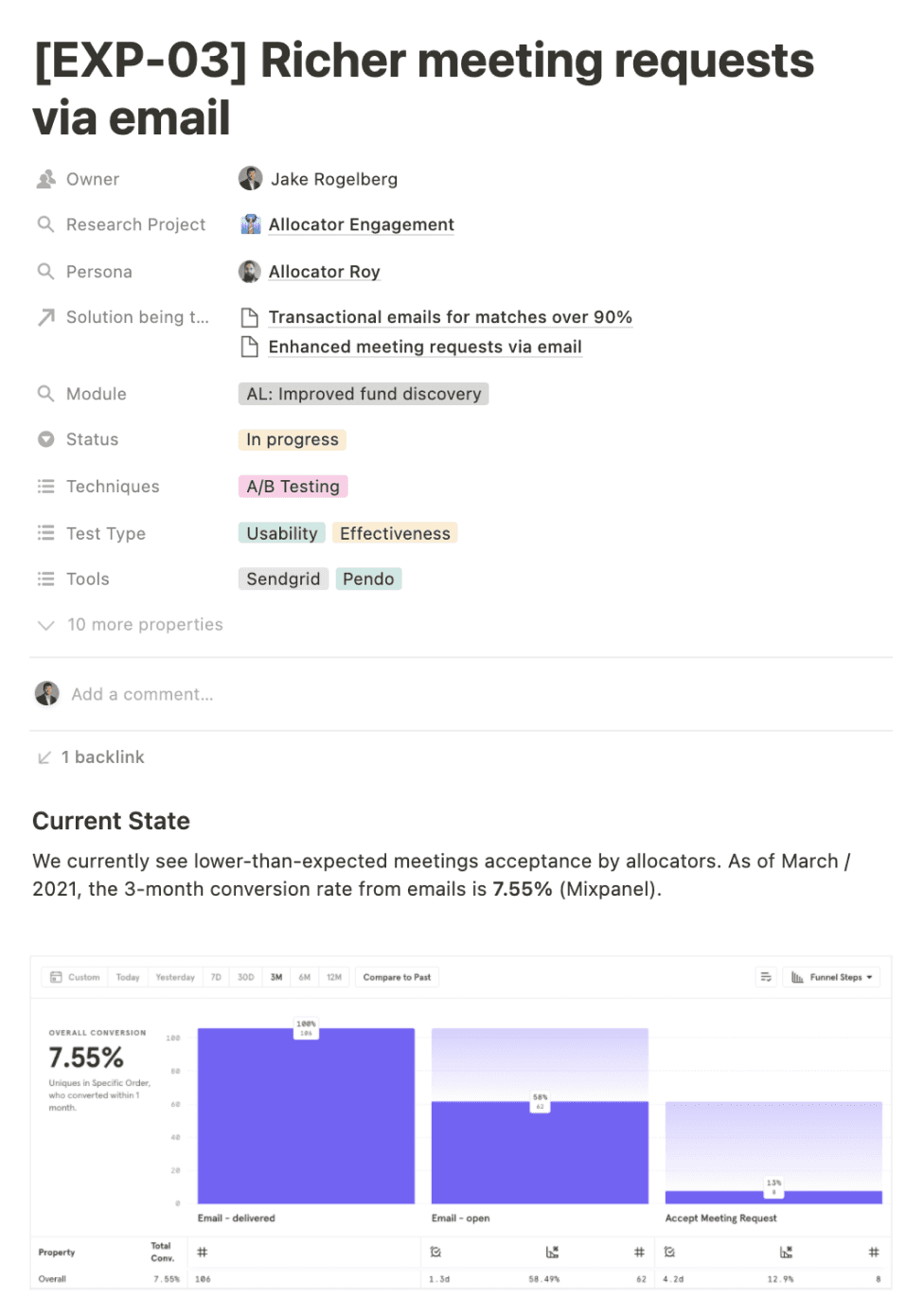

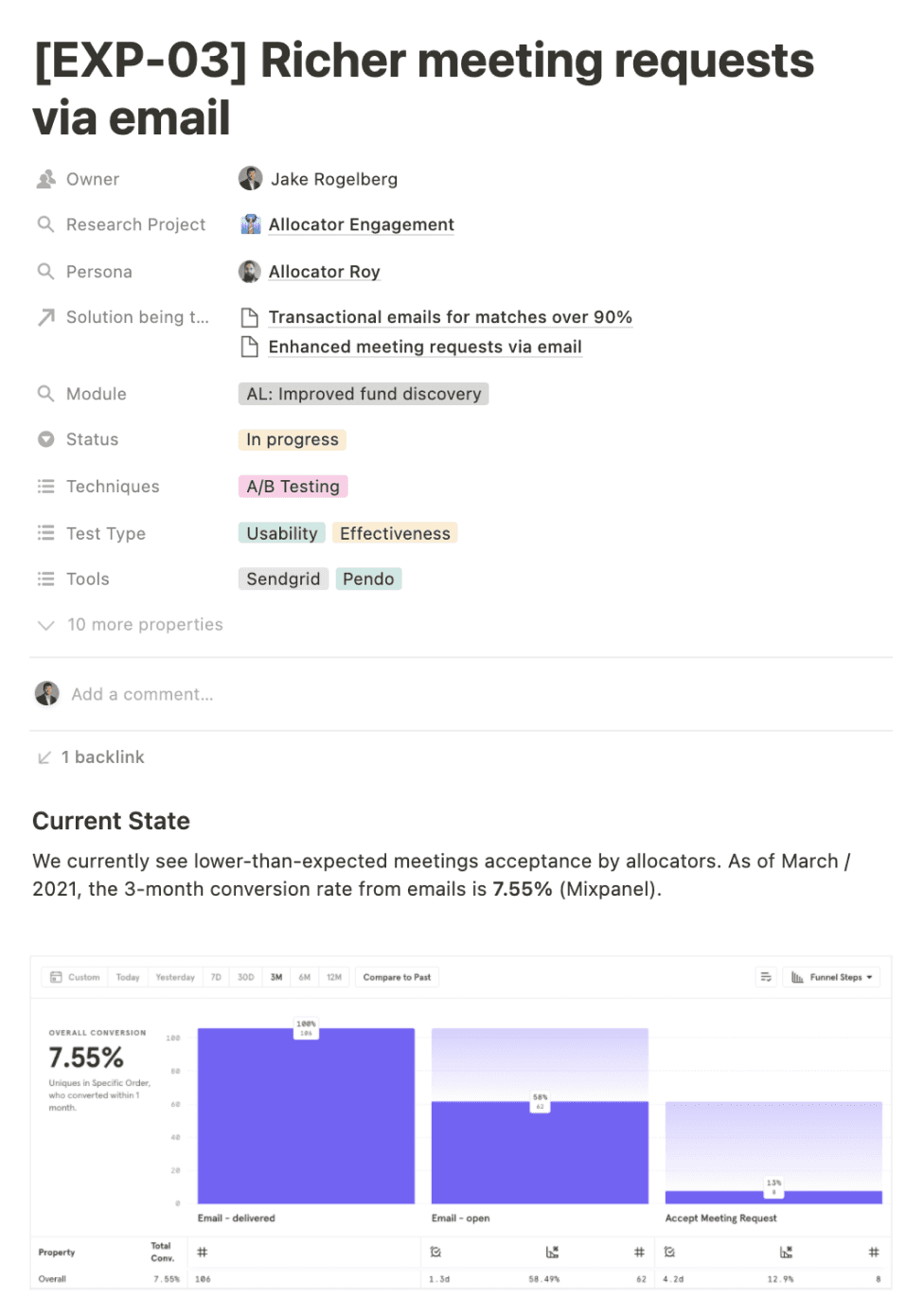

+364%

Conversion Rate

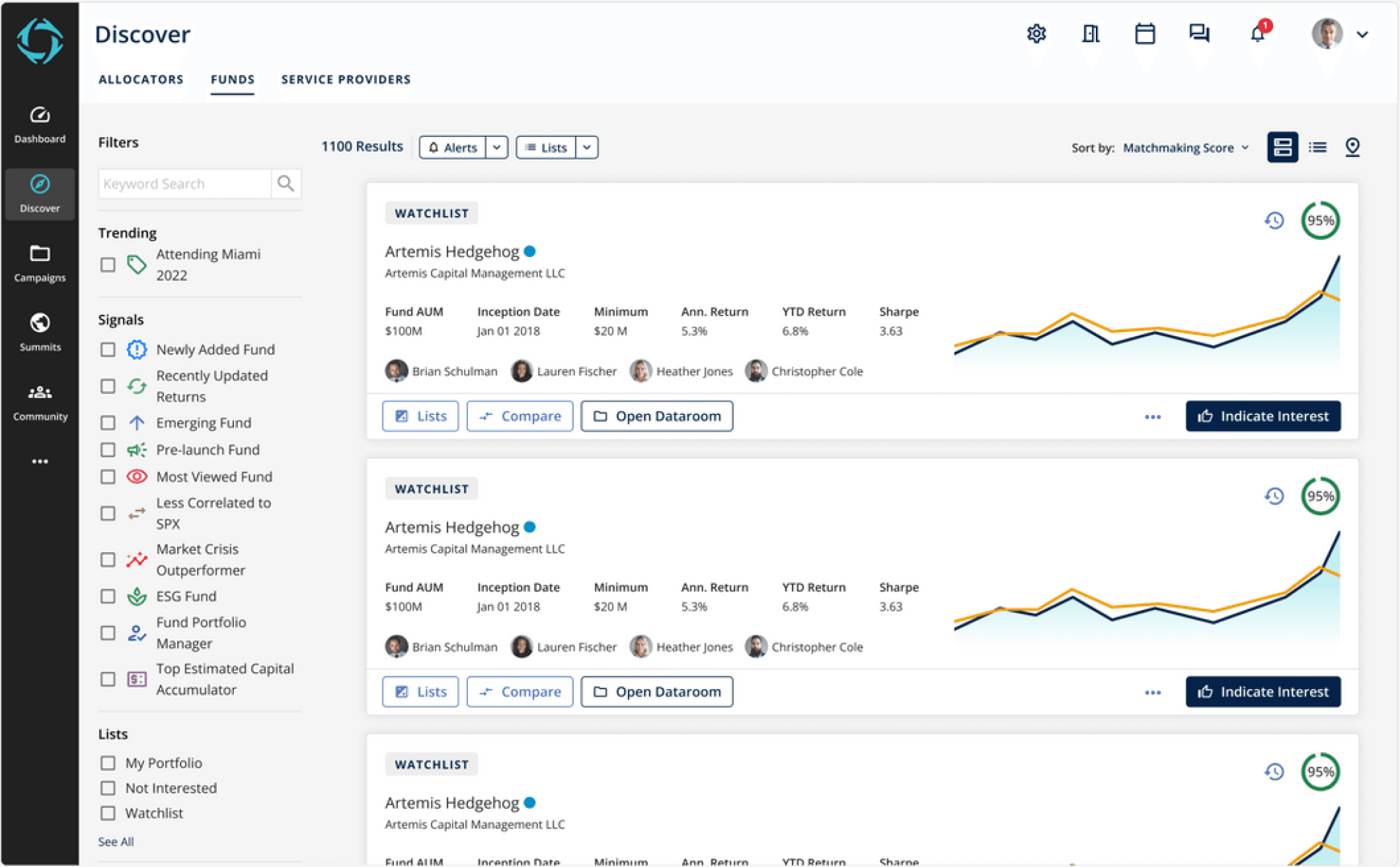

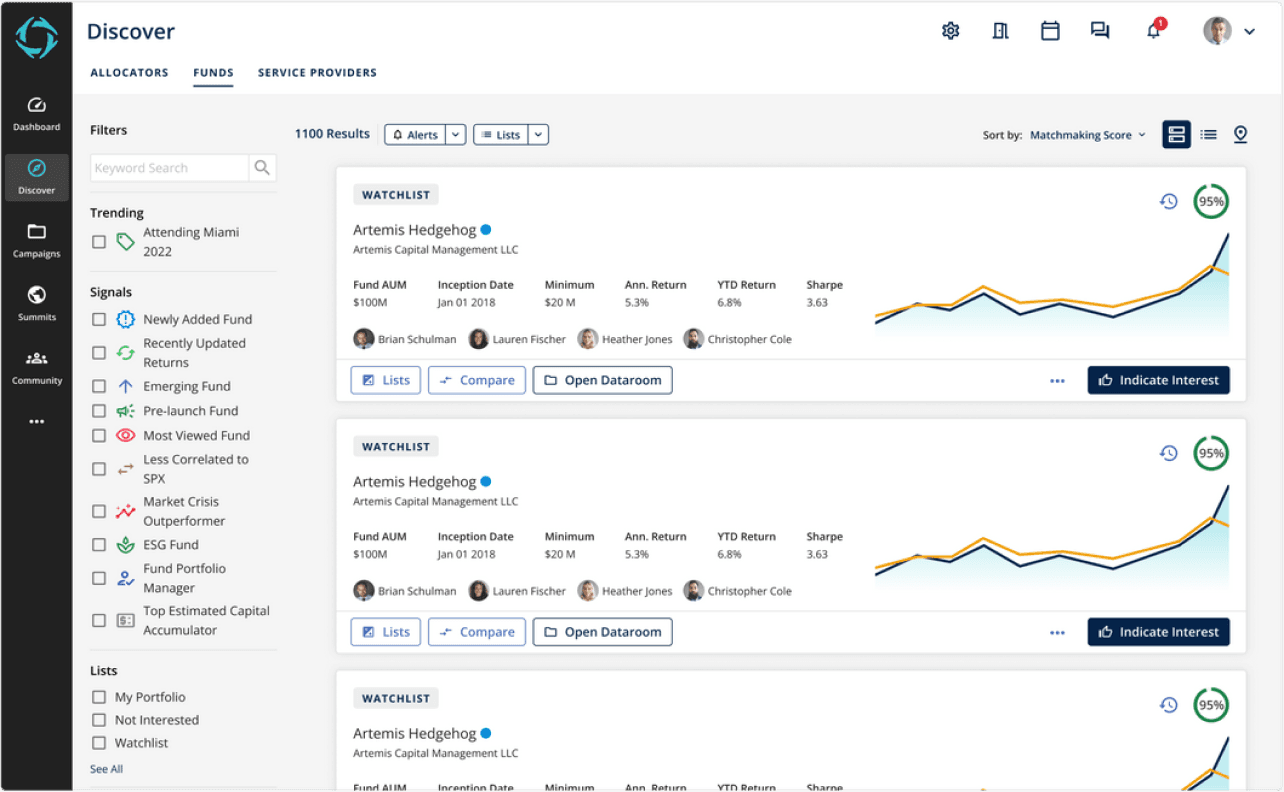

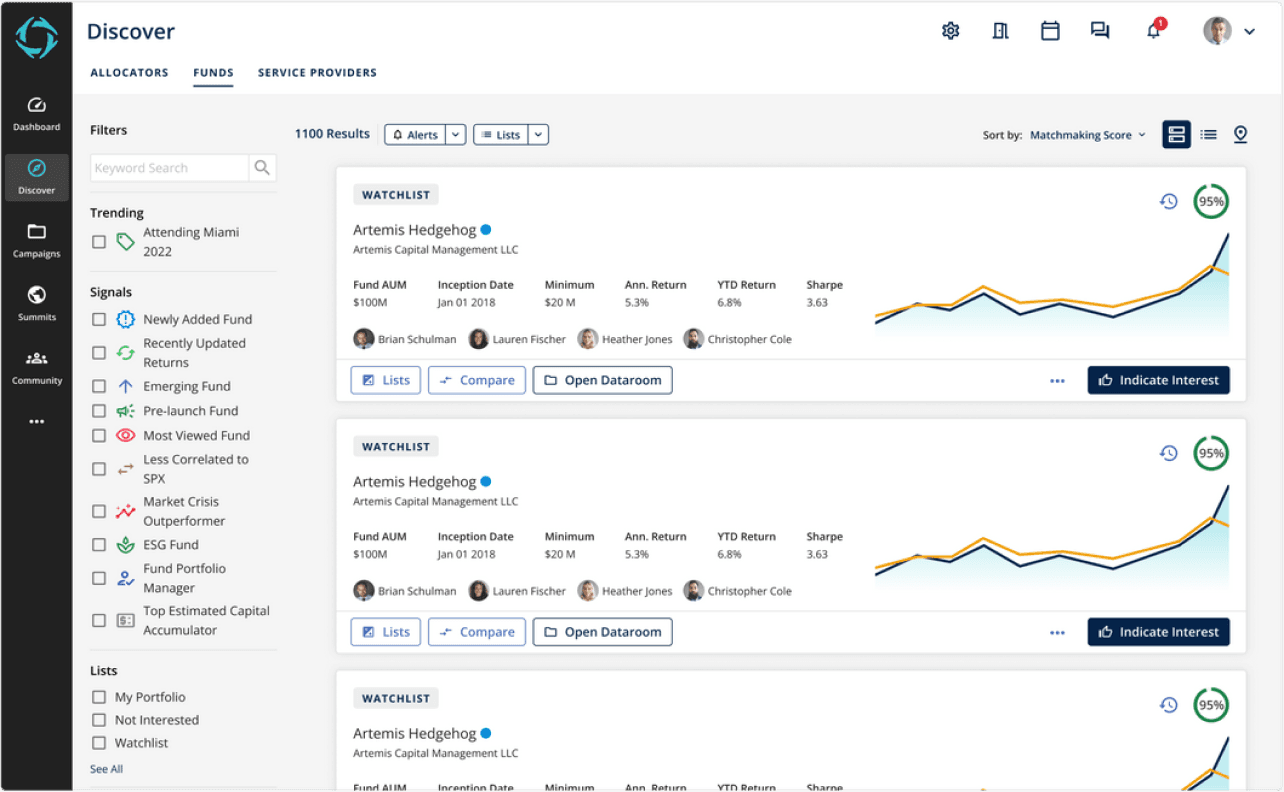

Acquired by Apex Group

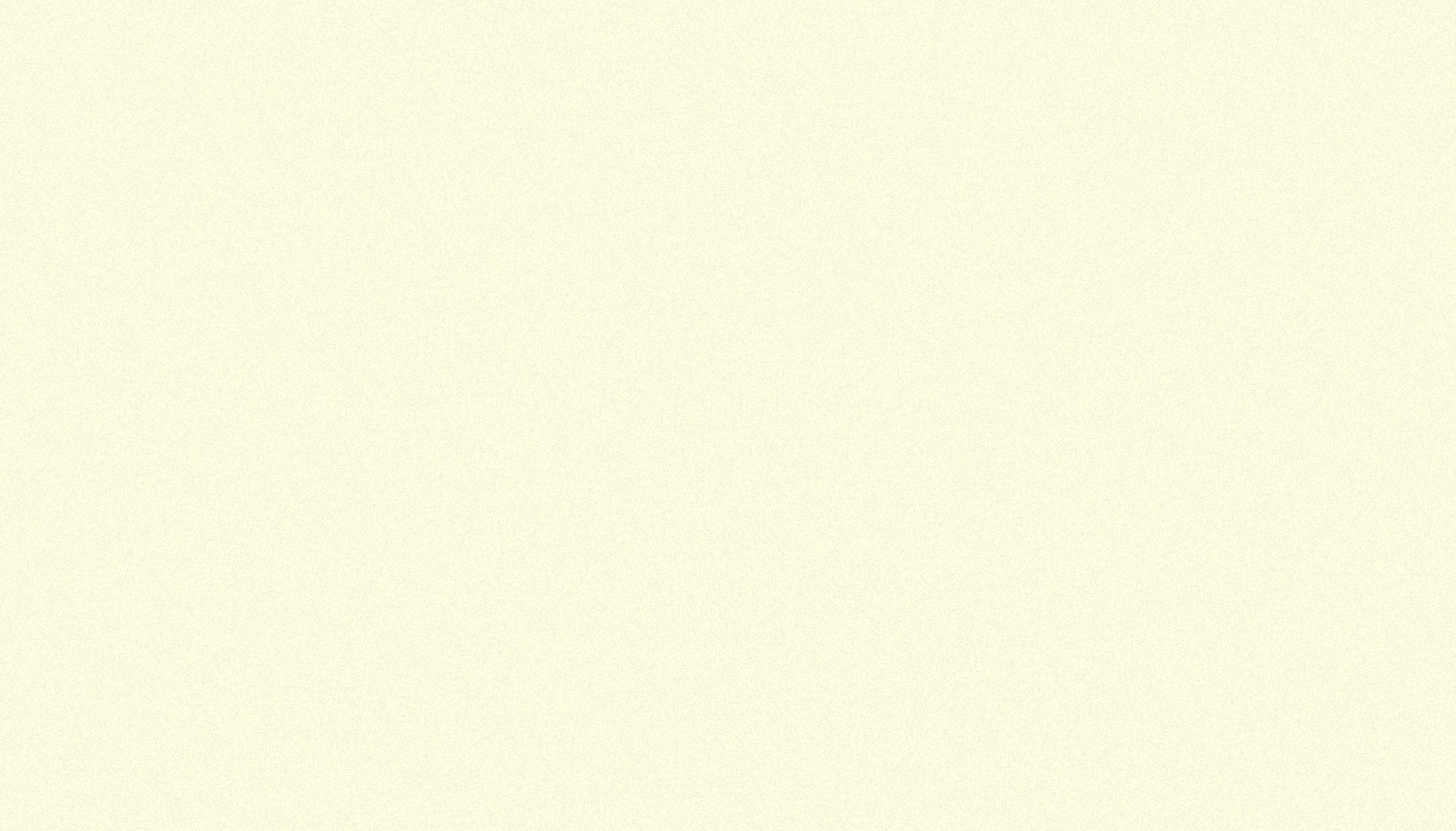

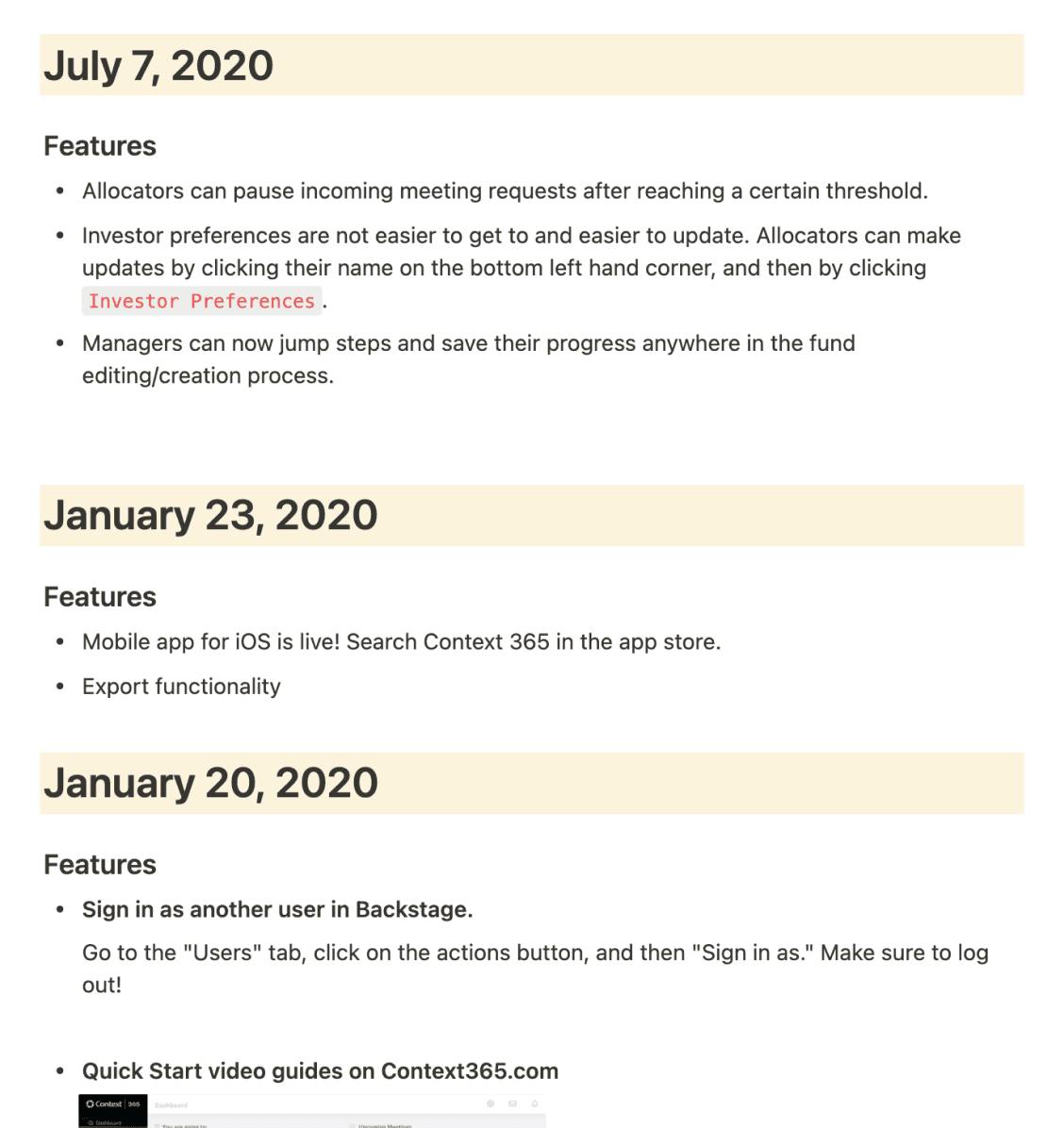

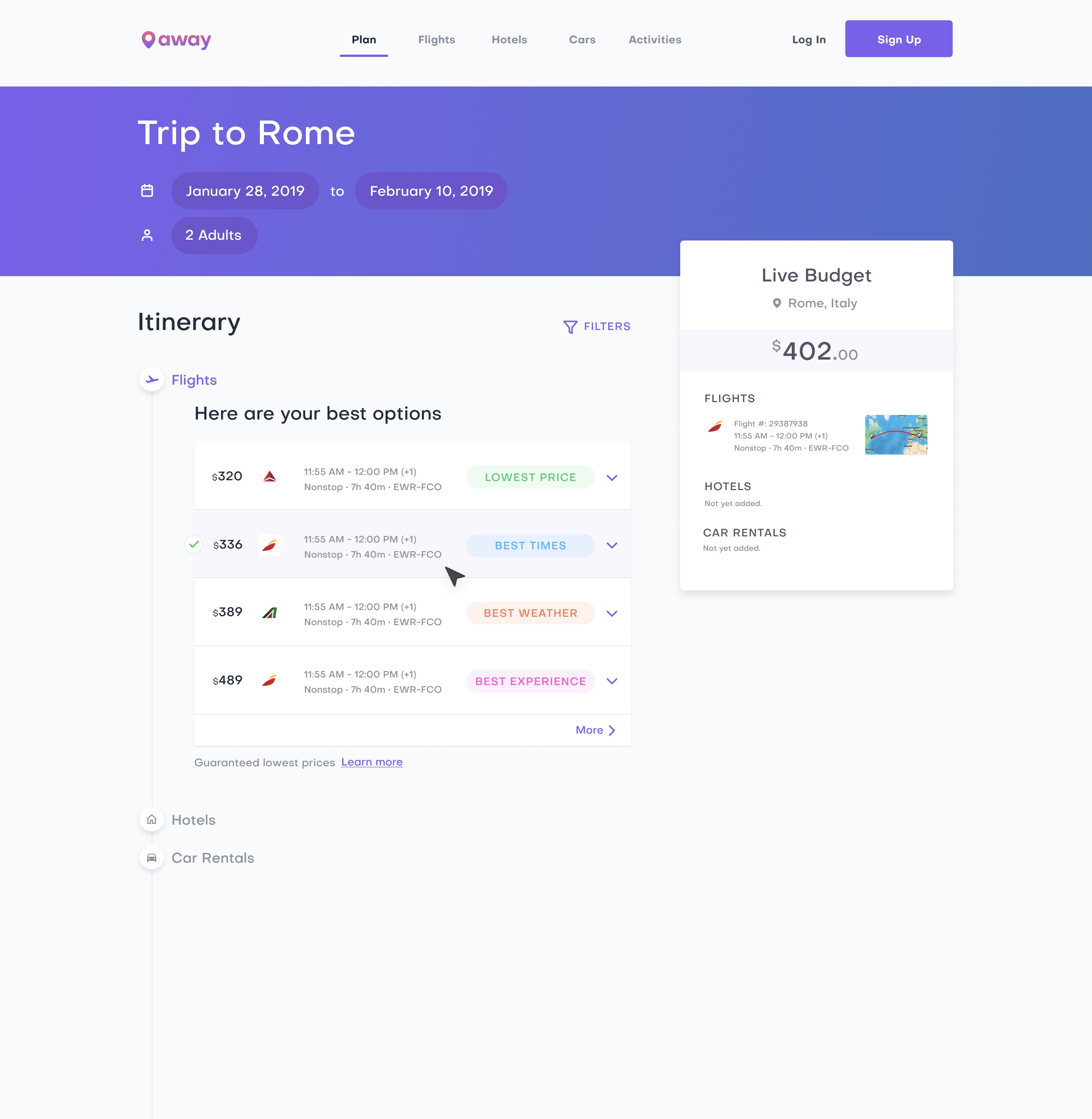

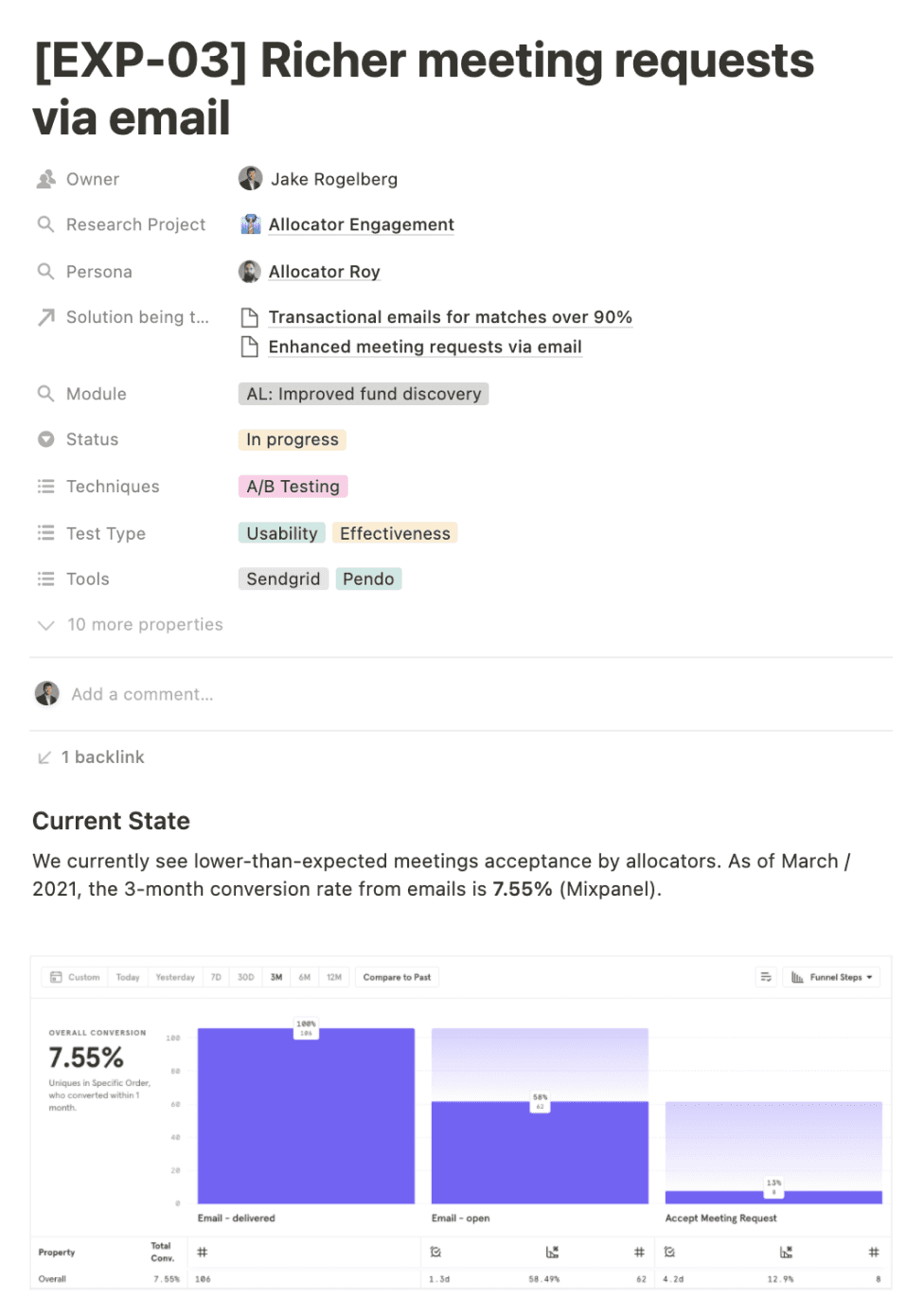

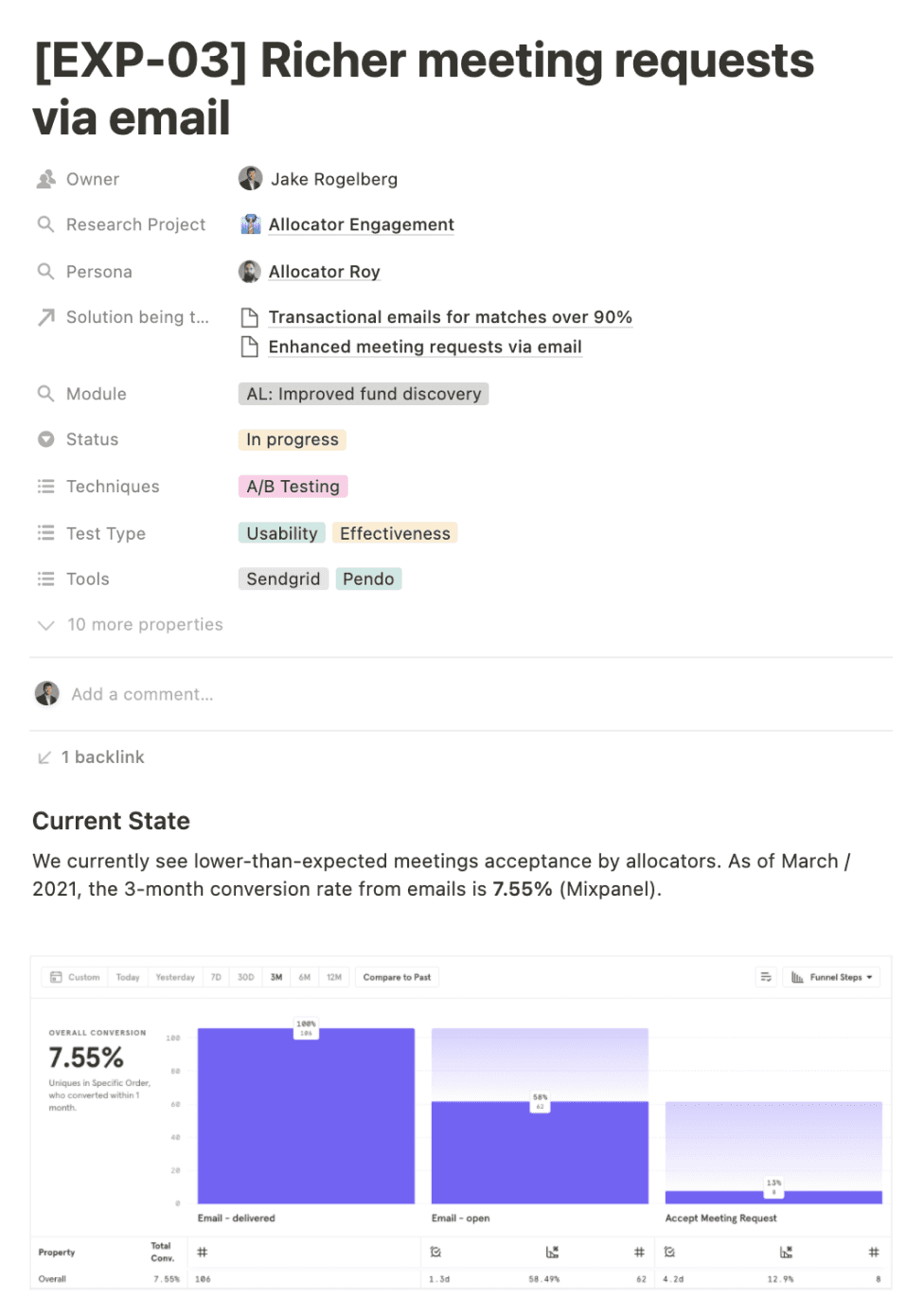

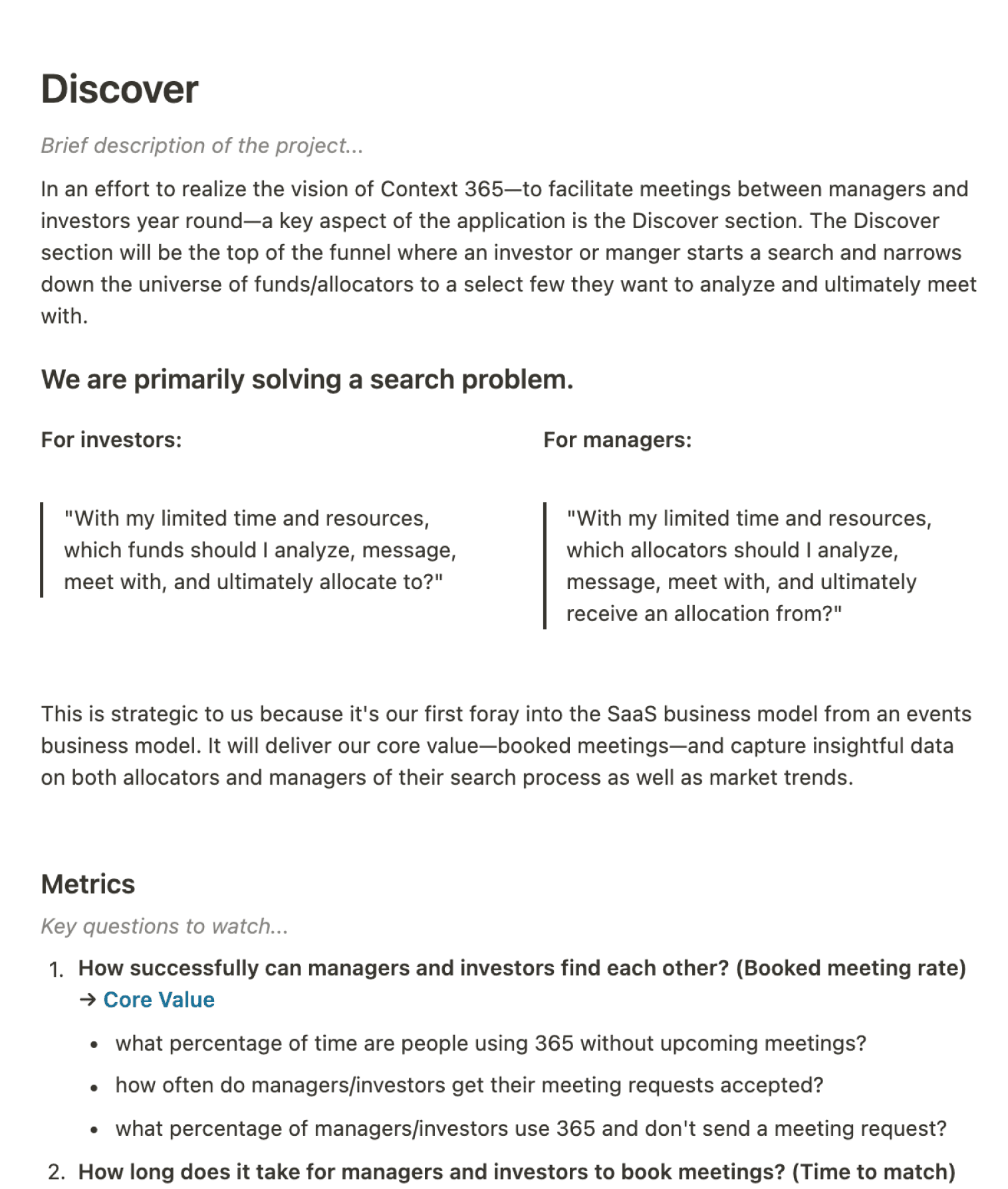

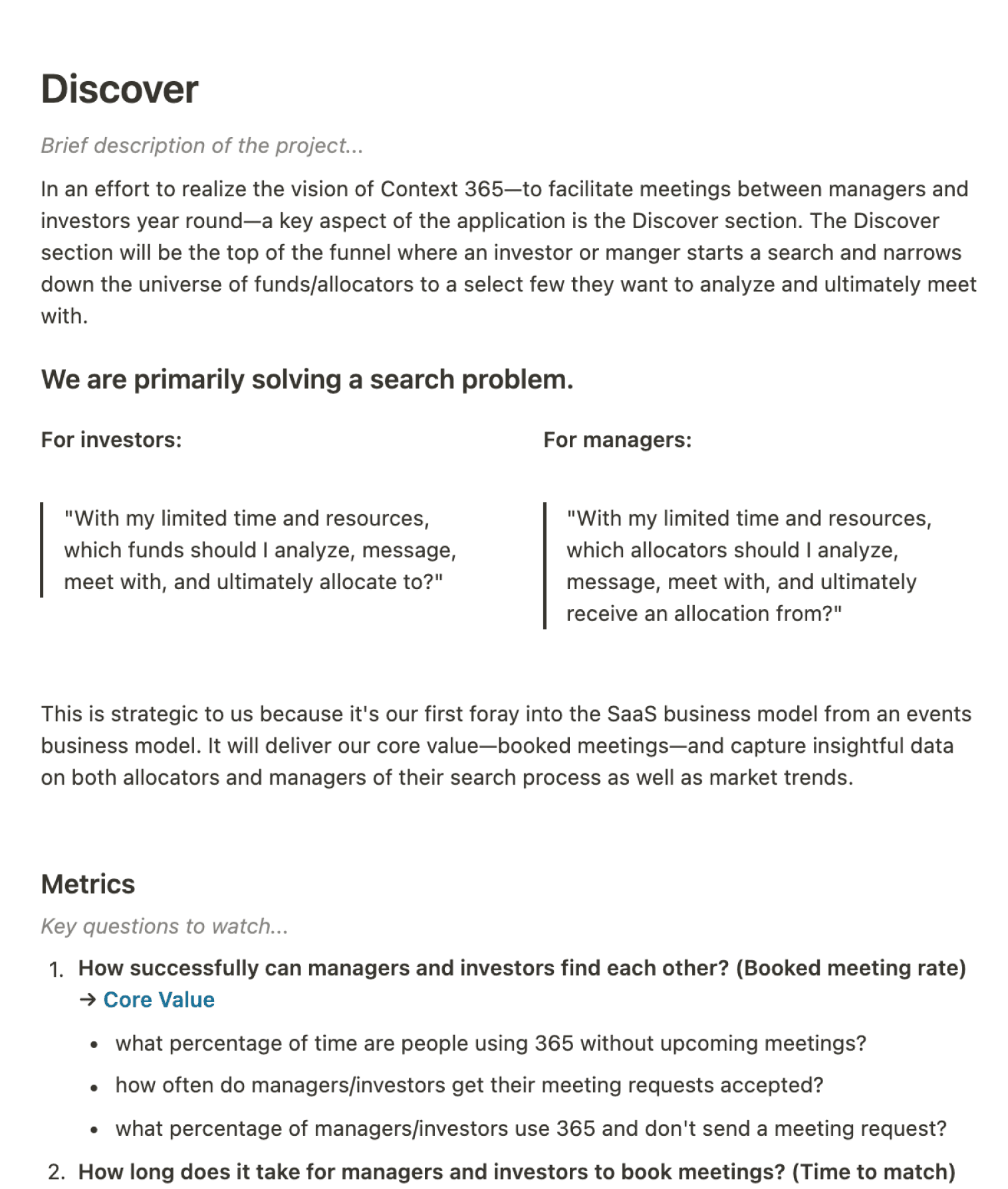

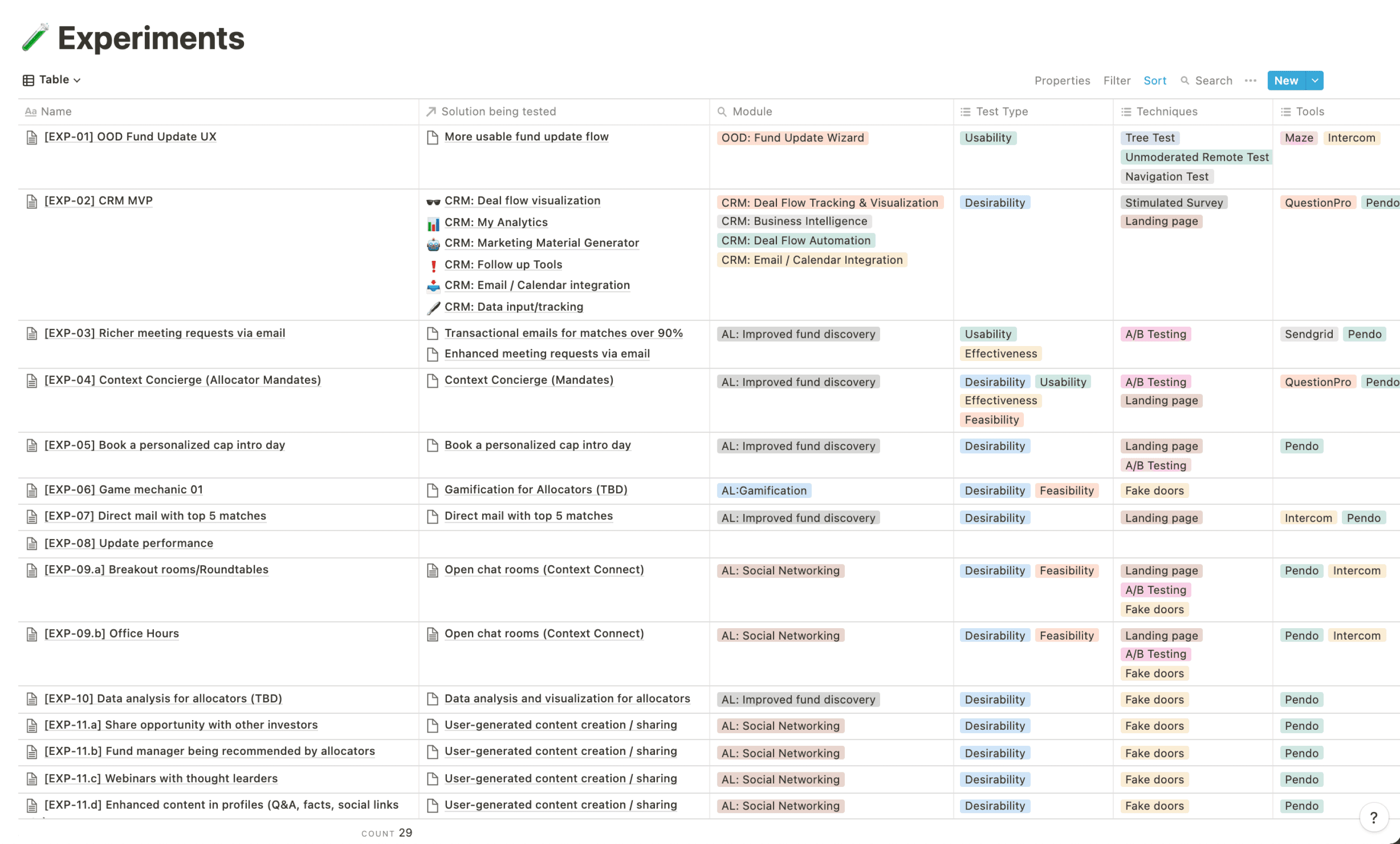

Redesign of the alternative investment platform, Context 365.

Led implementation and maintenance of Context 365’s React design system.

Idea to production in

3 months

100% Usage across

designers and developers

Design System

Context 365

Case Study In-Progress

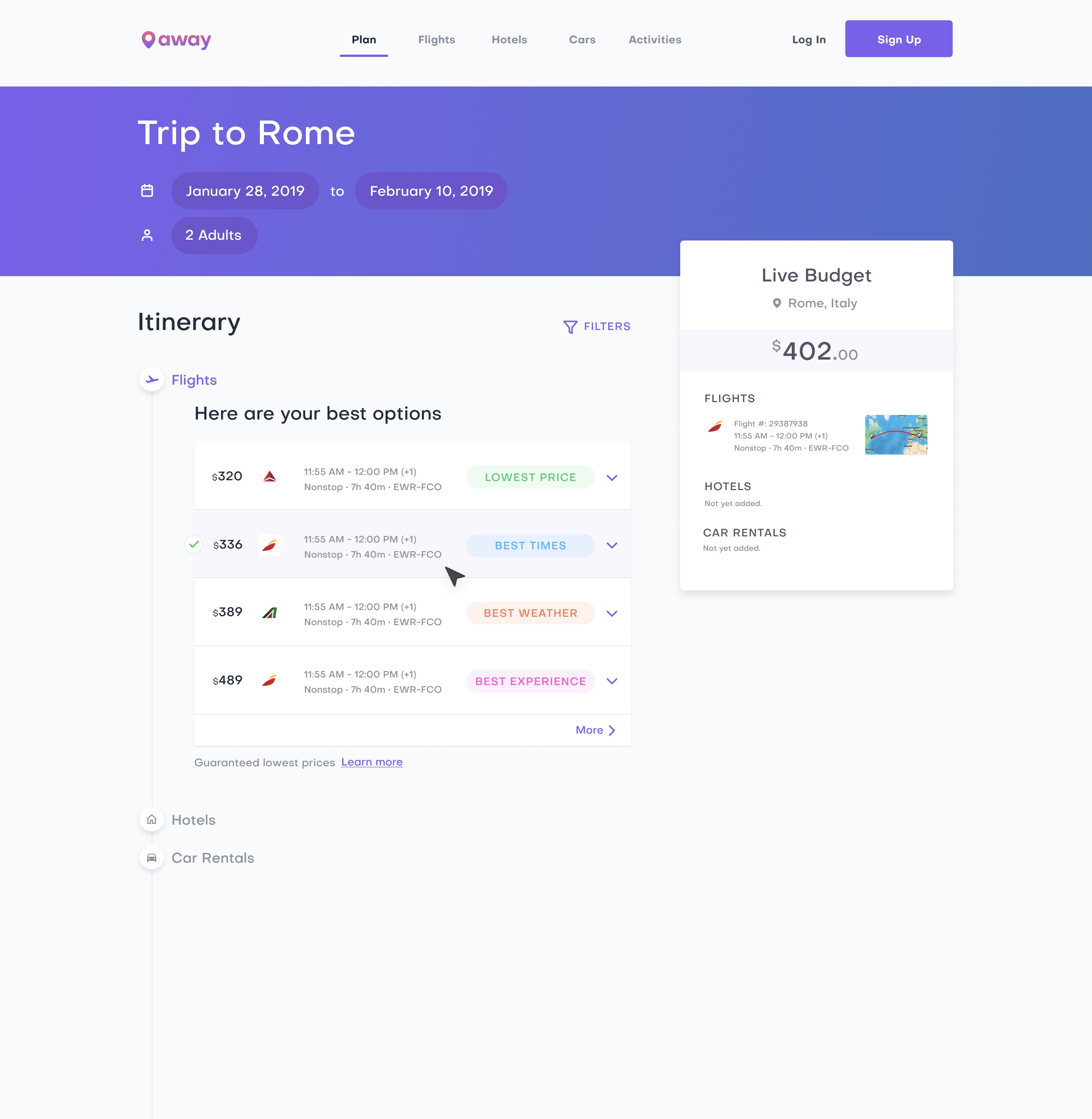

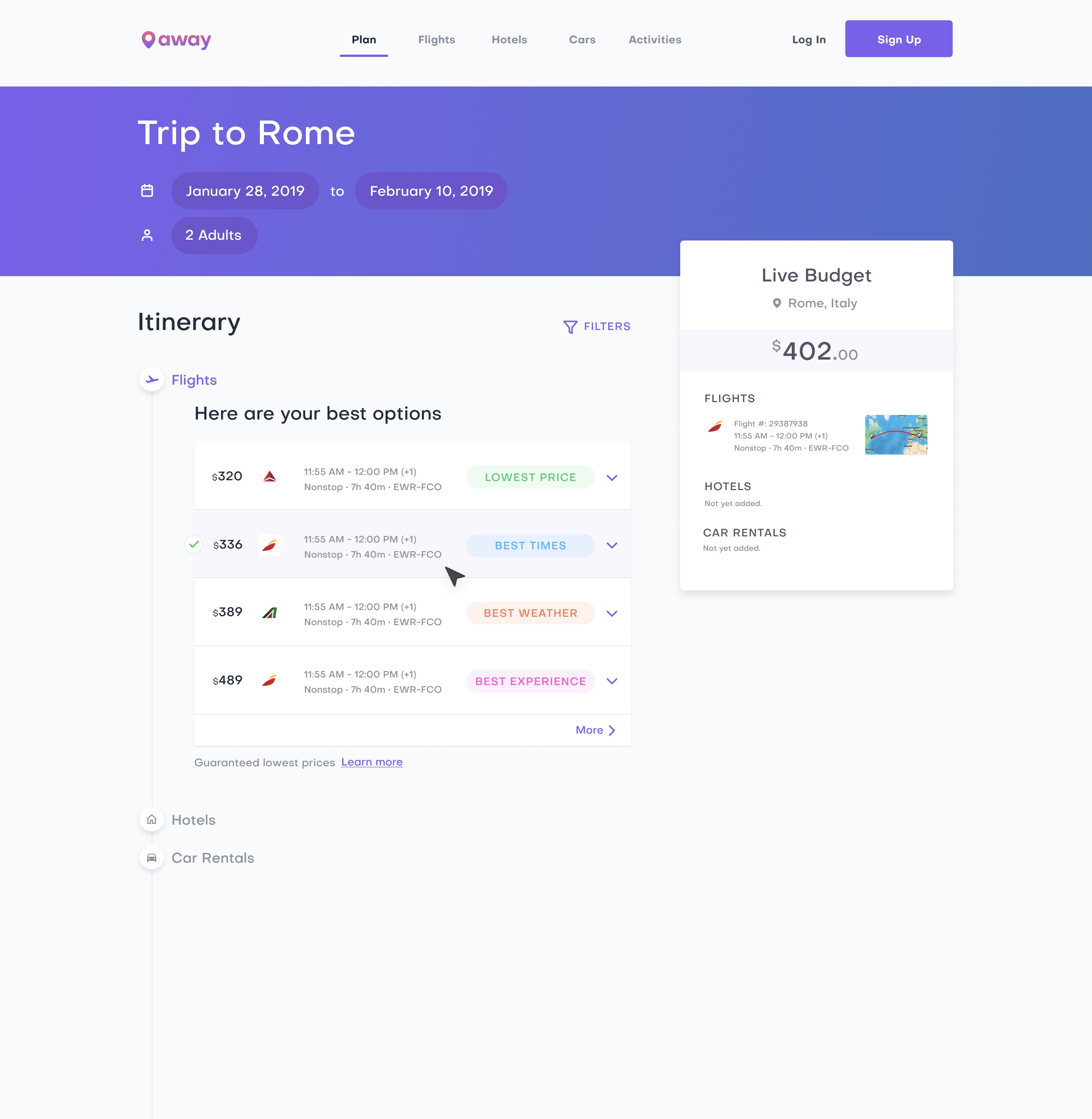

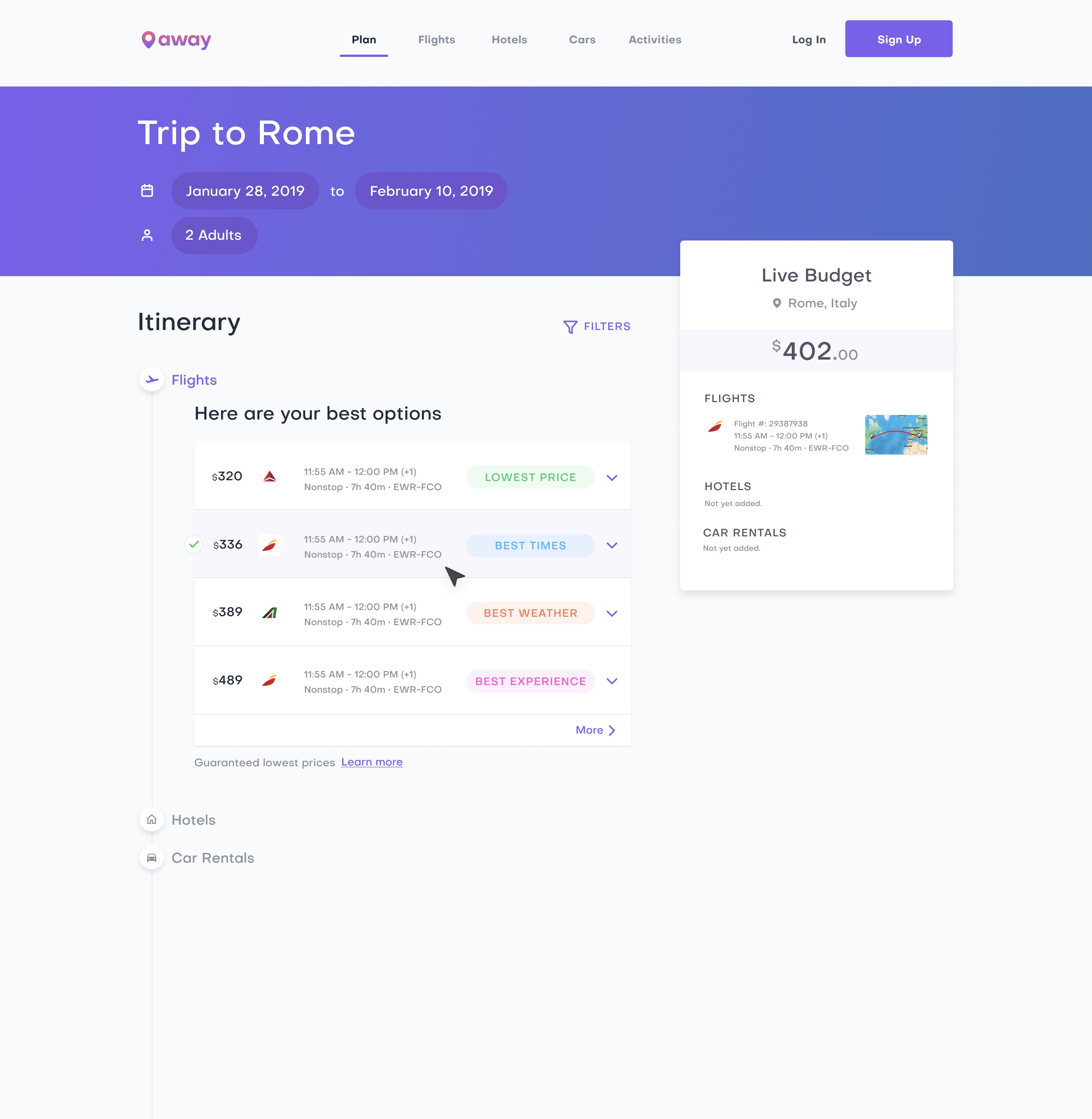

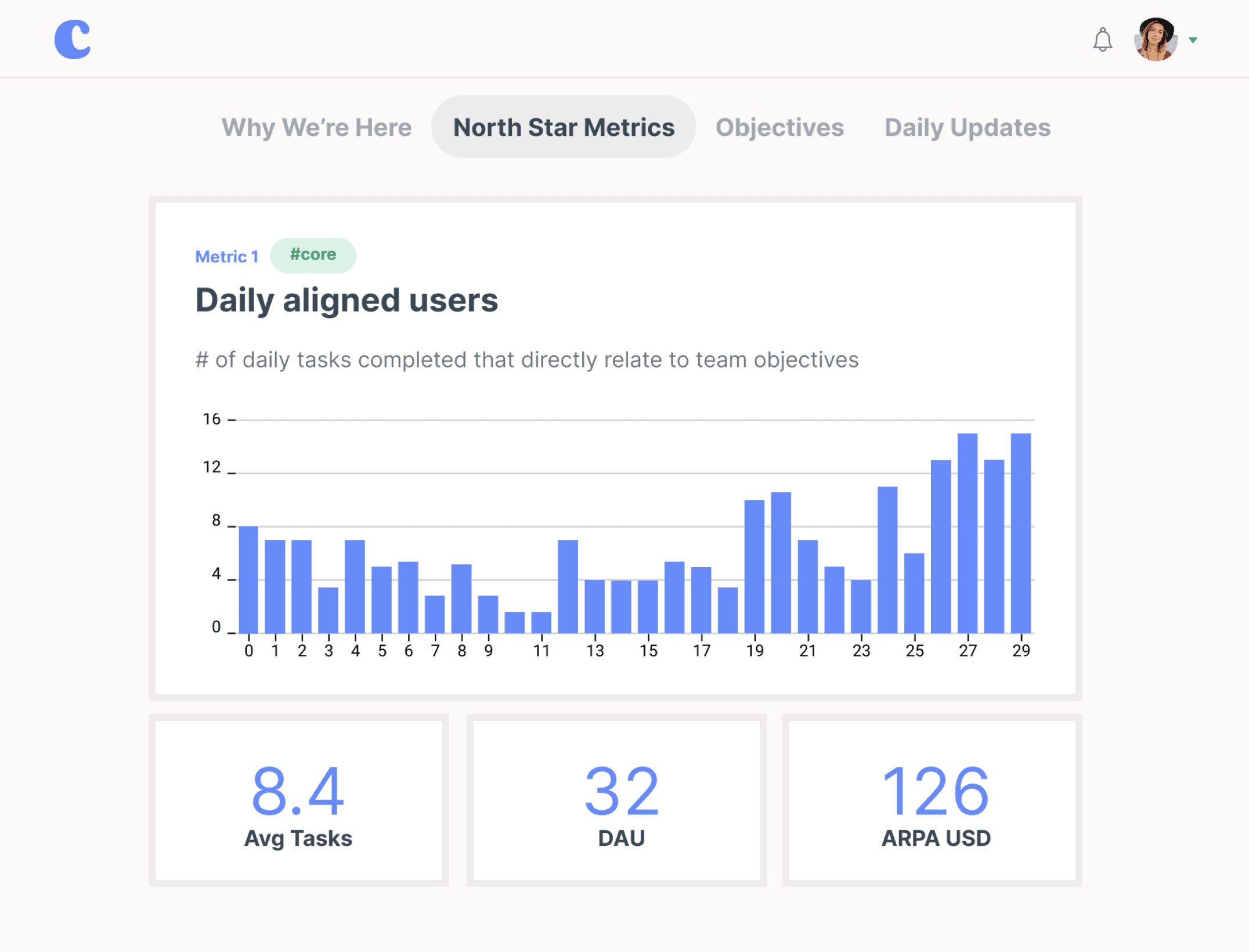

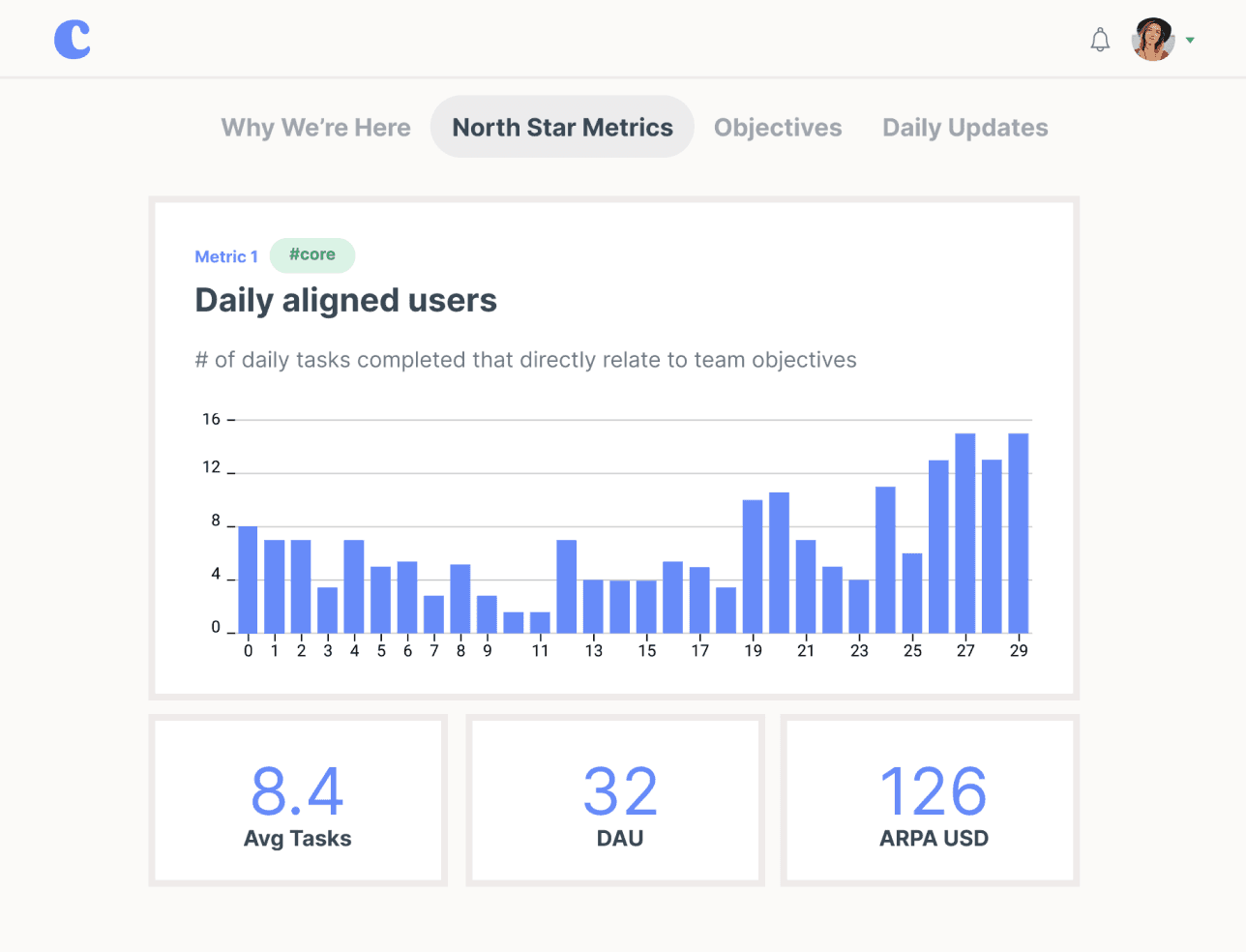

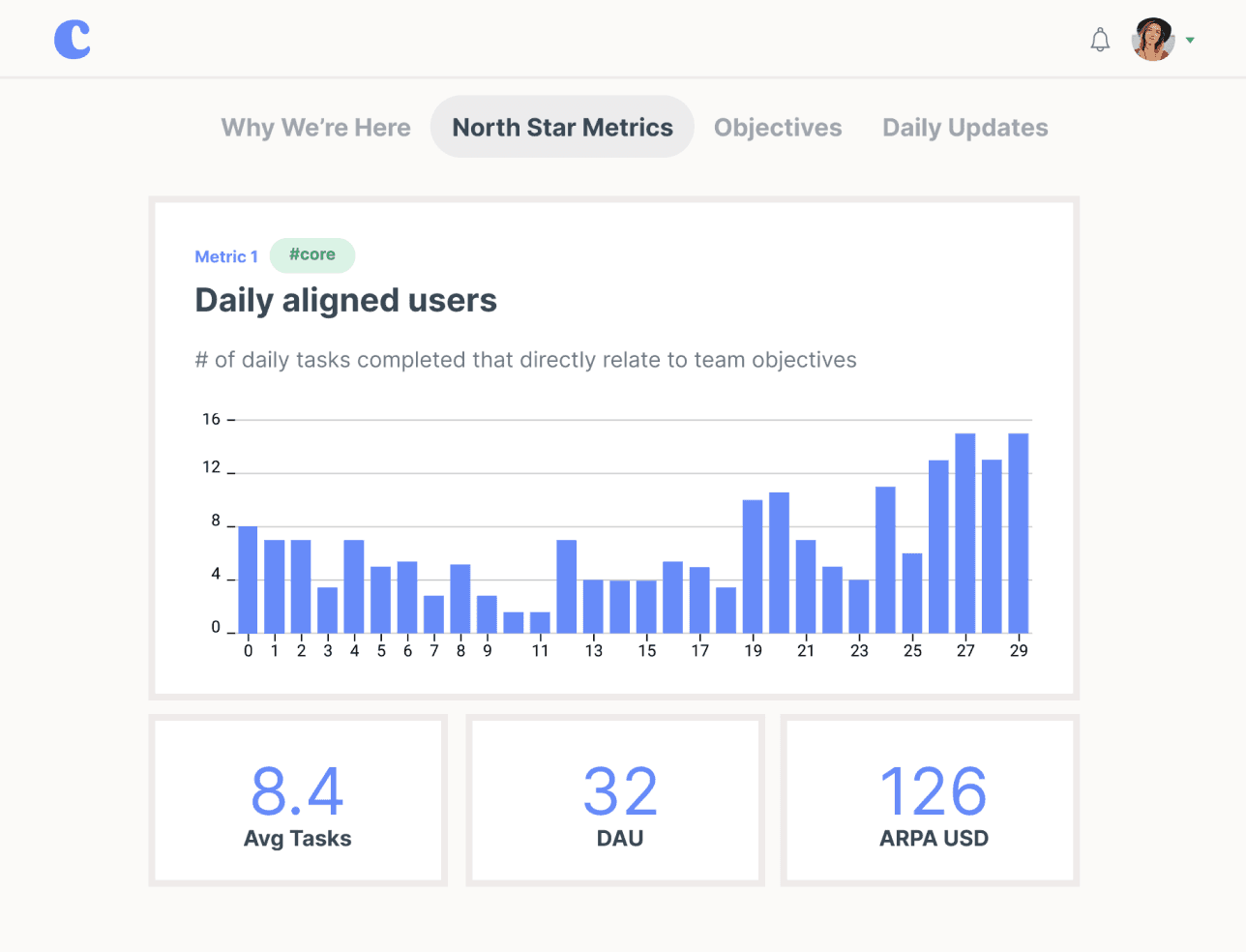

Application Design

Clarivate Analytics

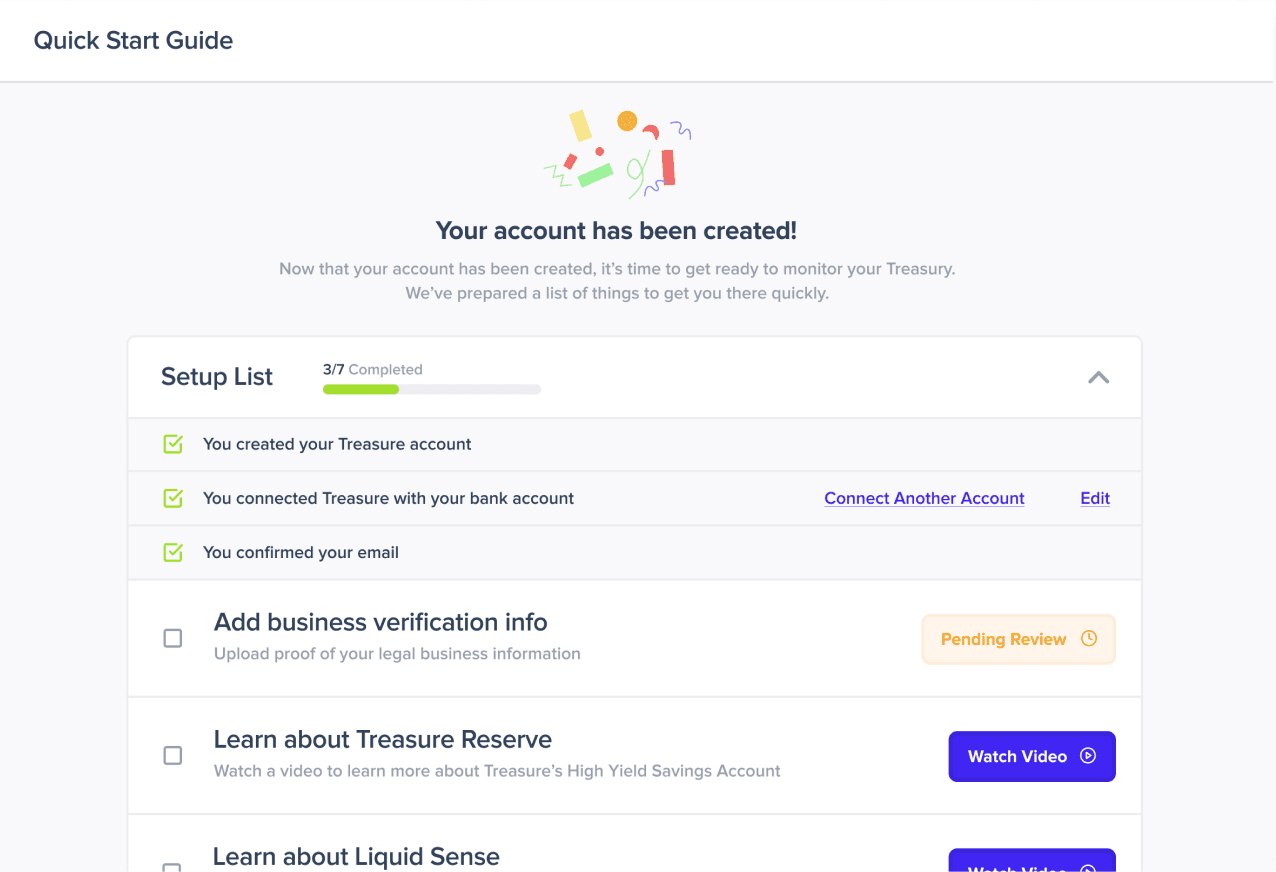

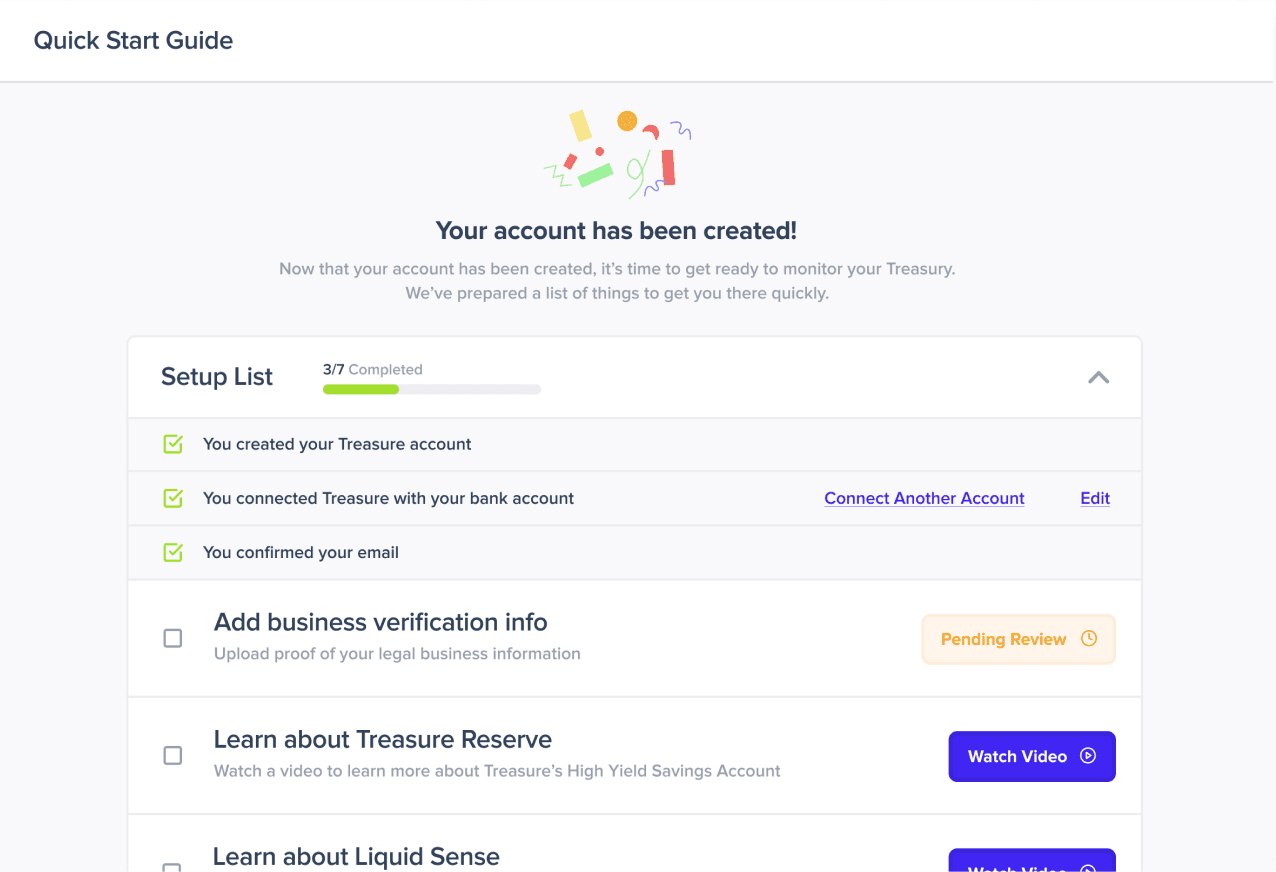

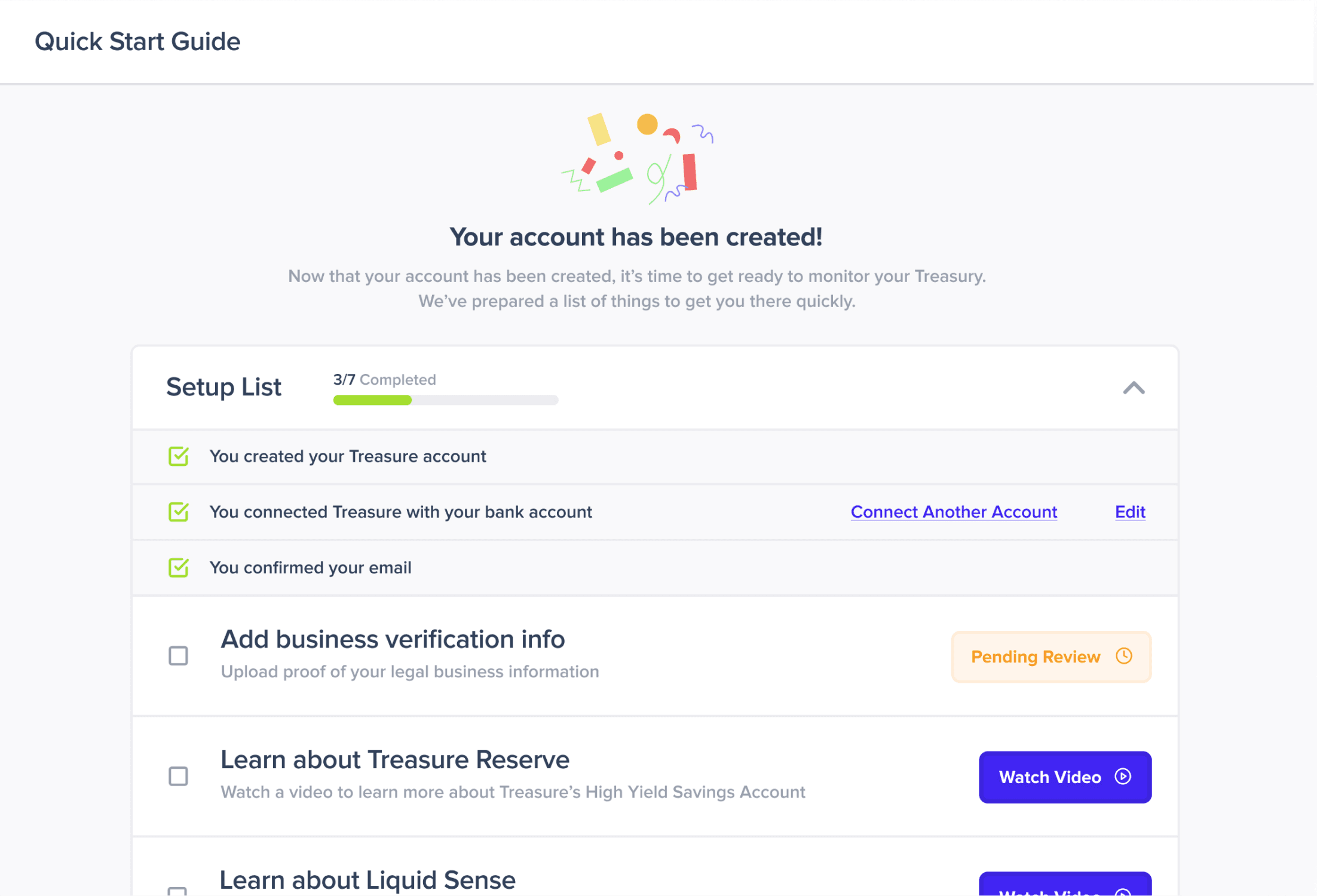

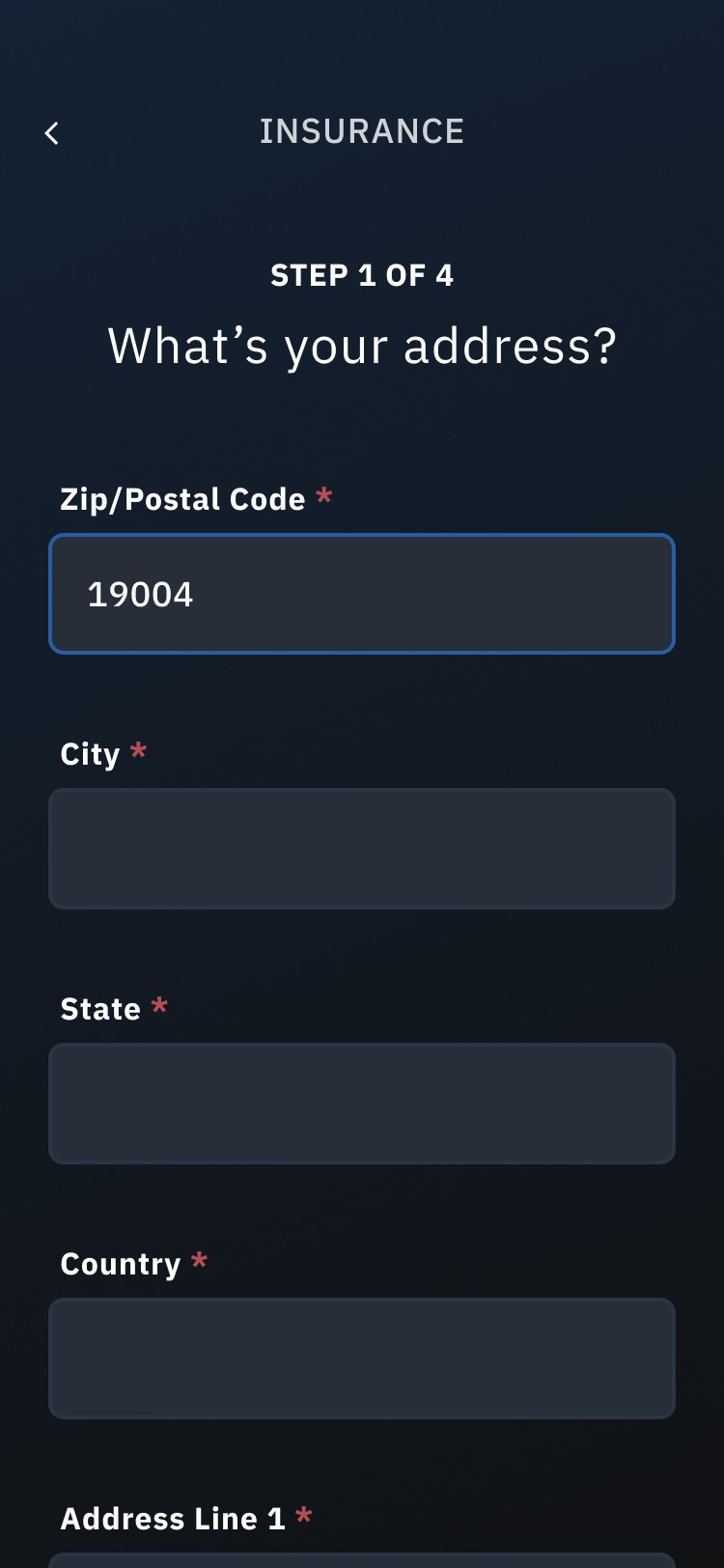

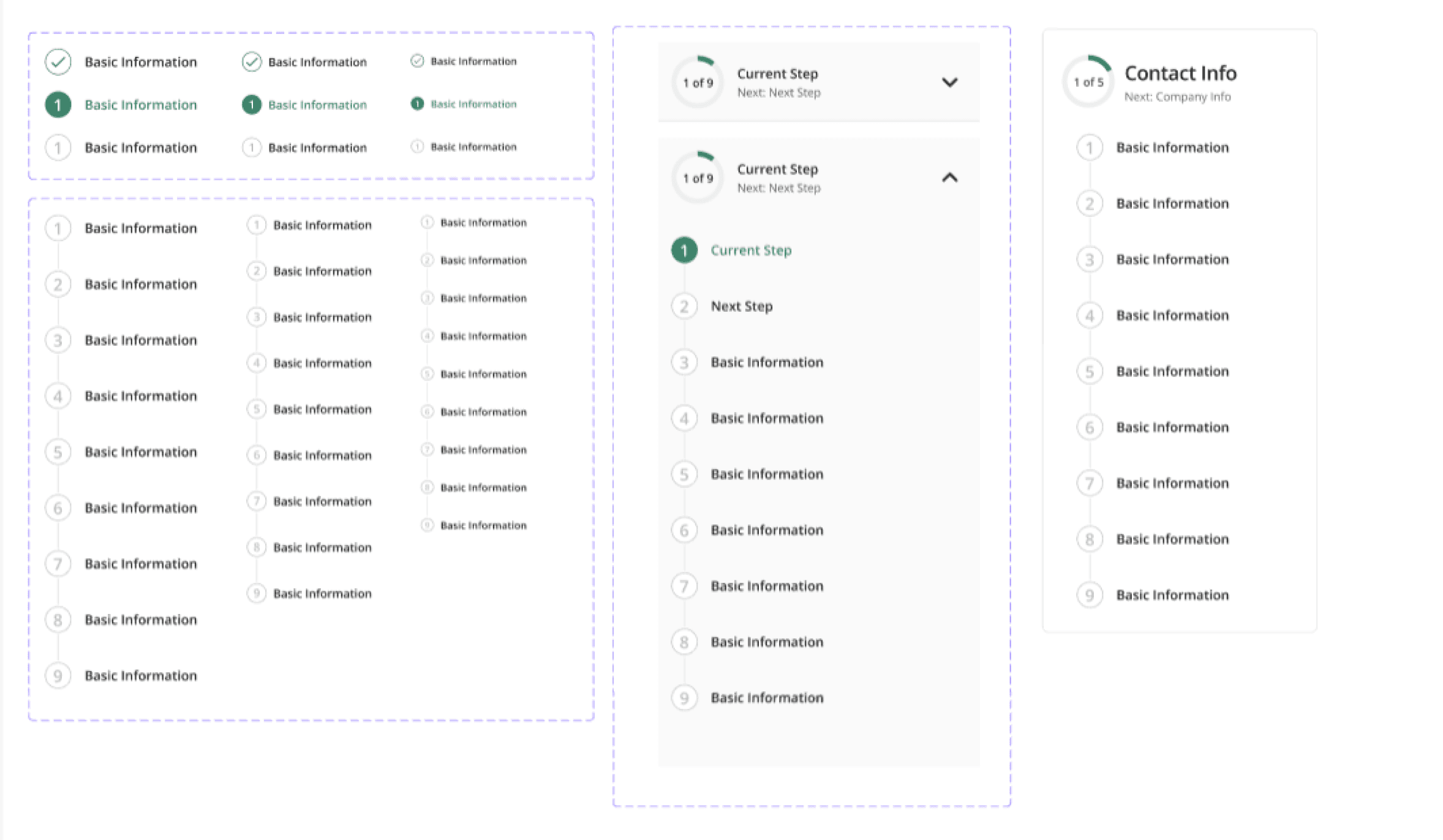

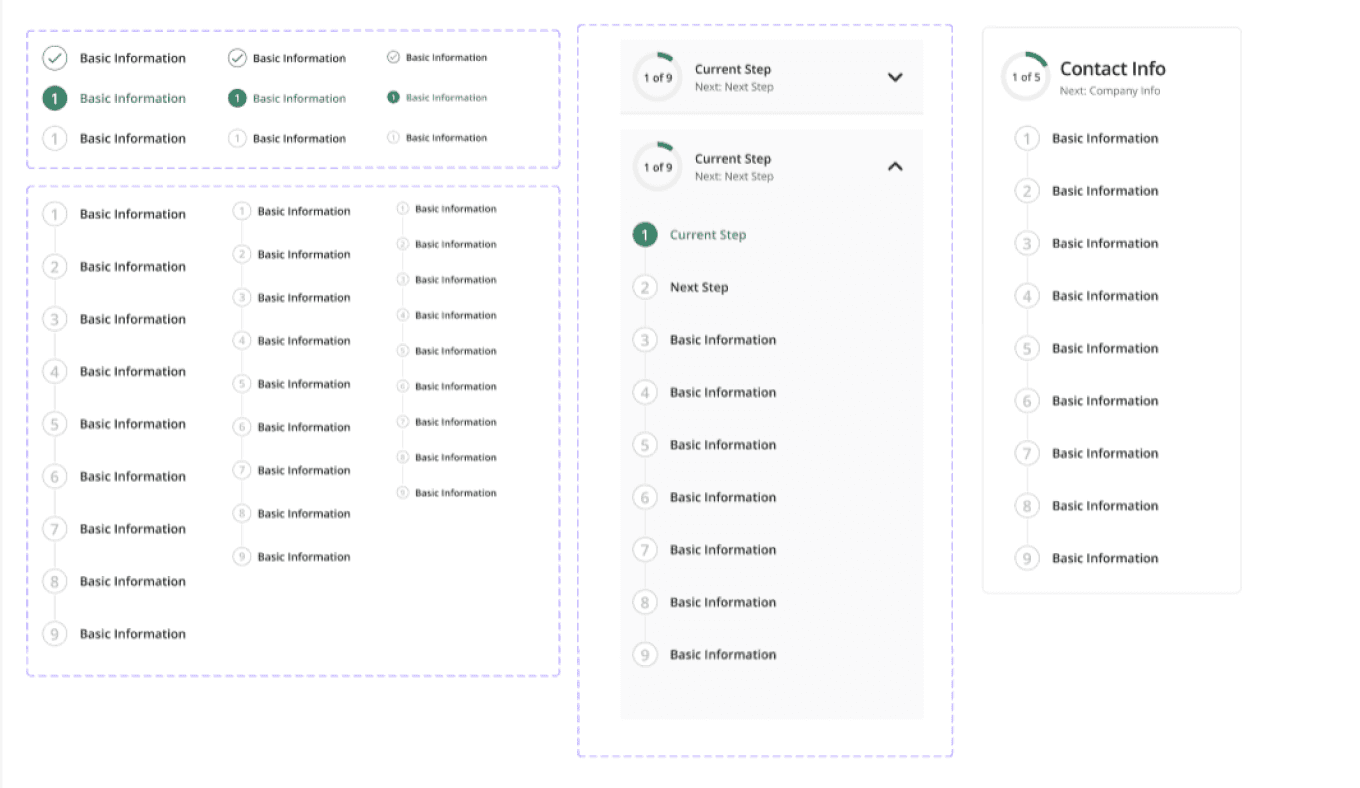

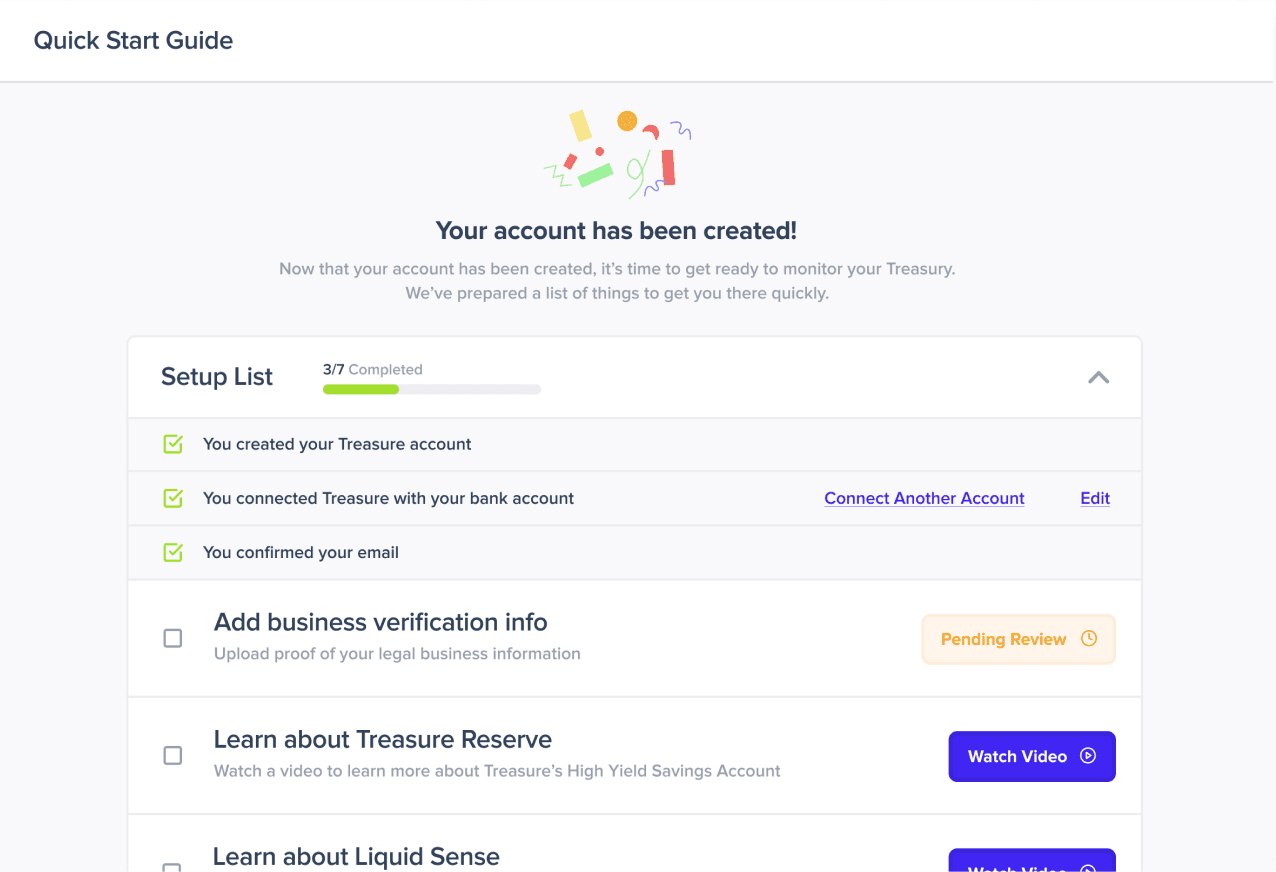

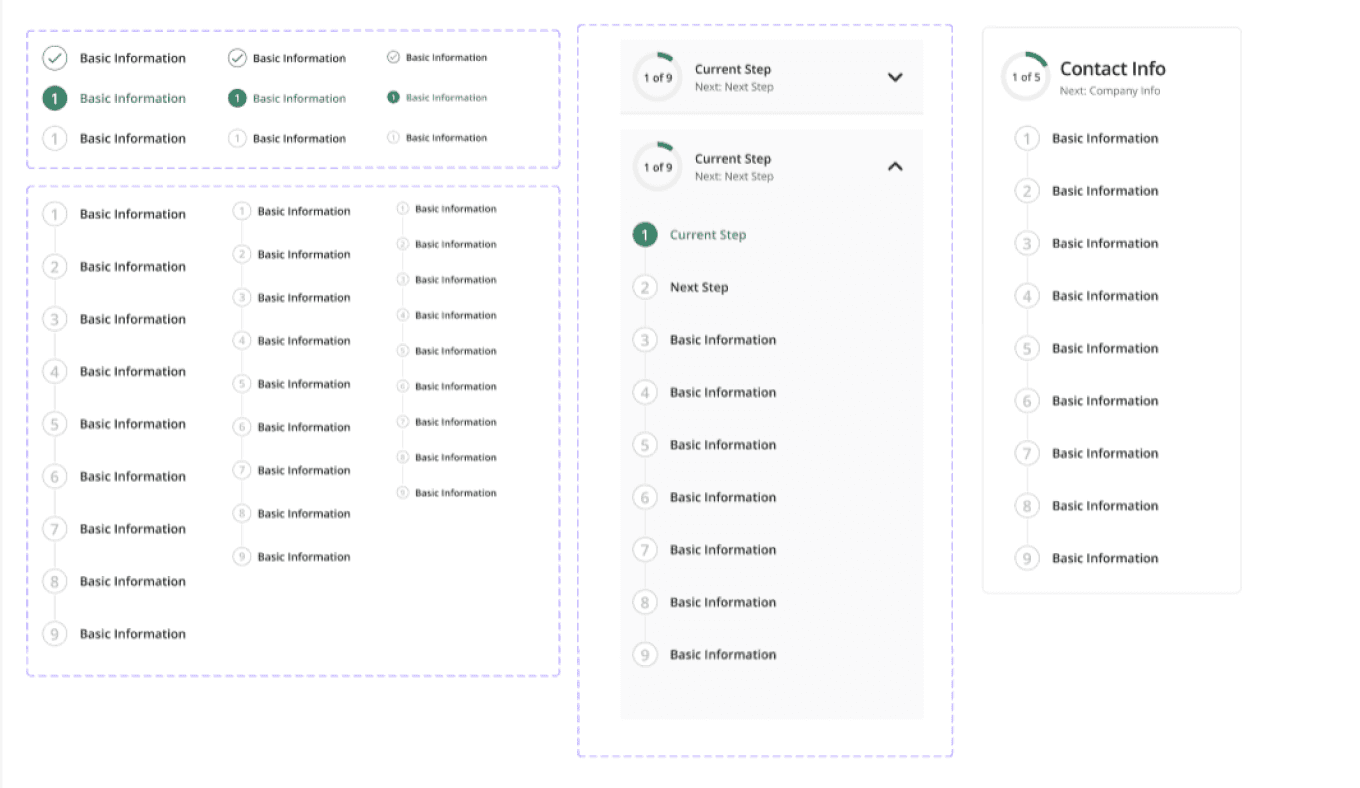

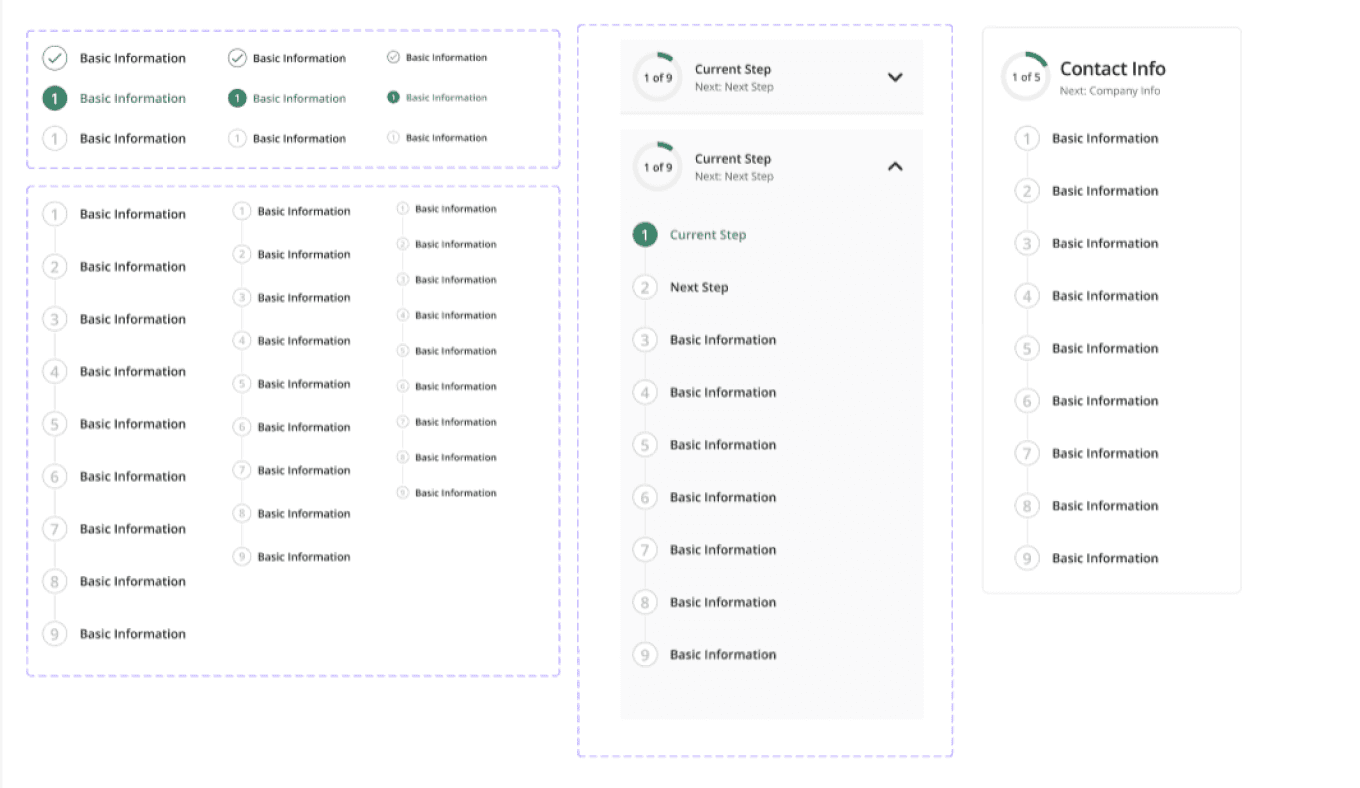

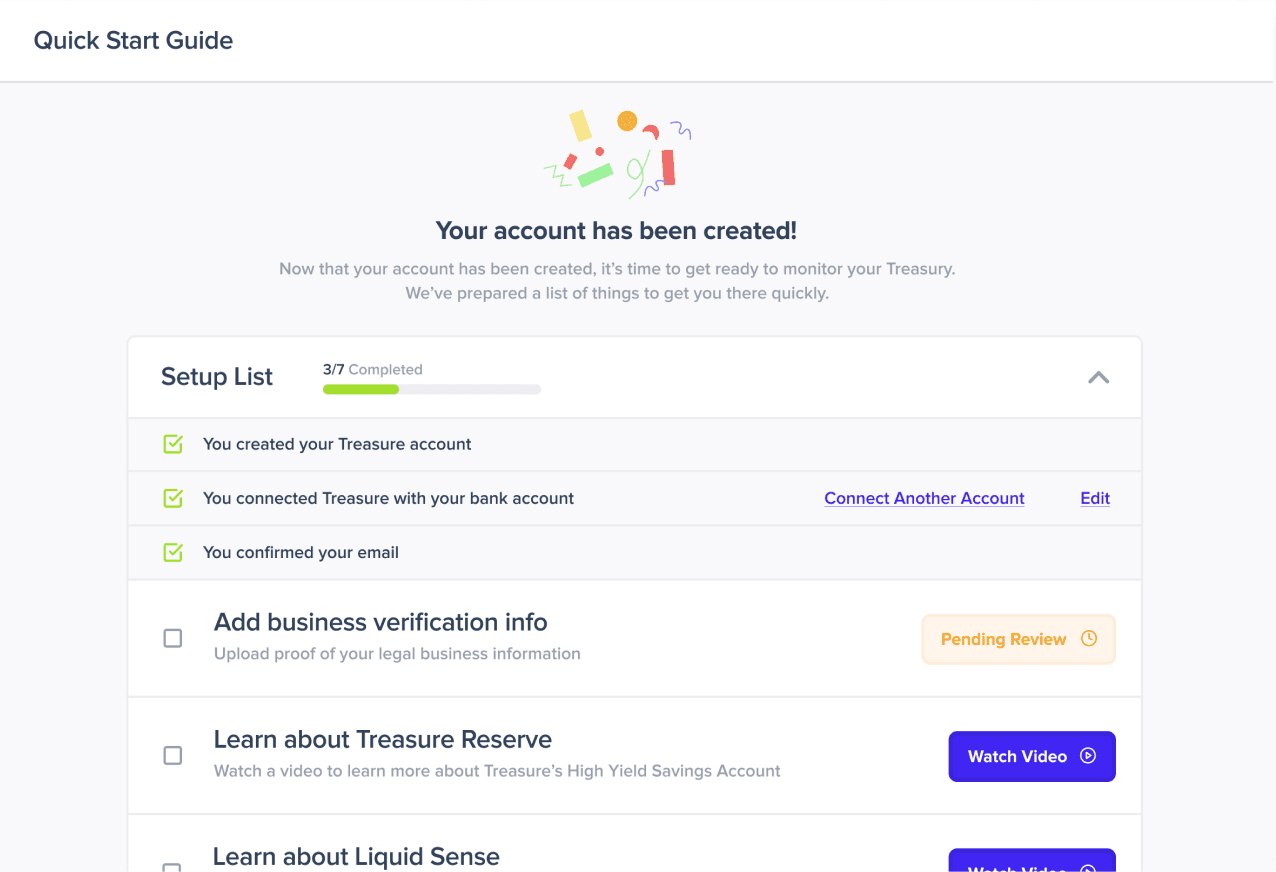

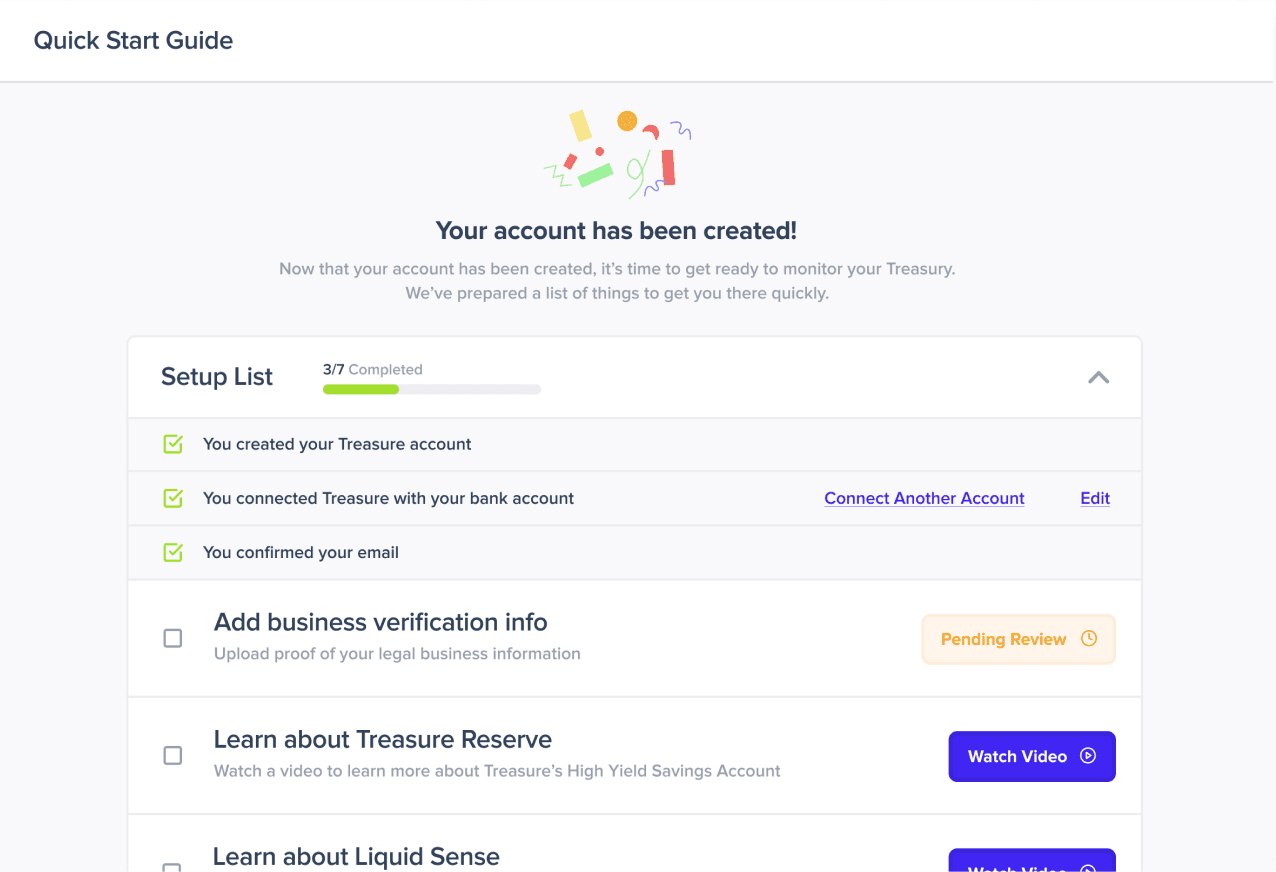

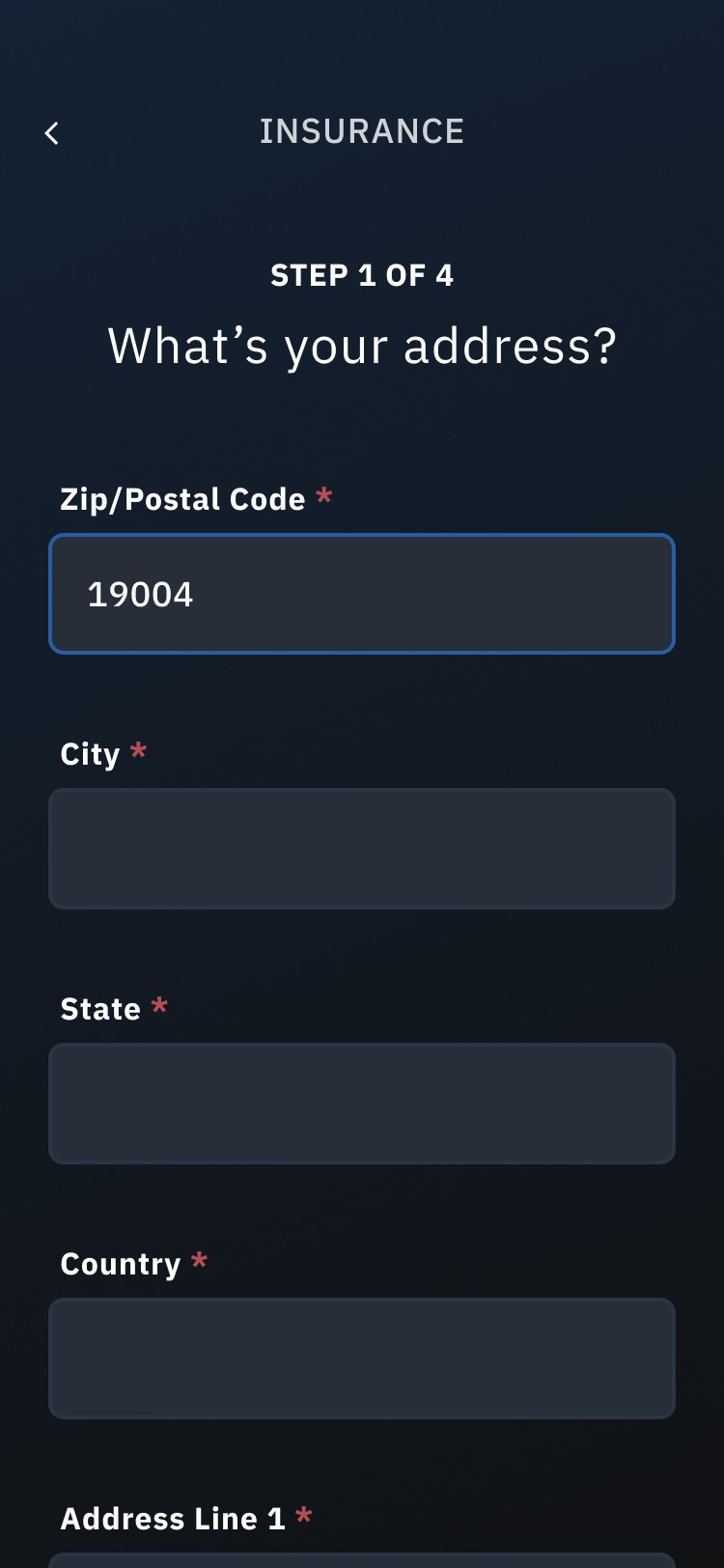

Onboarding Design

Treasure Finance

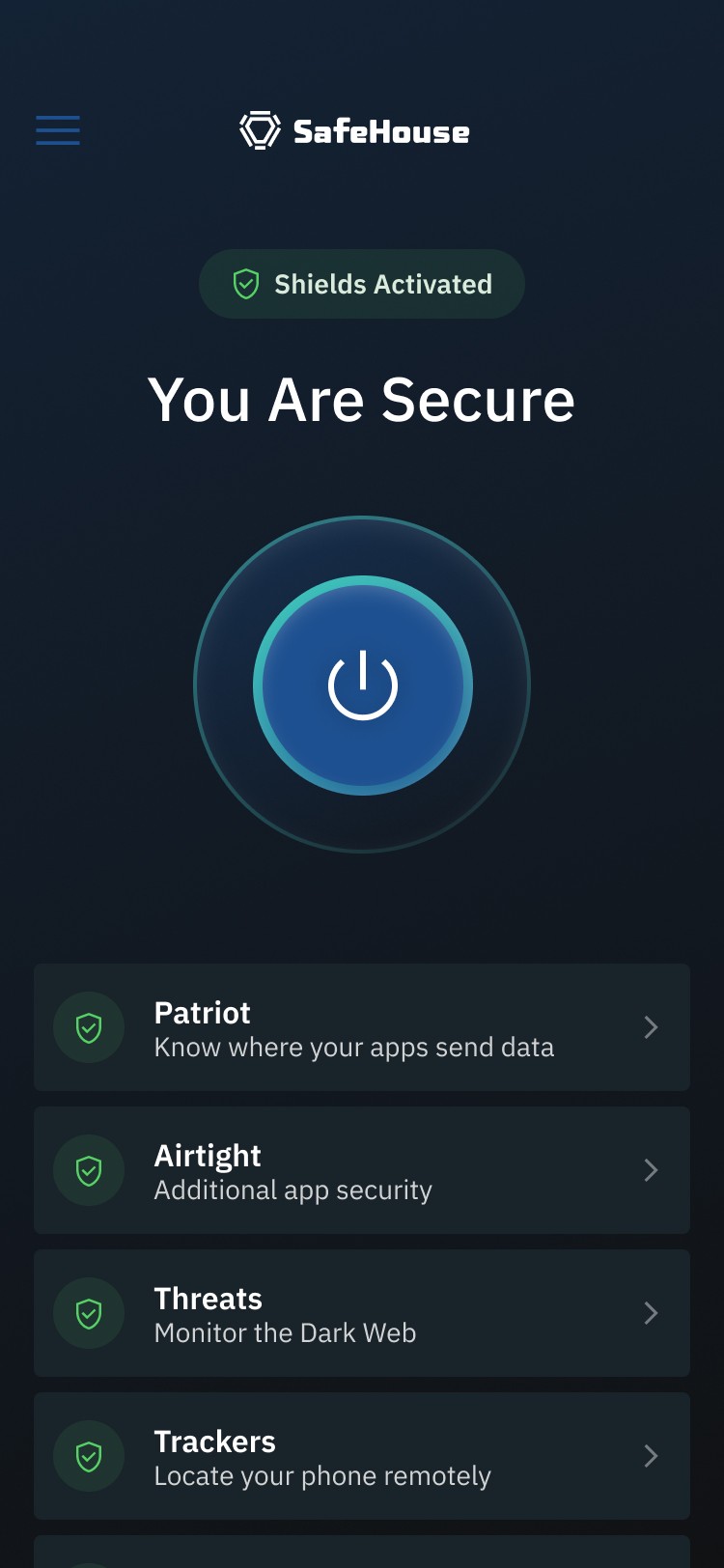

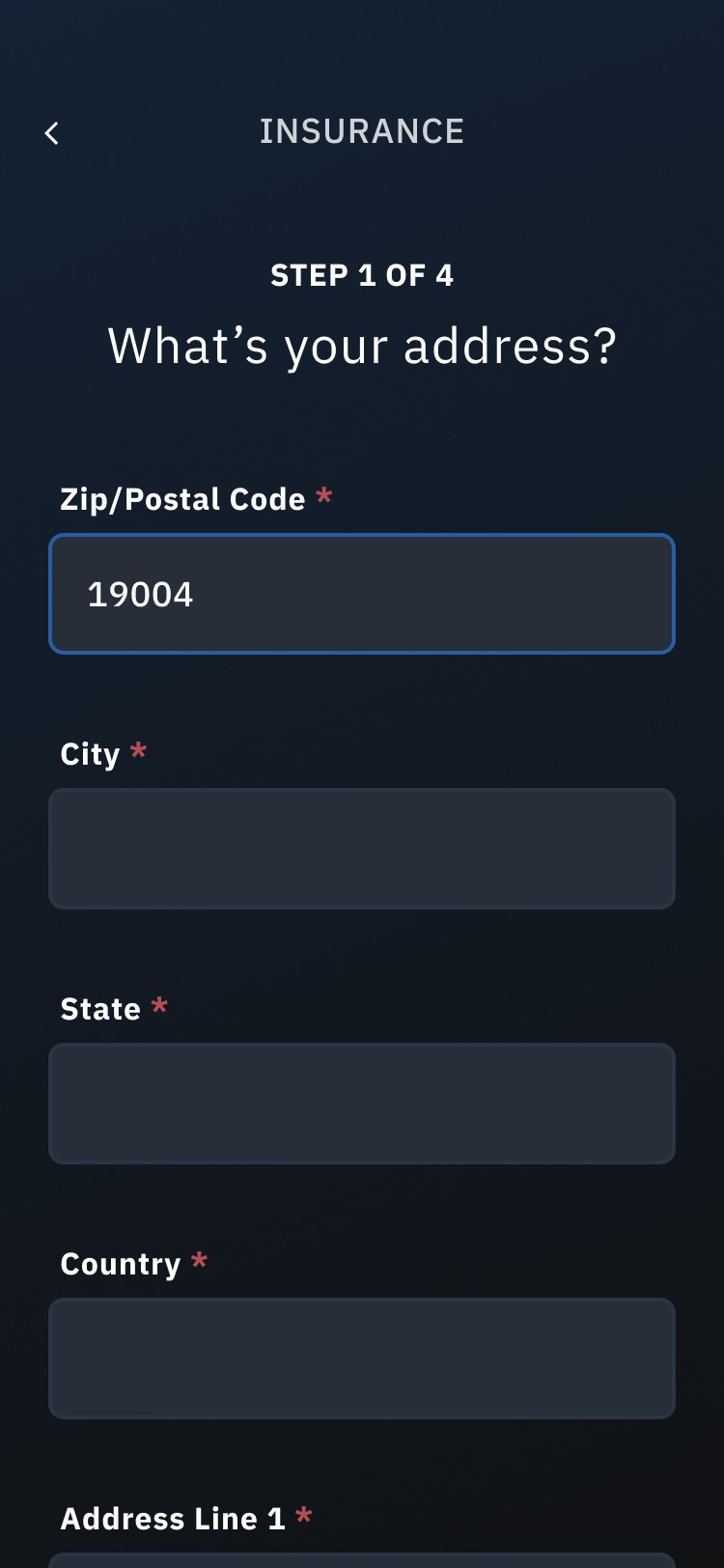

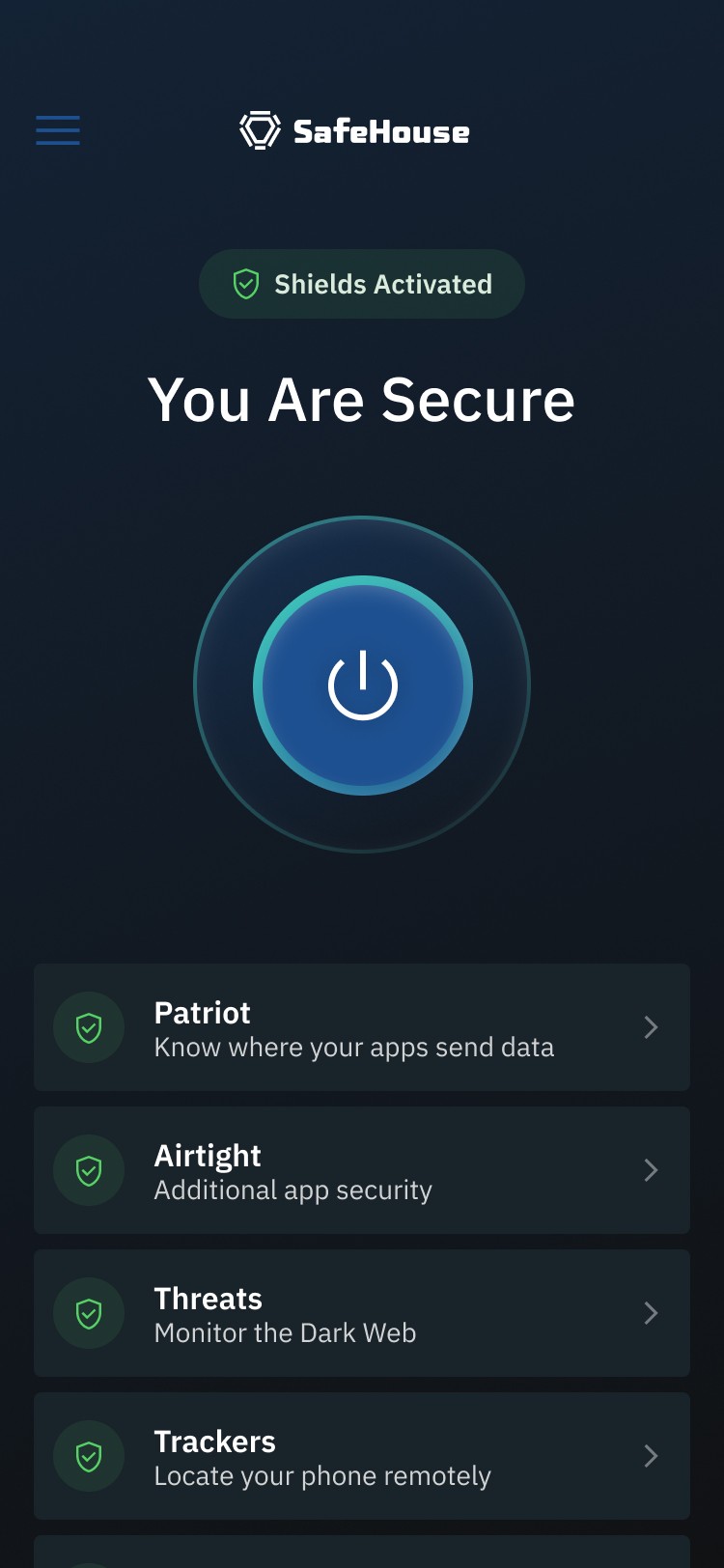

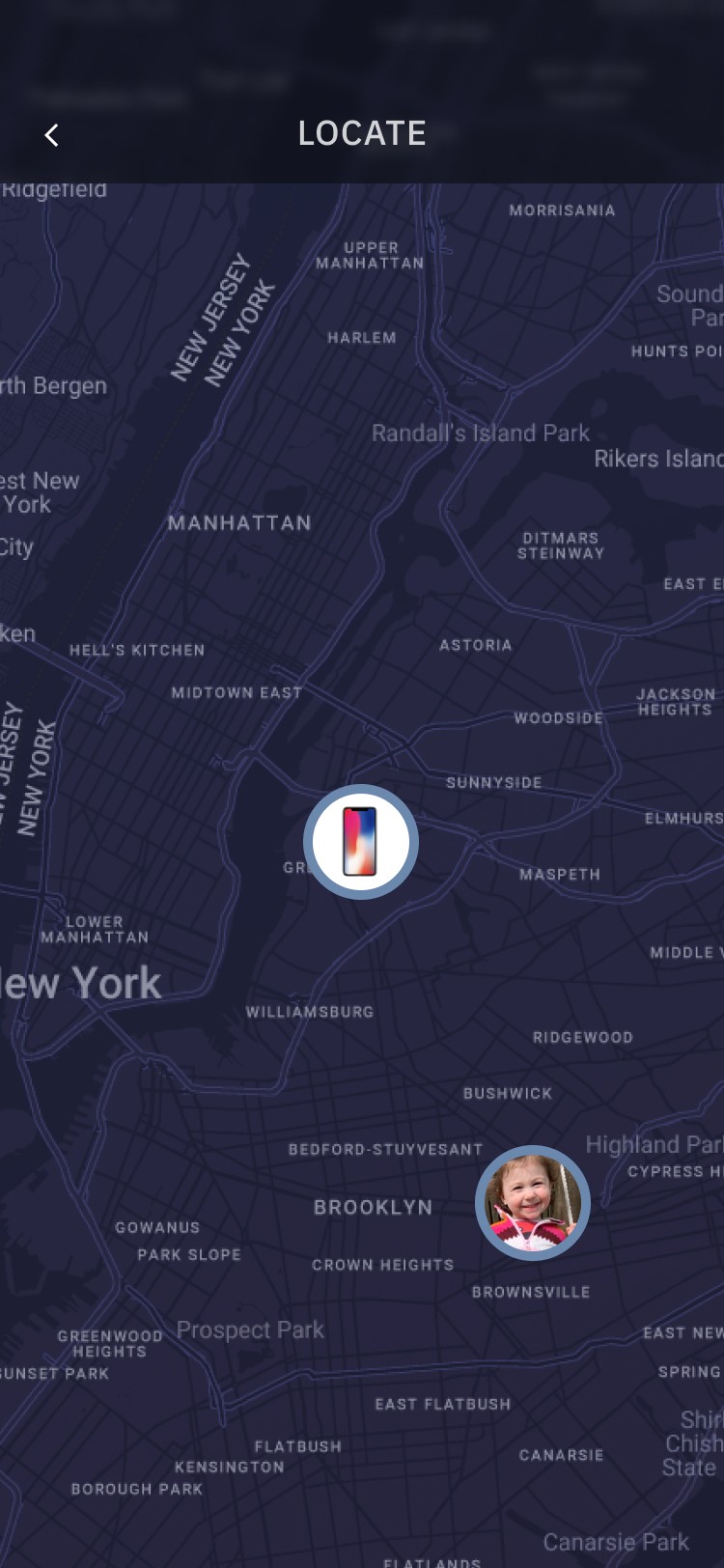

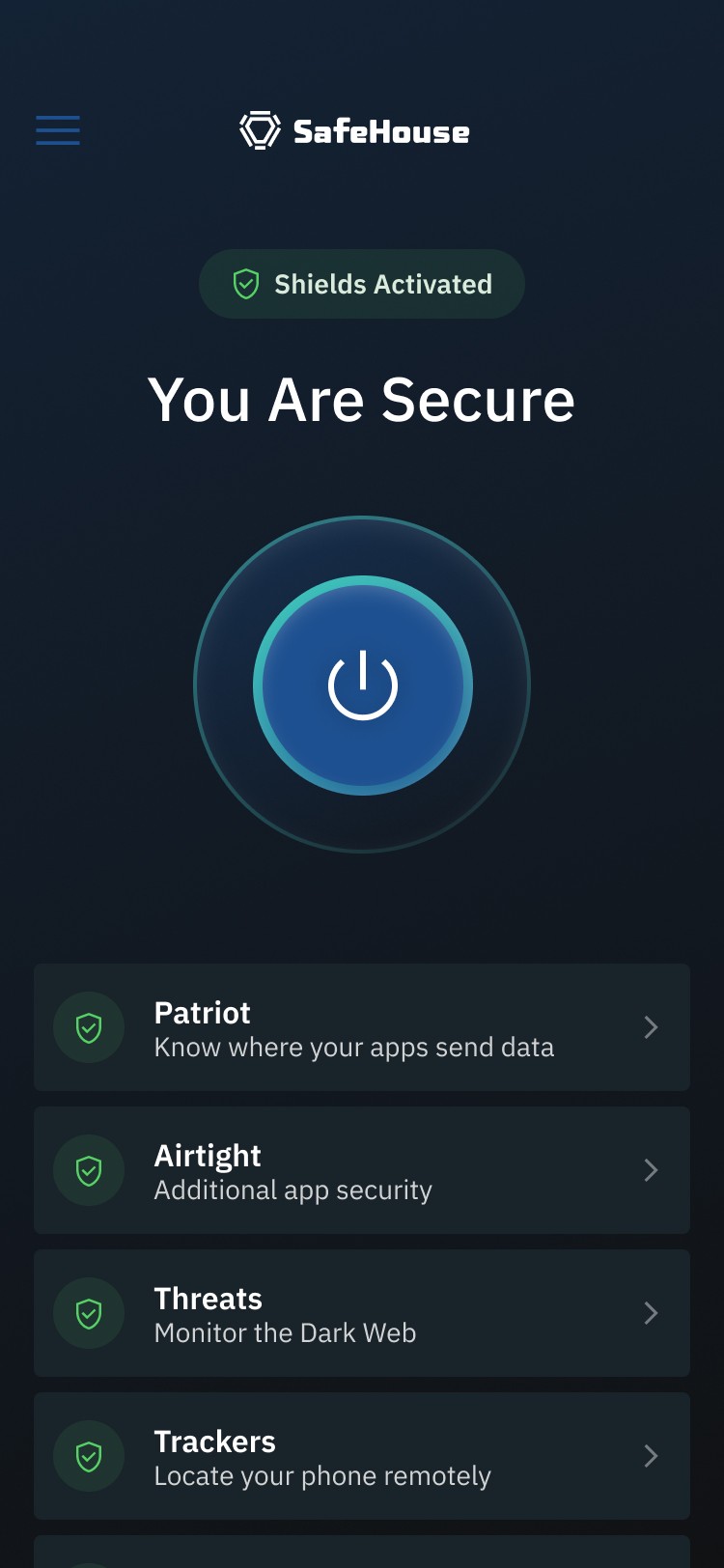

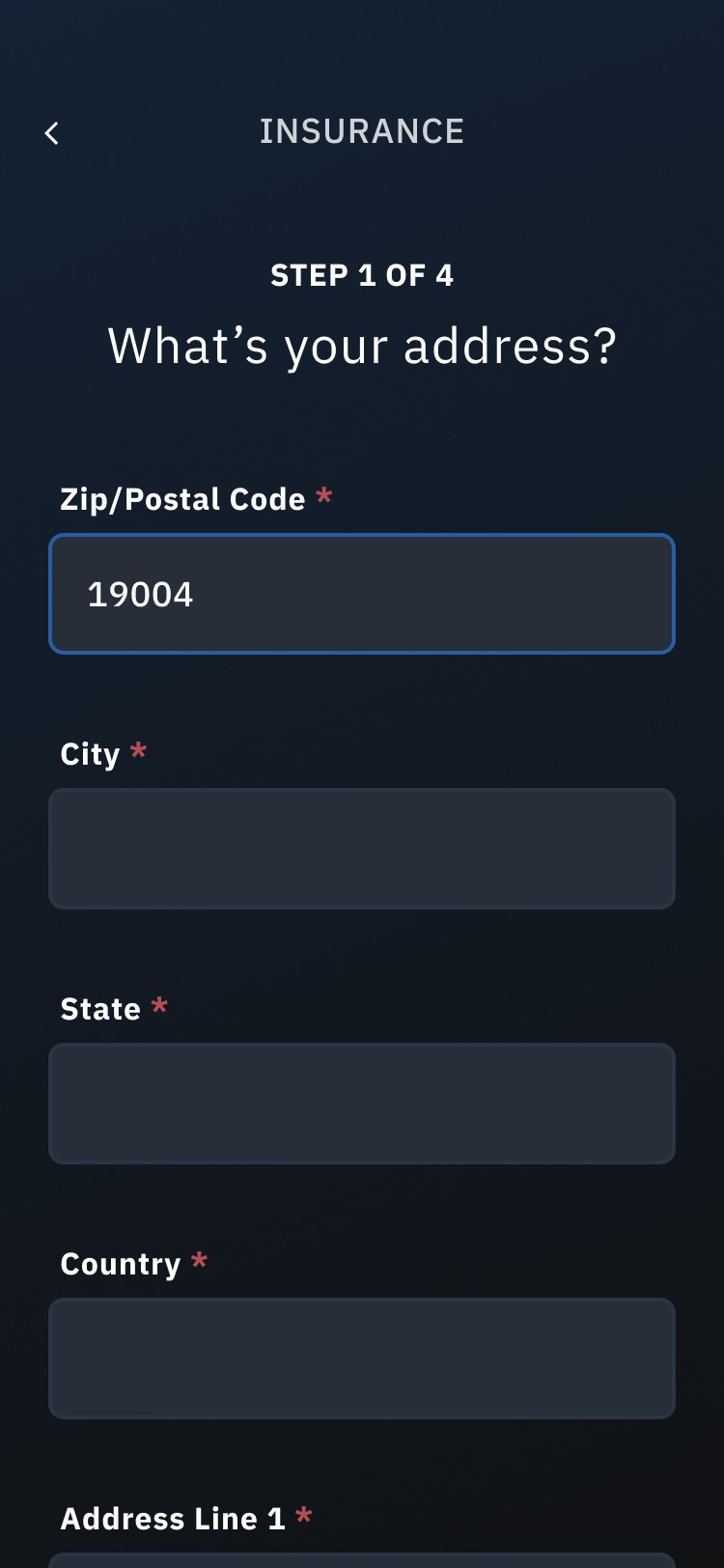

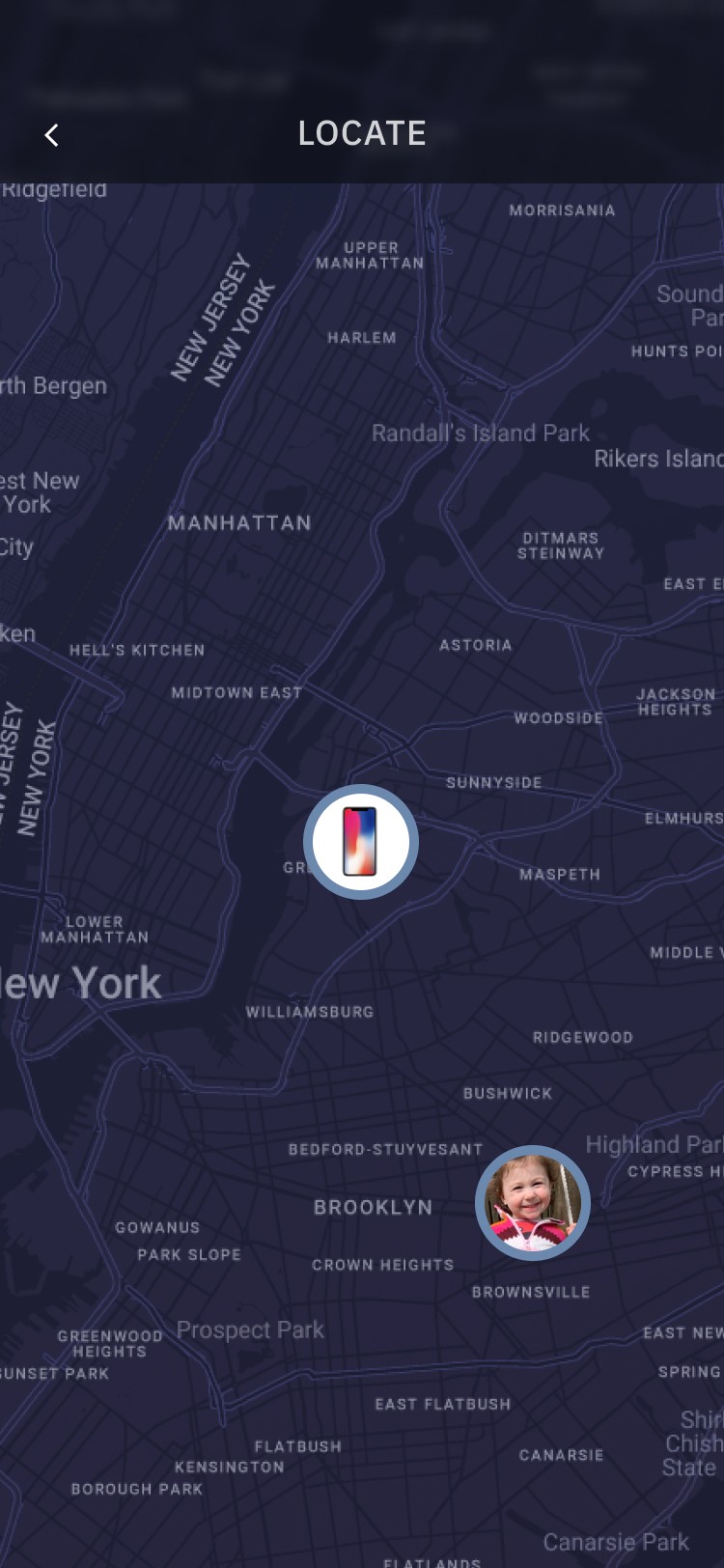

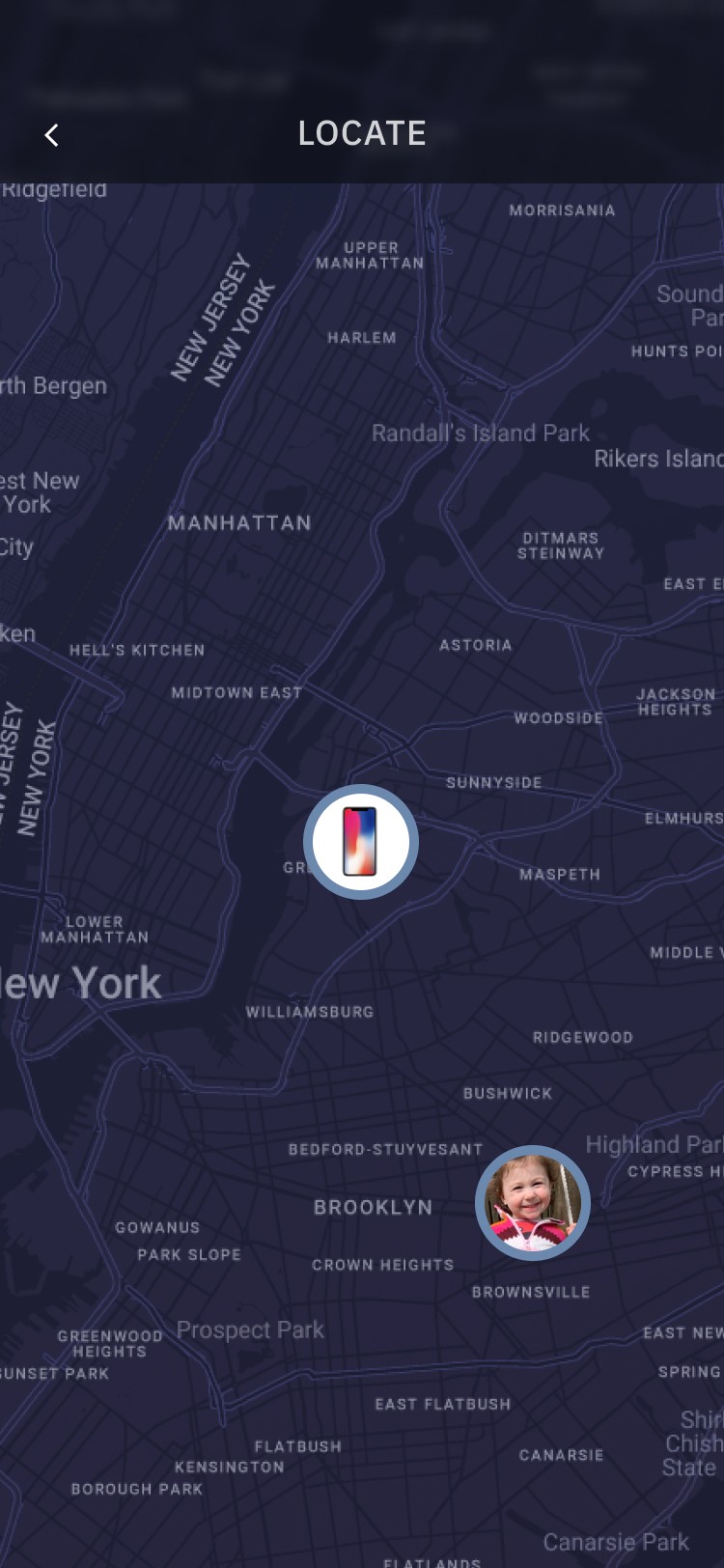

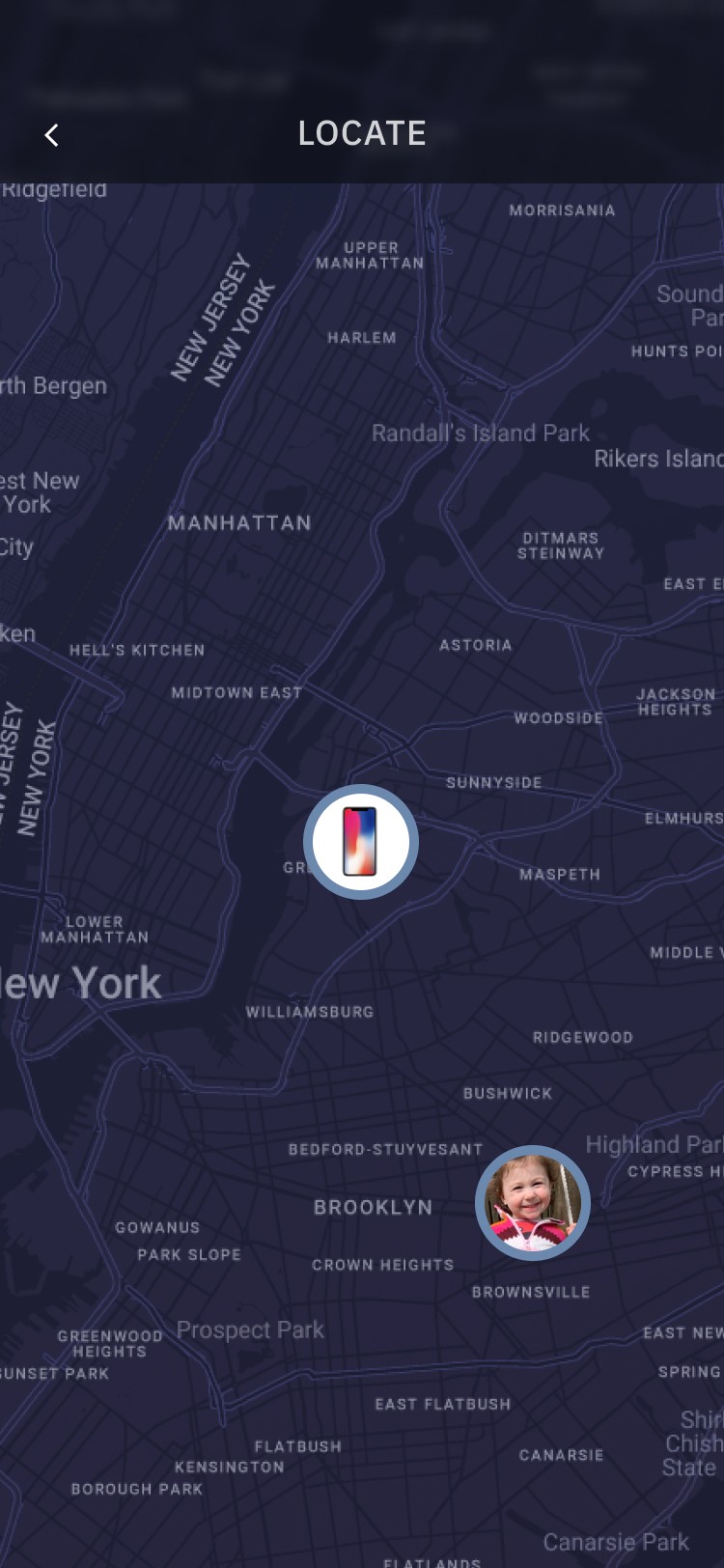

Mobile App Design

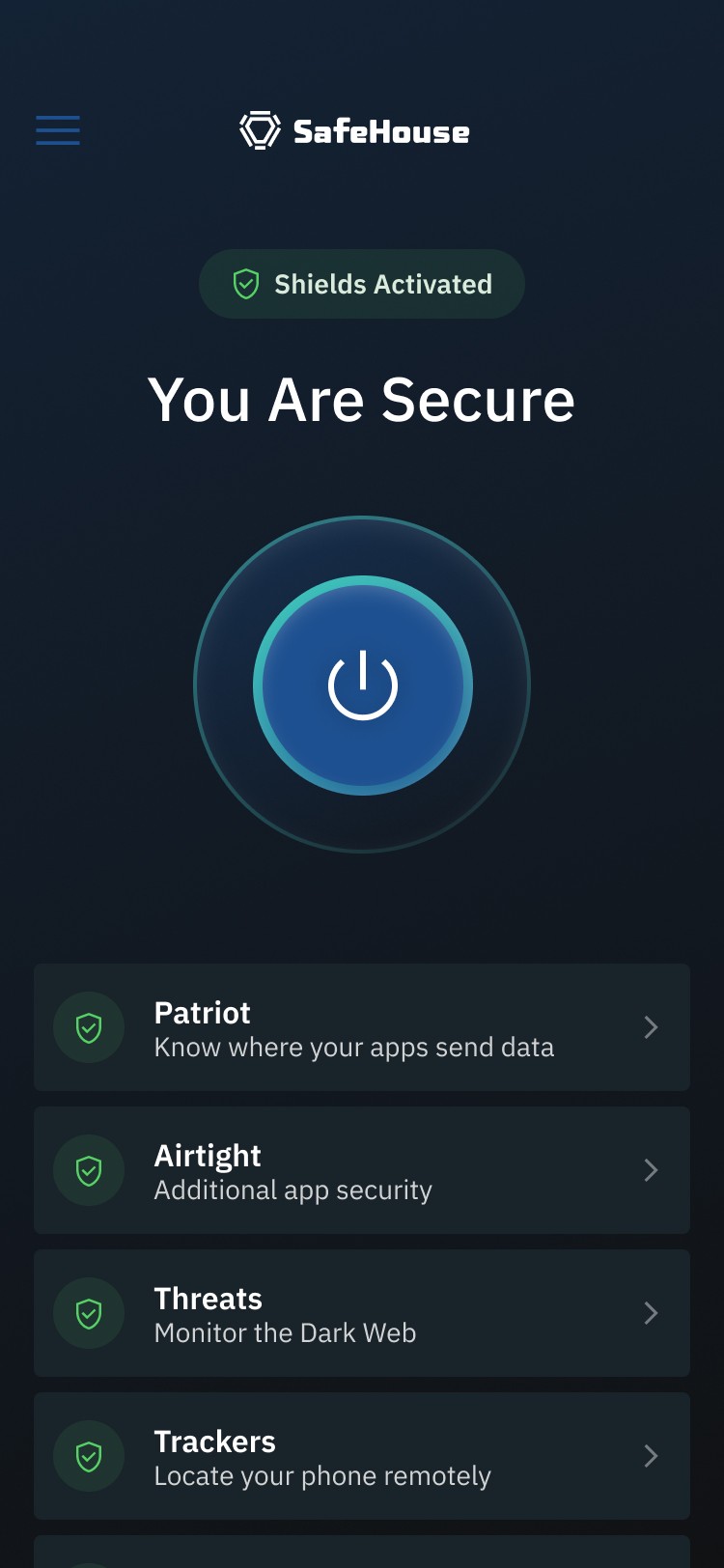

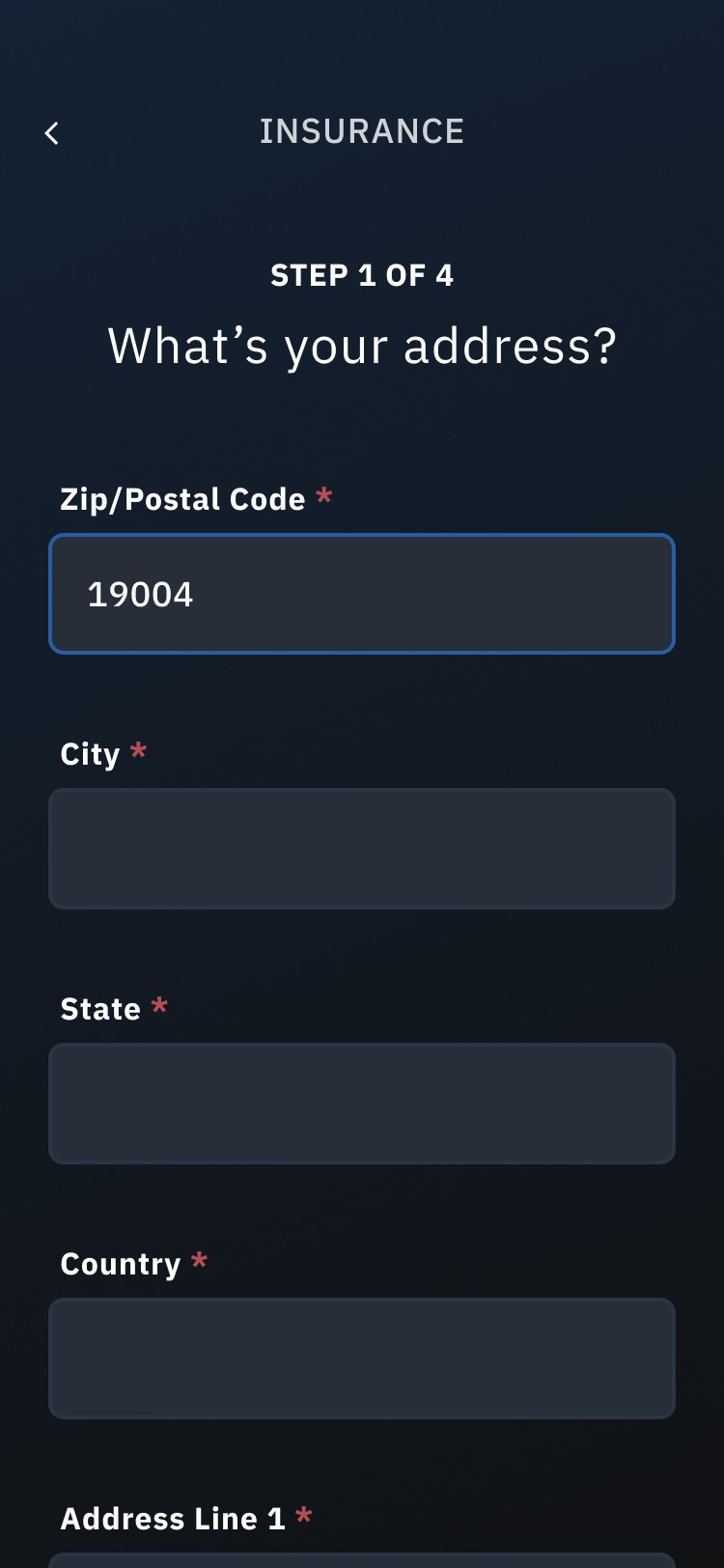

Safehouse

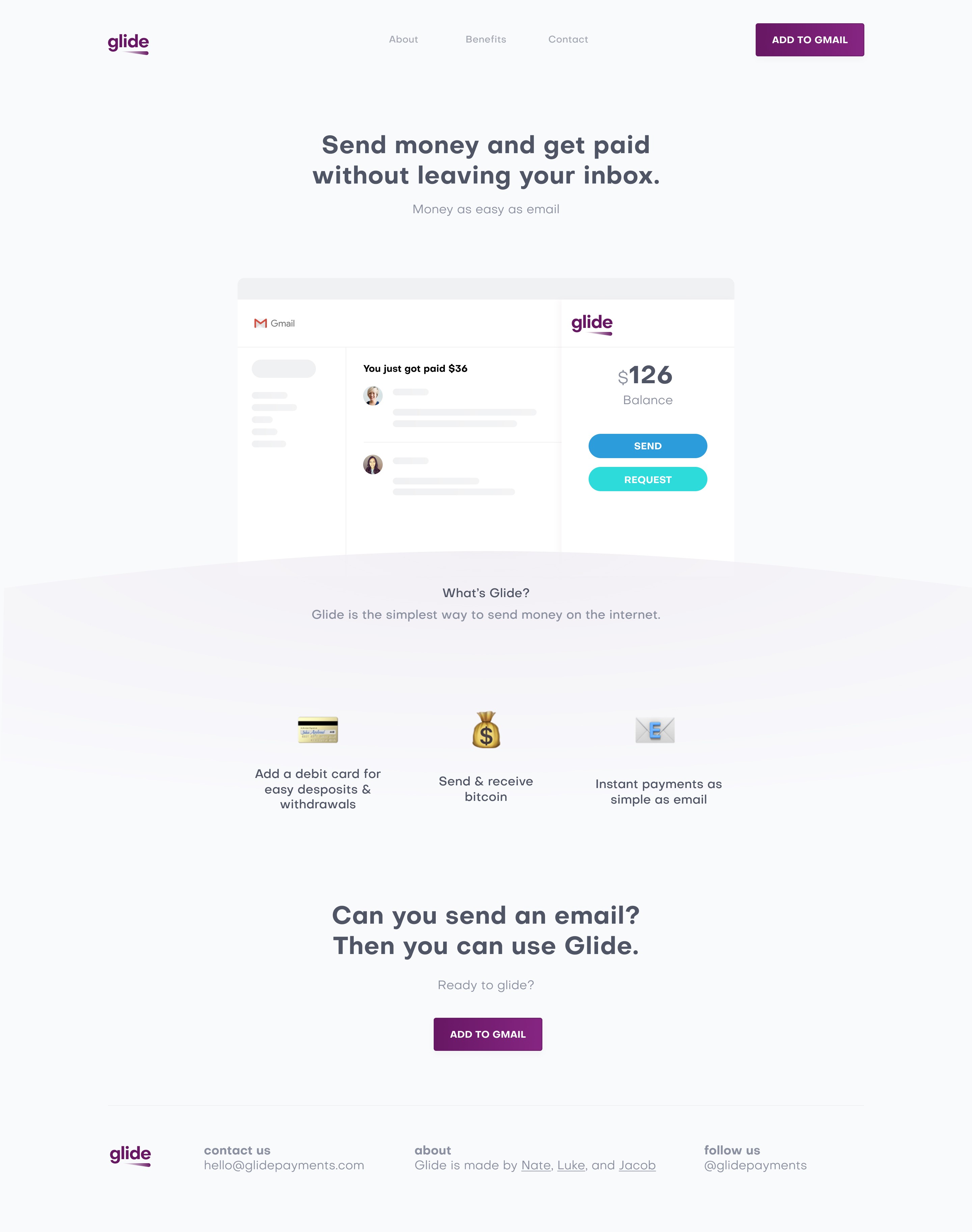

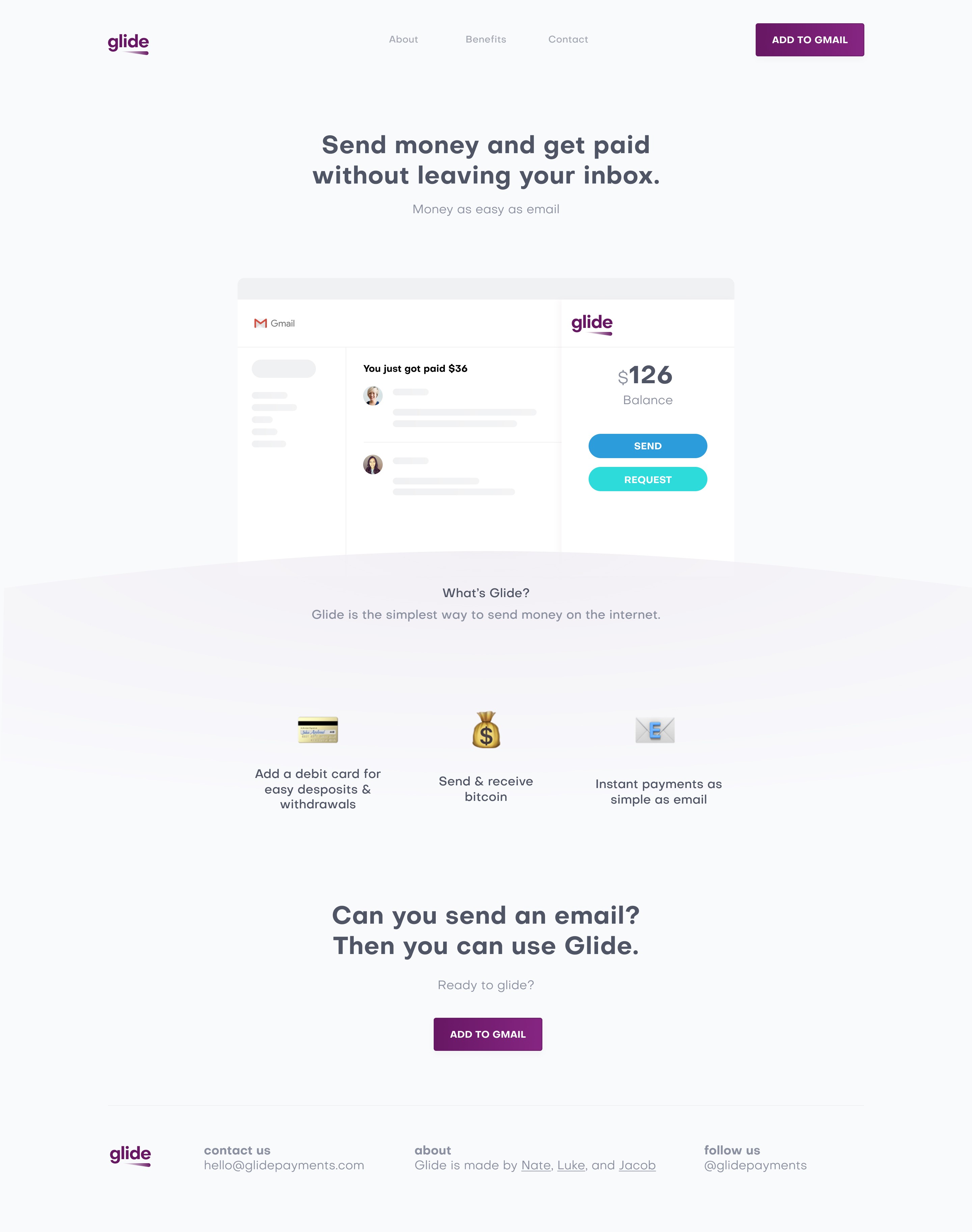

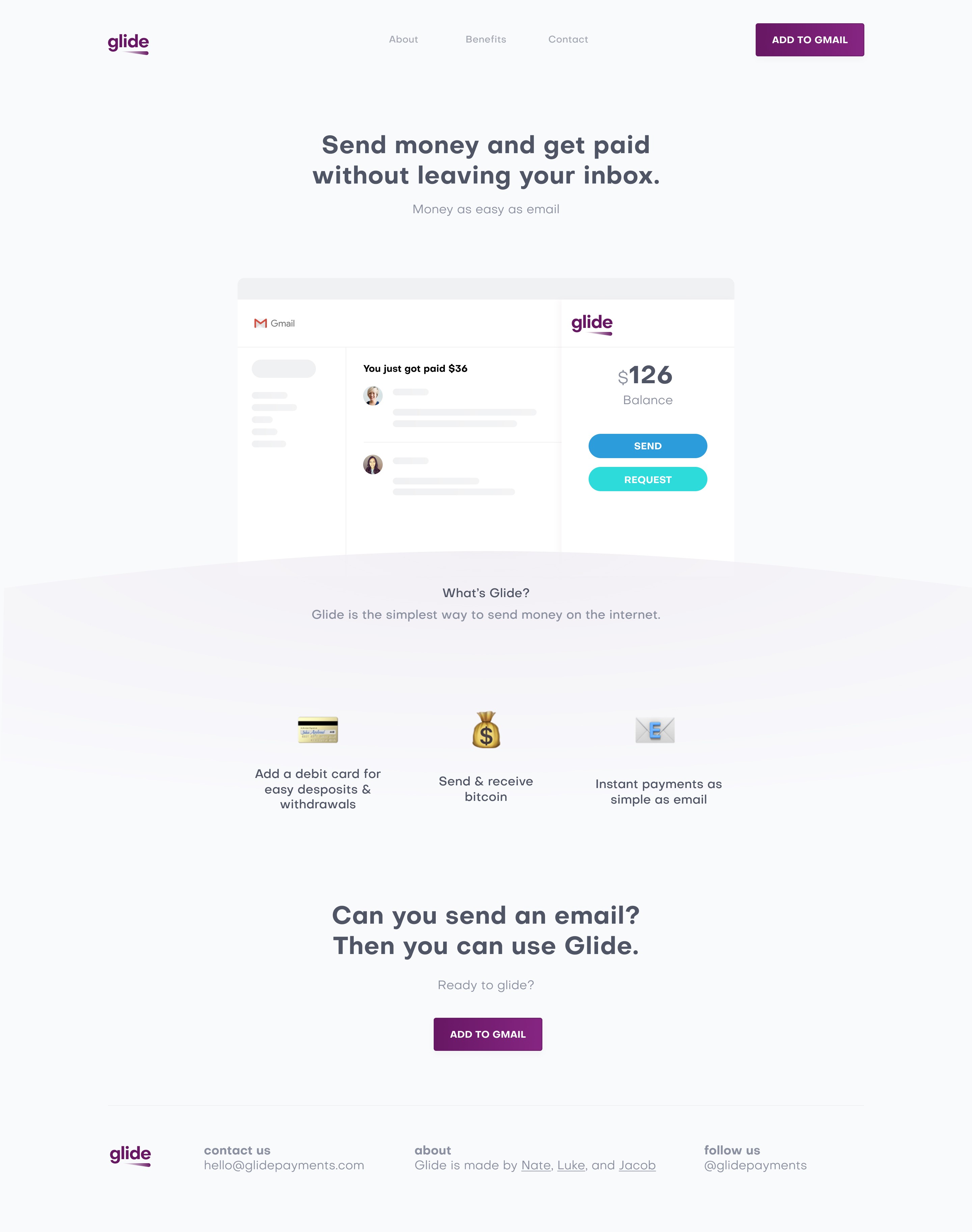

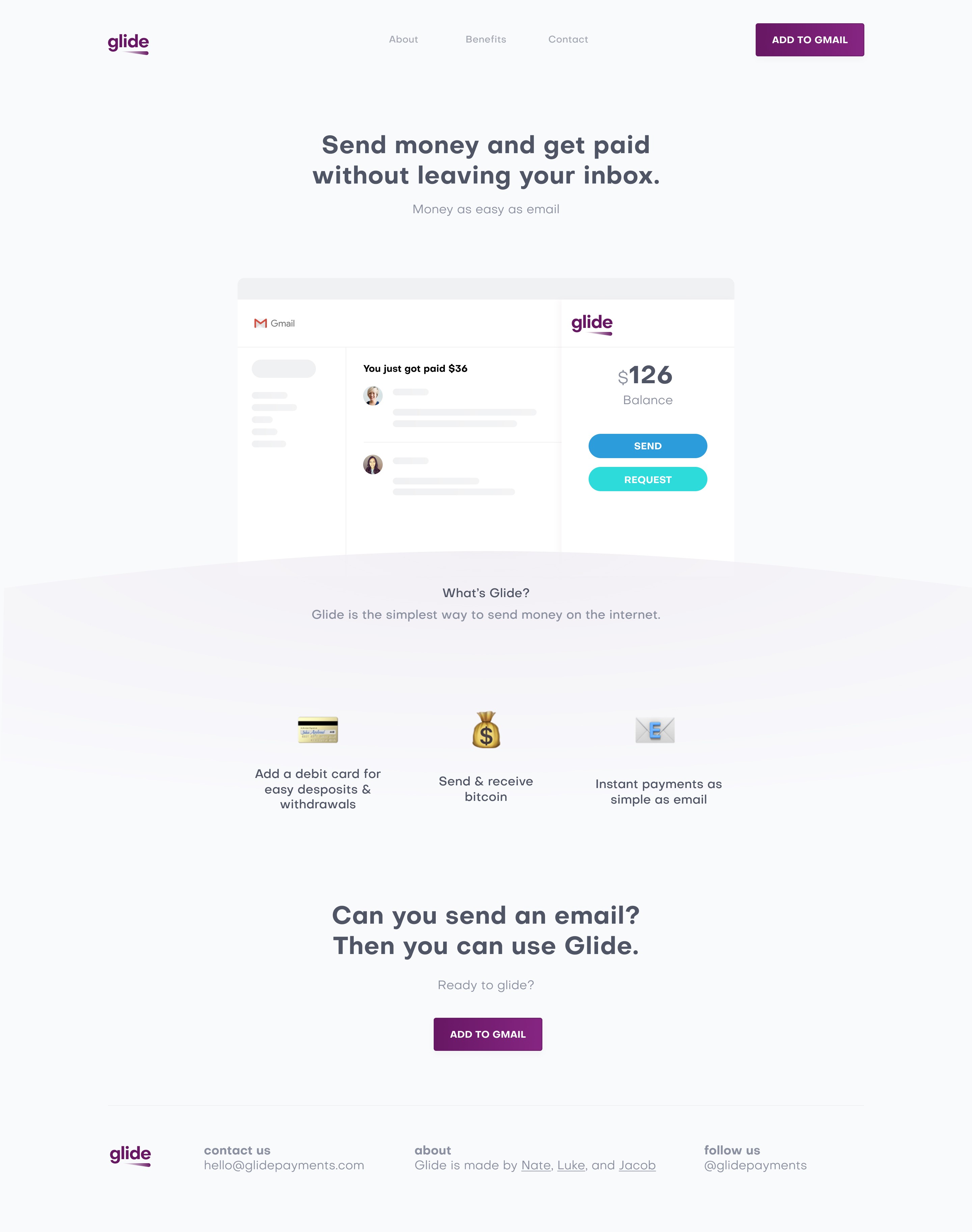

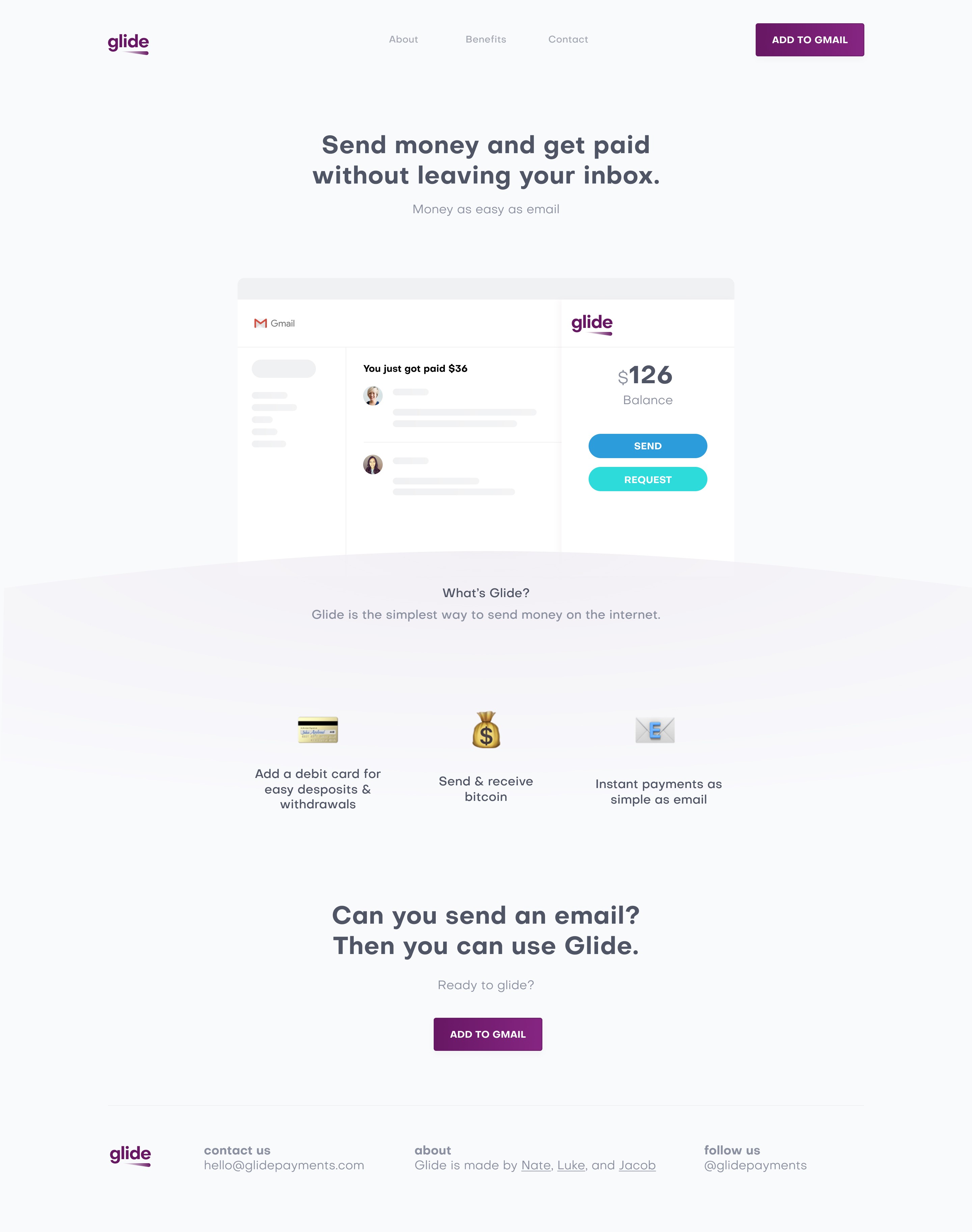

Landing Page Design

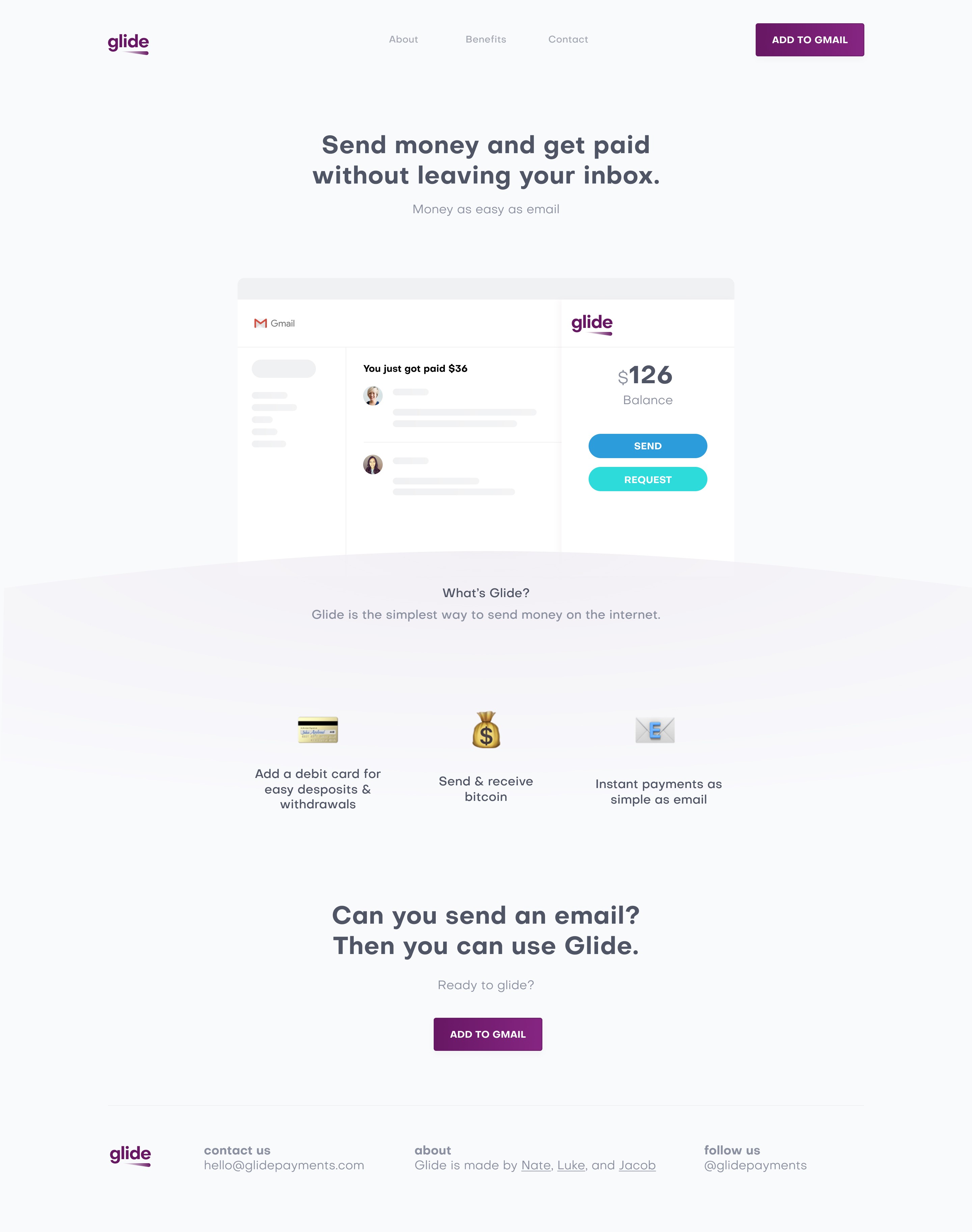

Glide

Pitch Deck Design

Story Capital

Graphic Design

Sounding Capital Partners

Concept Design

Common

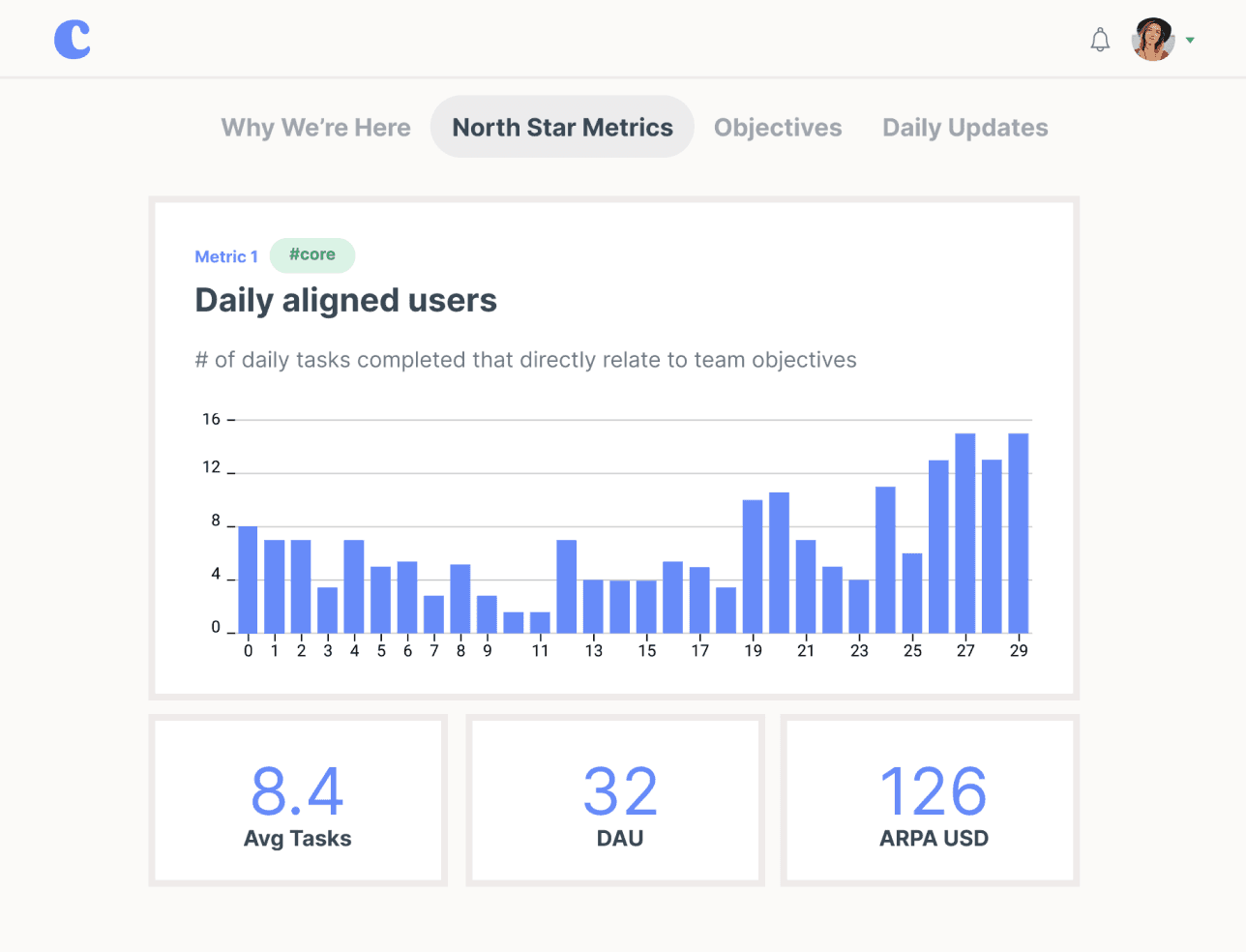

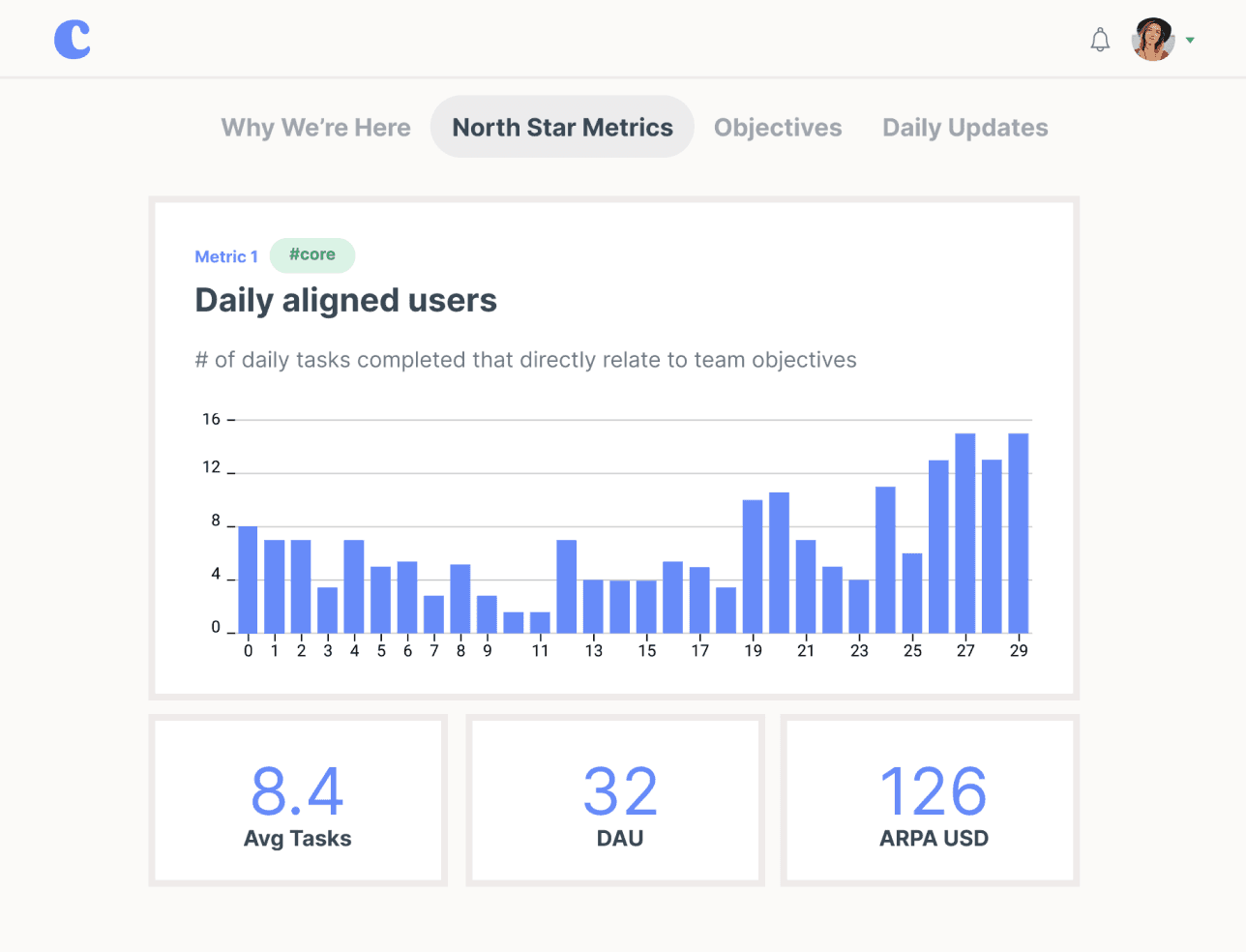

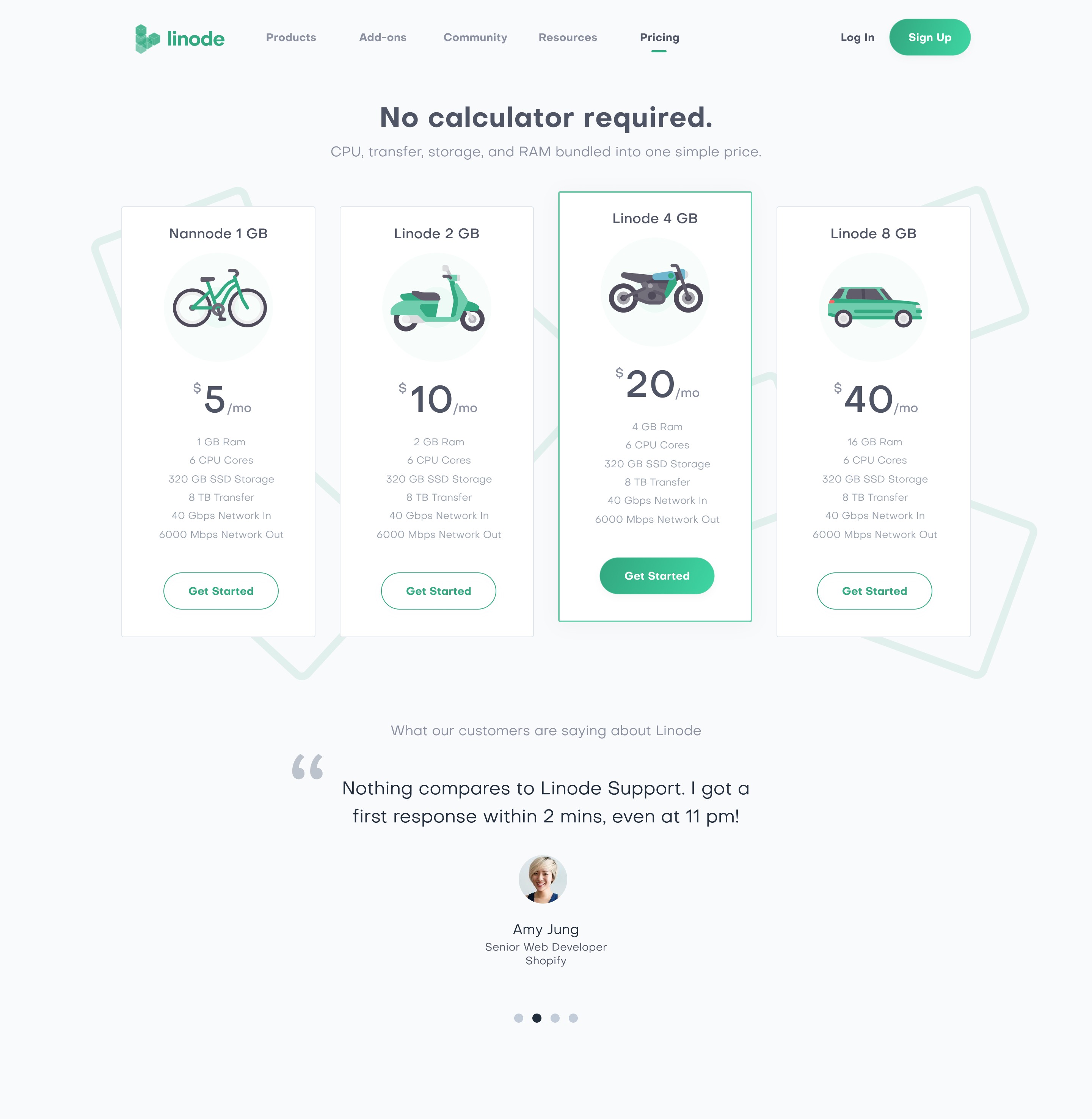

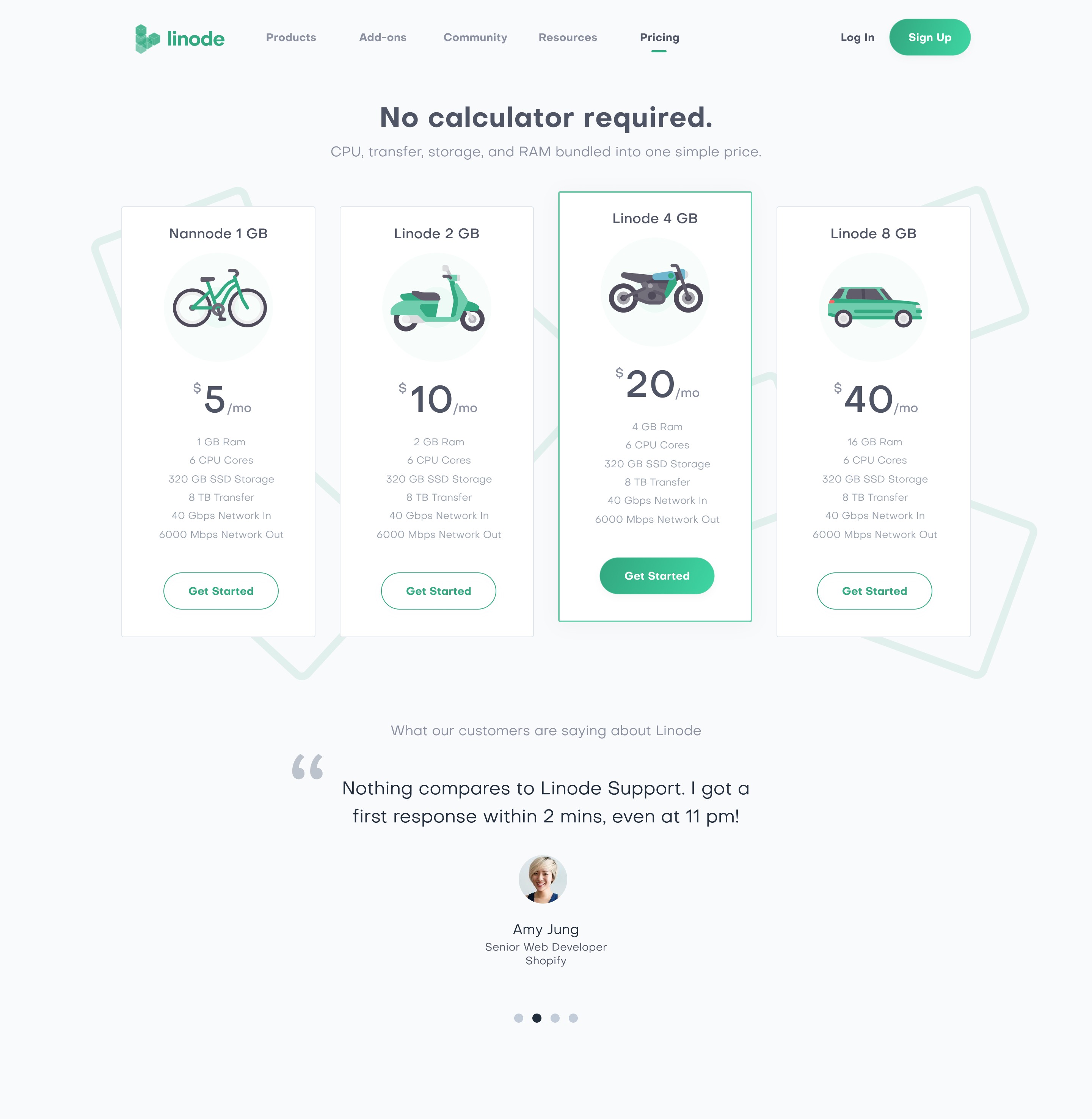

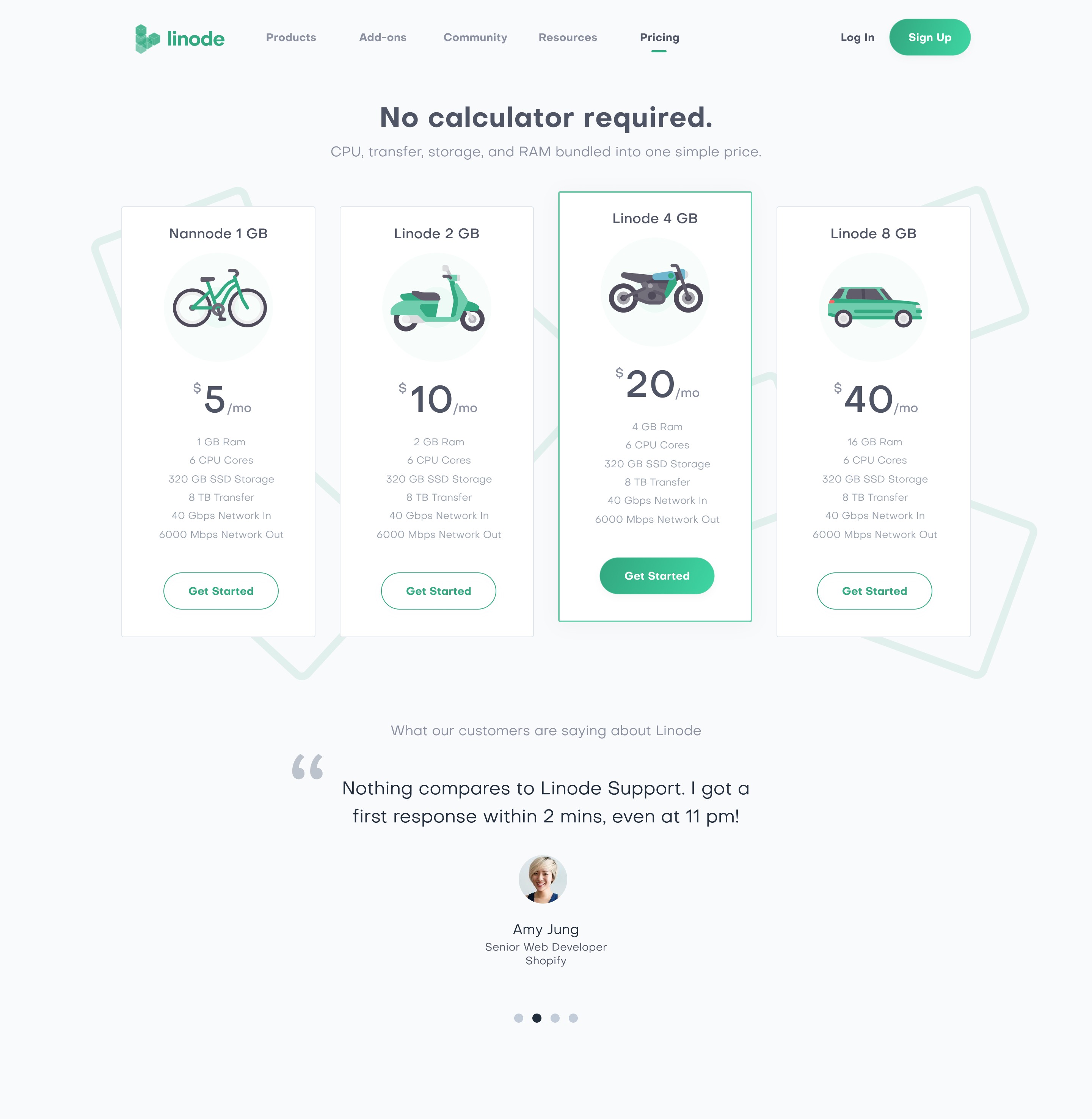

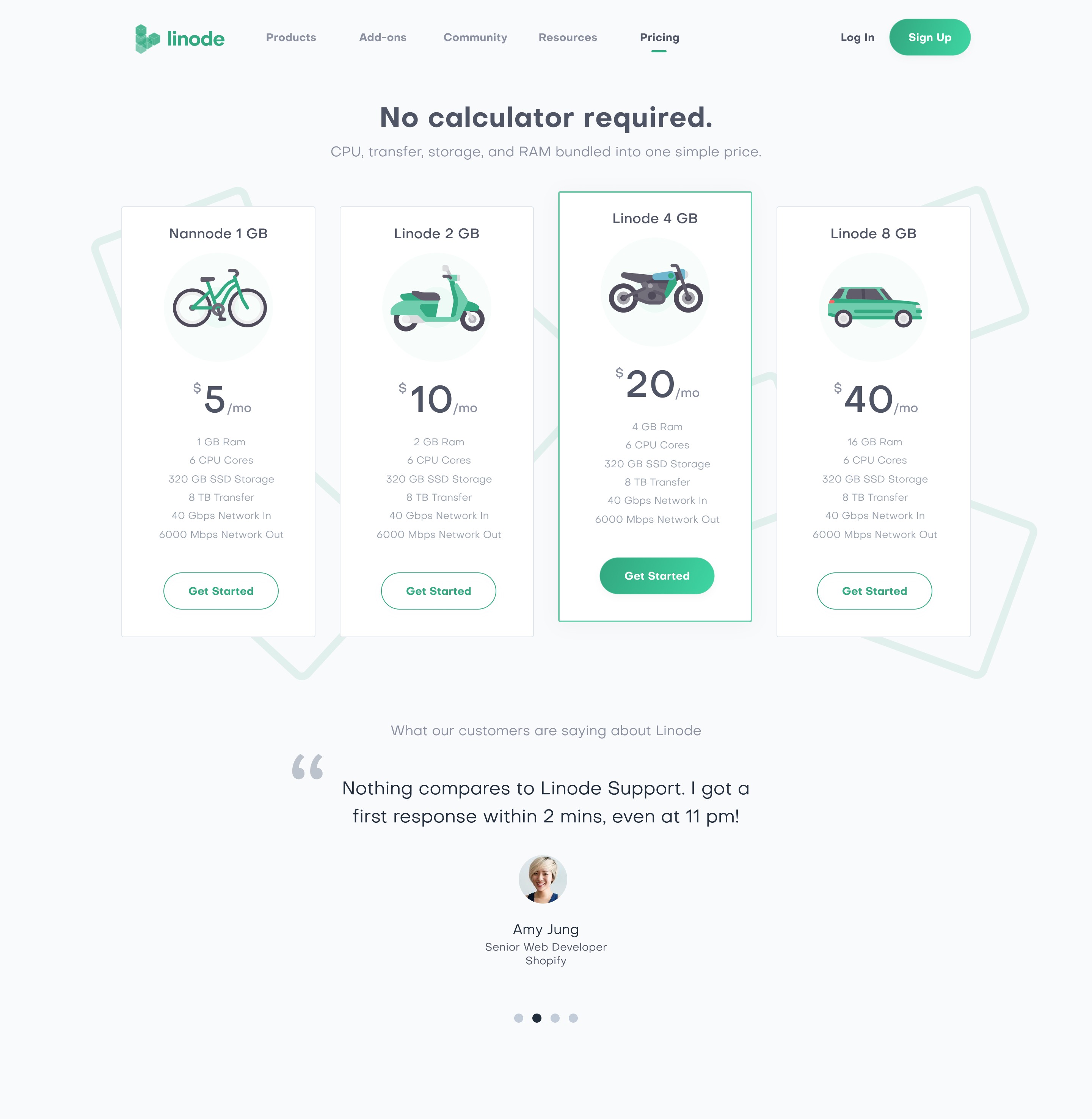

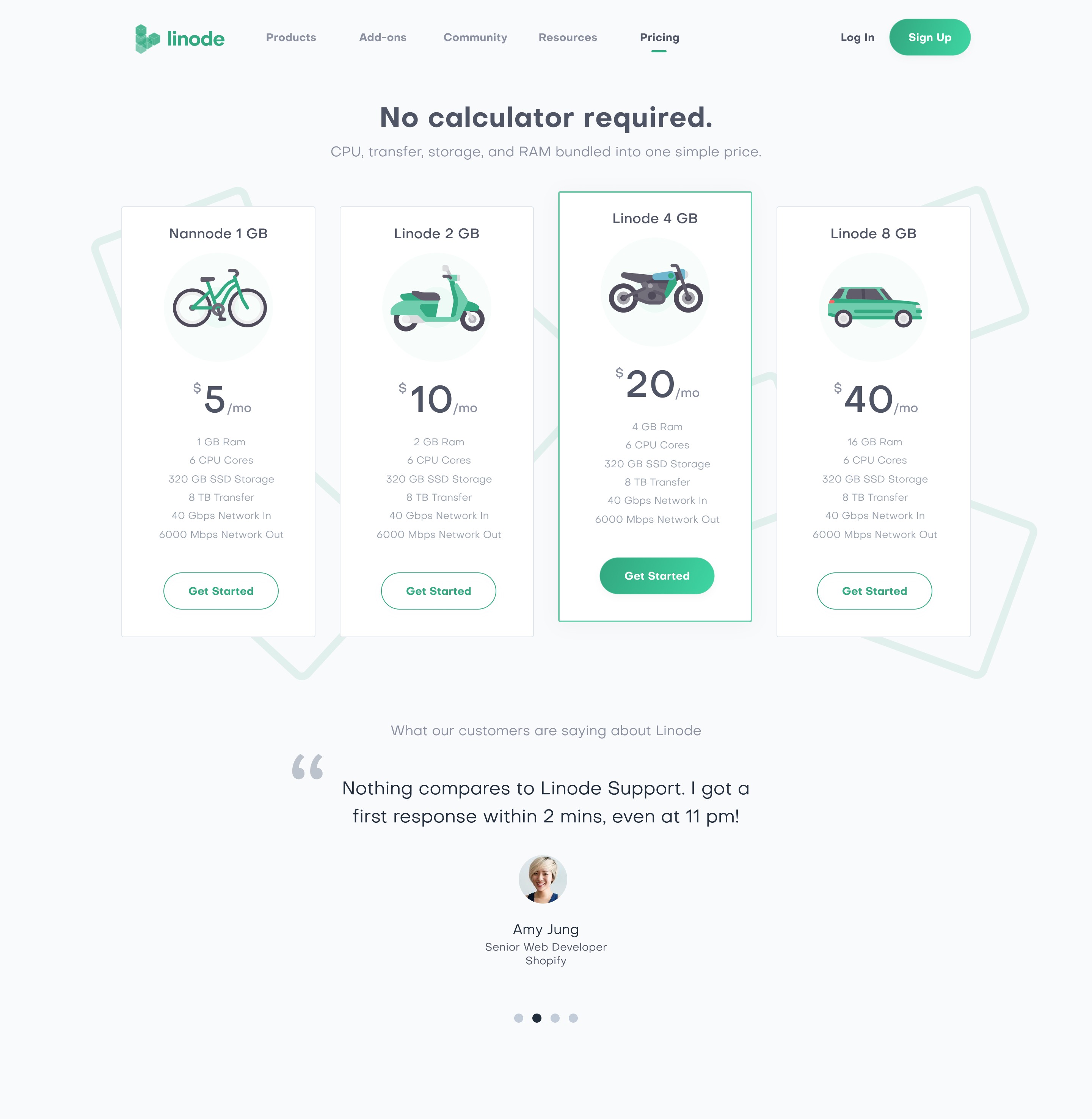

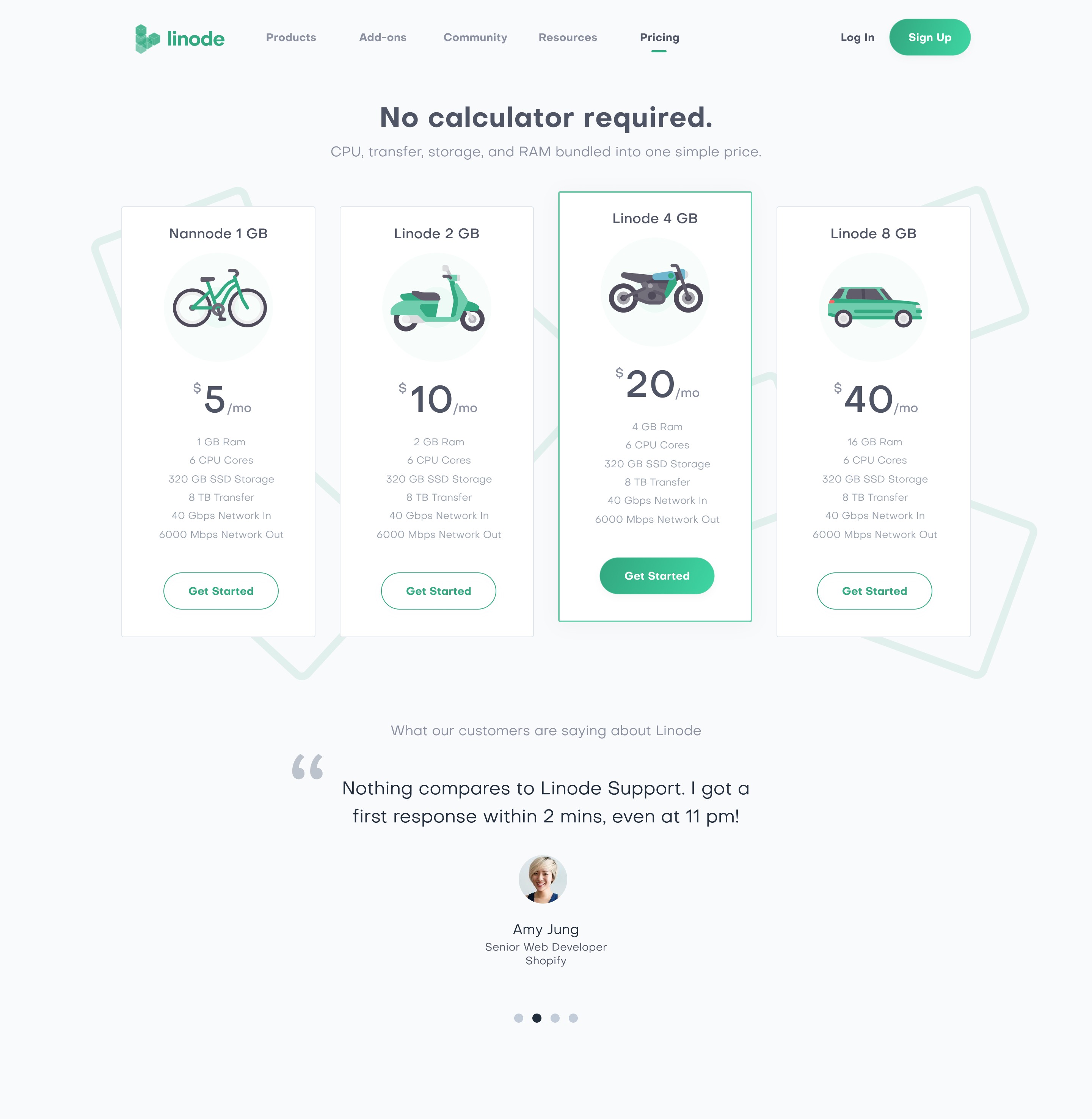

Pricing Page Design

Linode

GUIDING PRINCIPLES

I help teams and clients design end-to-end

cross platform digital experiences

that drive revenue and smiles

I help teams and clients design end-to-end

cross platform digital experiences

that drive revenue and smiles

Move fast without

breaking things

Insane attention

to detail

Effective collaboration

and communication

Outcomes driven and

data-informed design

Carlos Rosemberg

UX Researcher, AI at IBM

Working with Jake was an absolute pleasure and a privilege. He possesses a rare combination of skills in product design, research, and product management, being able to navigate and handle end-to-end project responsibilities with ease in those areas. That is amplified with his extensive knowledge of the SaaS industry, and I was always impressed with his ability to connect small details in the user experience with high-stakes product strategy. On top of that, he is a natural leader with a genuine empathy for his team members, and his strong communication skills make working with him a breeze. If you're looking for someone who can take charge, build great products, and inspire a team, look no further, Jake is the perfect choice!

Kenneth Tsuji

Data Scientist, Cybersyn

I worked with Jake for three years and I wouldn’t hesitate to work with him again. He was a force multiplier on the development team by carefully scoping client needs, coordinating engineering work efficiently, and guiding us through several successful major feature launches. He empowered my own work as a data scientist by ensuring that the SAAS platform always collected clean data to beget even more data driven features.

“

Selected Work

End-to-end Redesign

Context 365

Redesign of the alternative investment platform, Context 365.

+364%

Conversion Rate

Shipped multiple major features

Acquired by Apex Group

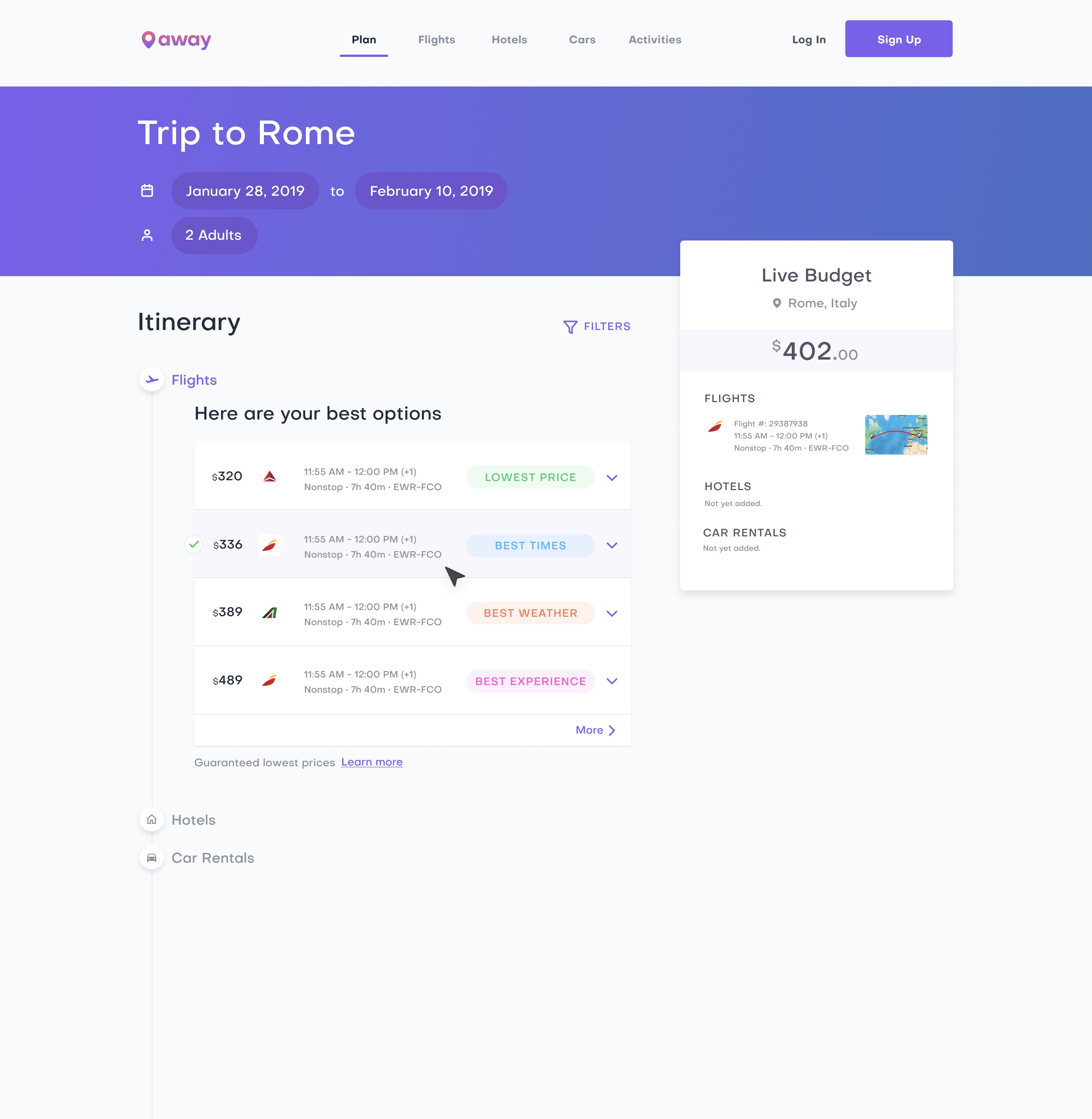

Application Design

Clarivate Analytics

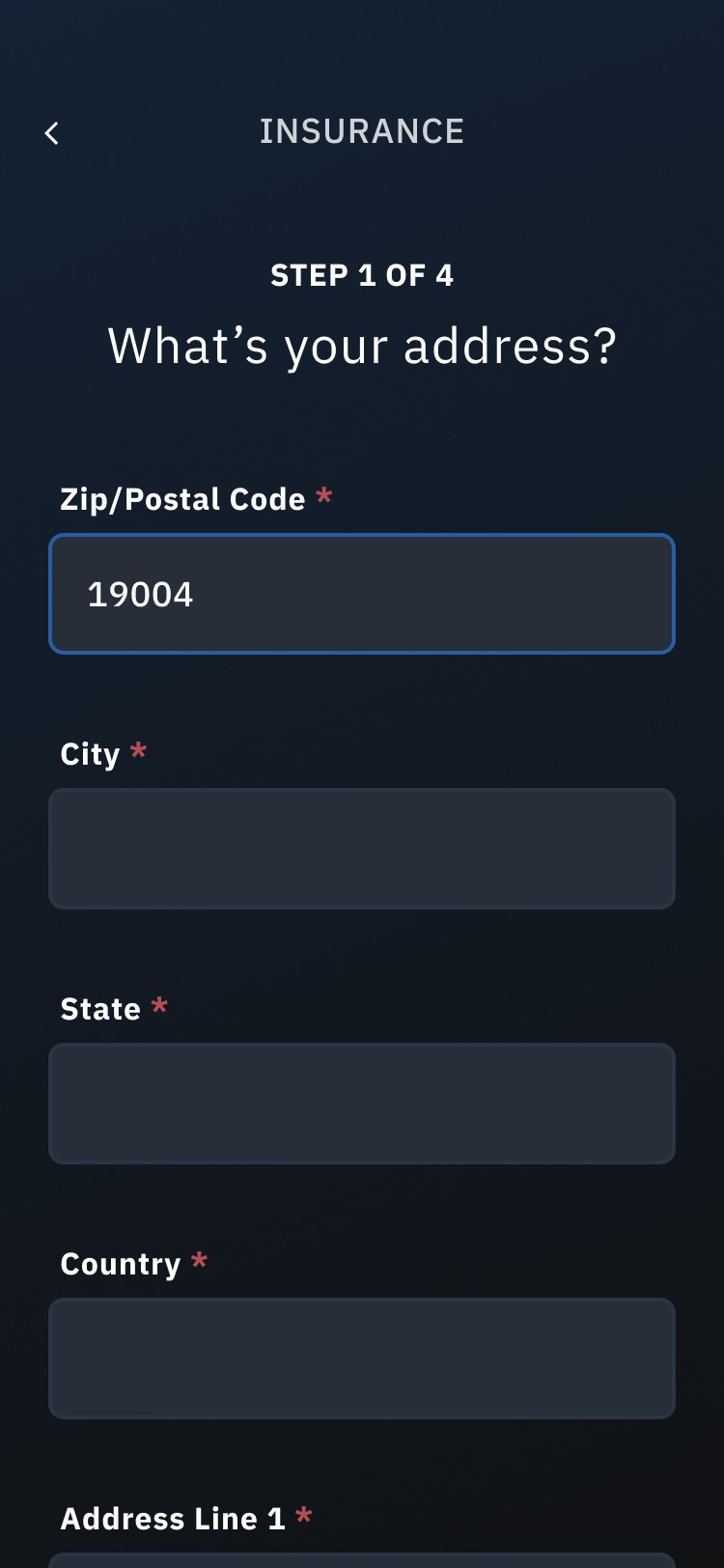

Onboarding Design

Treasure Finance

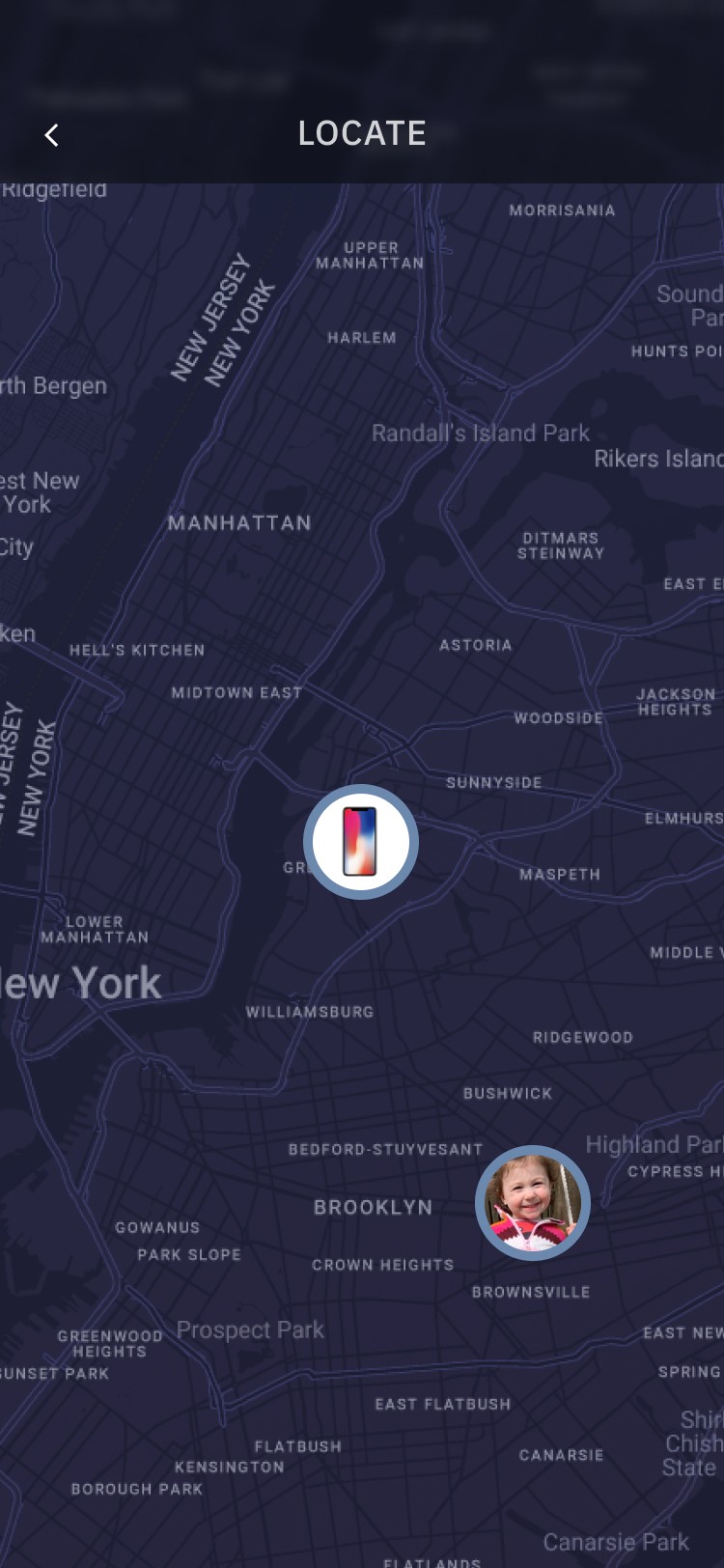

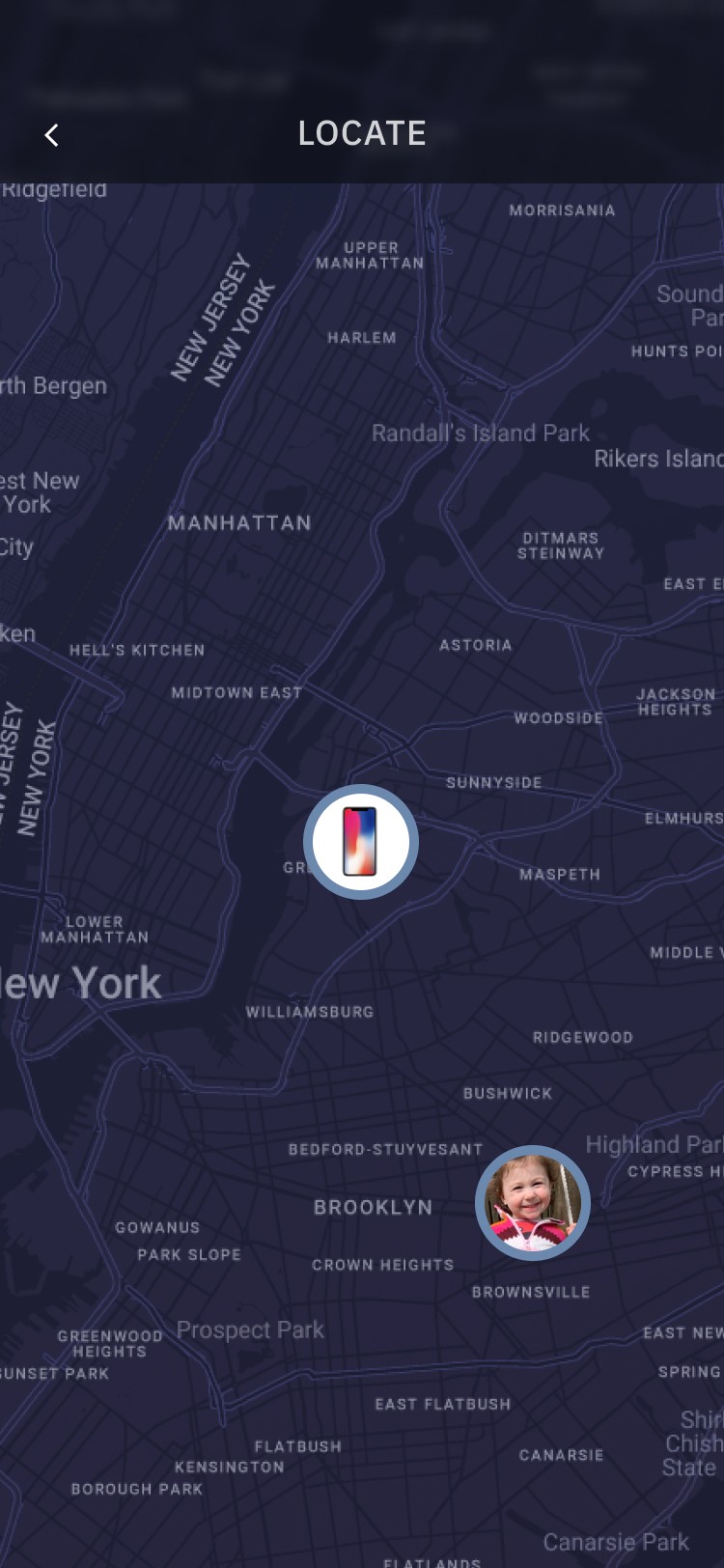

Mobile App Design

Safehouse

Landing Page Design

Glide

Pitch Deck Design

Story Capital

Graphic Design

Sounding Capital Partners

Pricing Page Design

Linode

Concept Design

Common

Case Study In-Progress

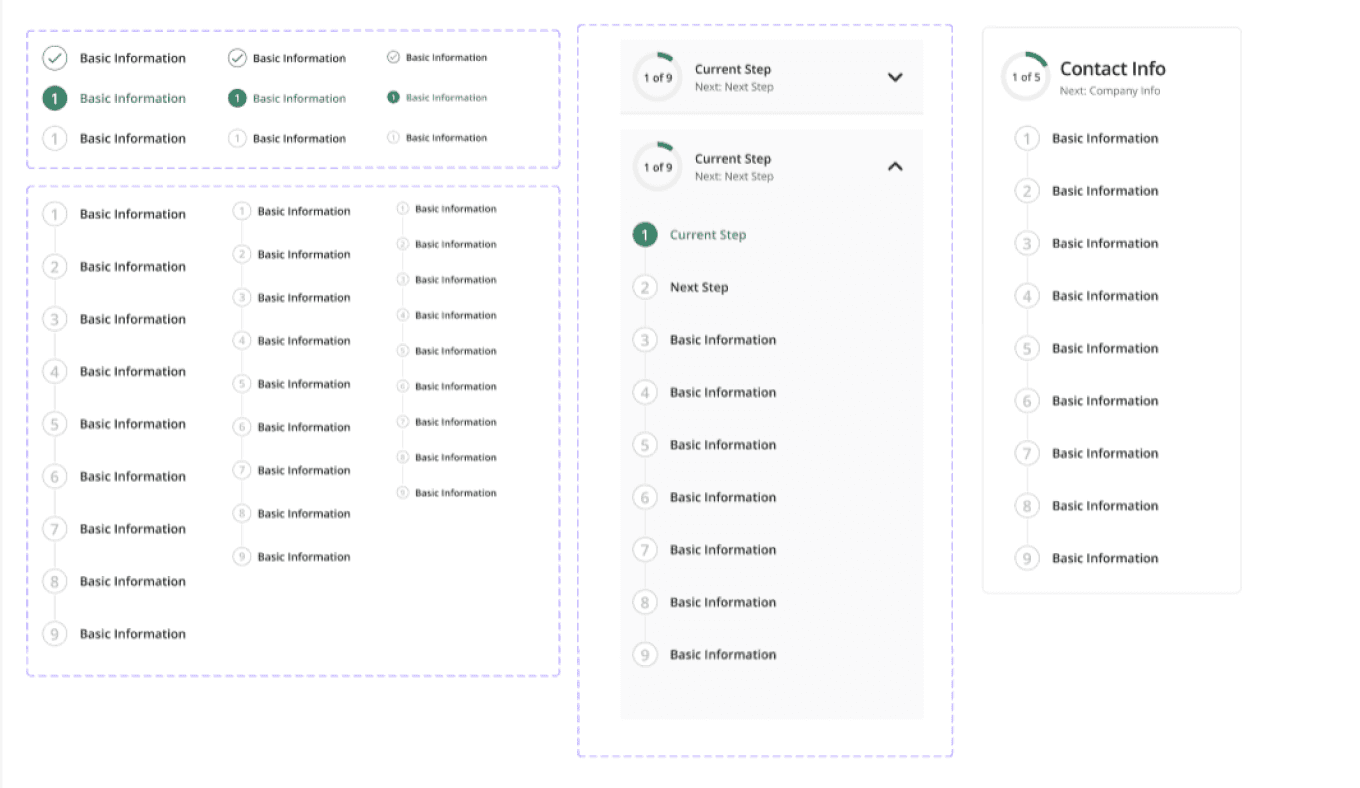

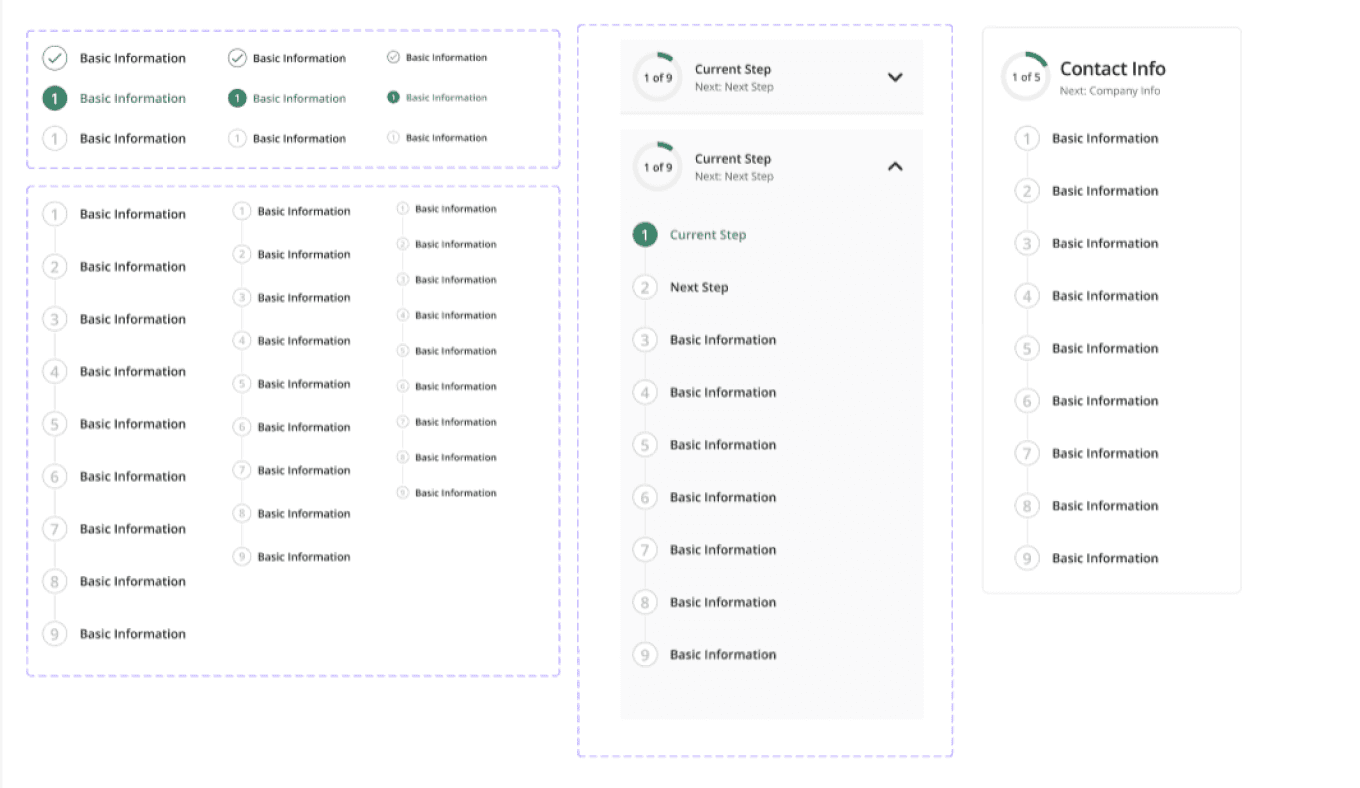

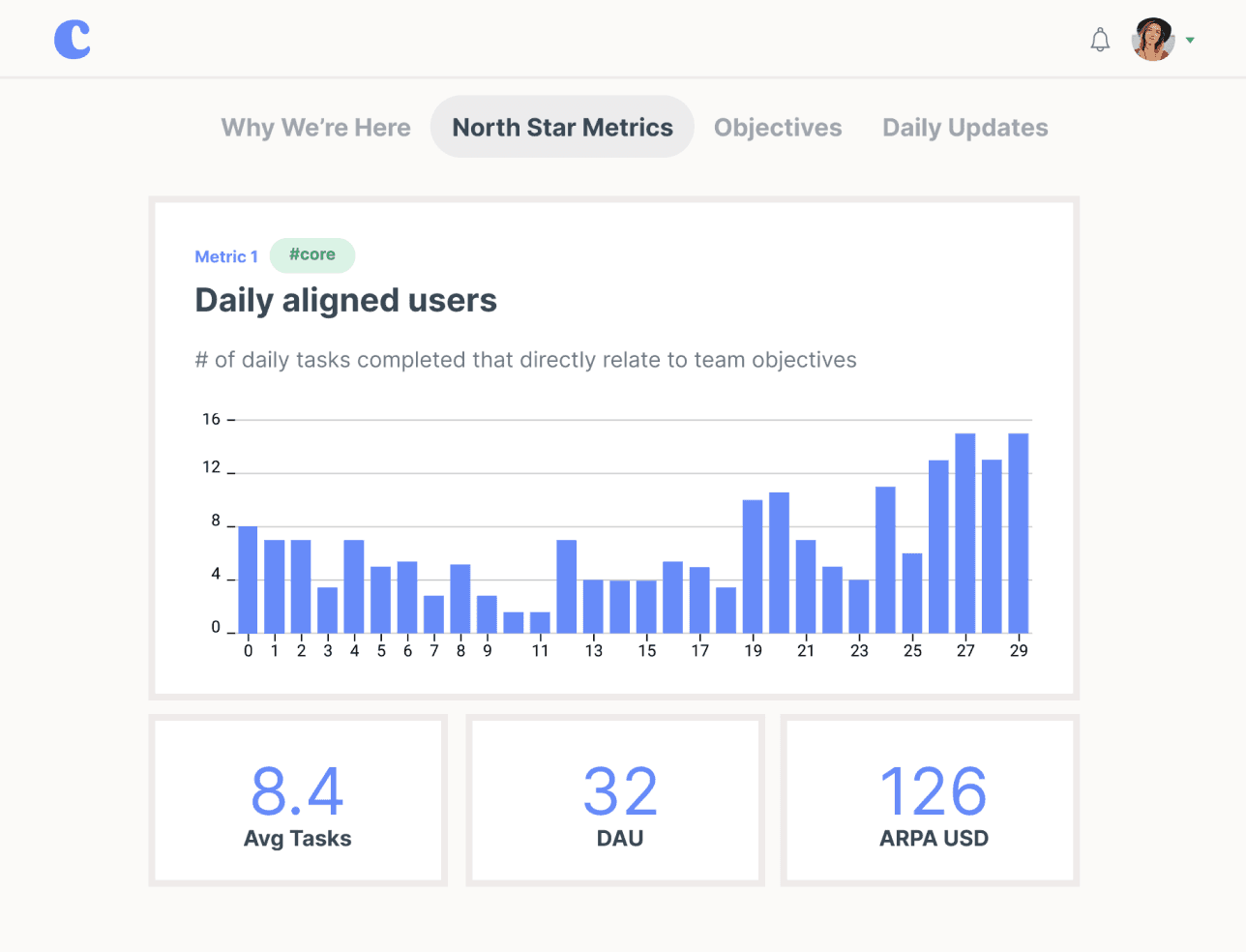

Design System

Context 365

Led implementation and maintenance of Context 365’s React design system.

100%

Usage across designers and developers

Idea to production in 3 months

Led implementation and maintenance of Context 365’s React design system.

Idea to production in

3 months

100% Usage across

designers and developers

Design System

Context 365

Case Study In-Progress

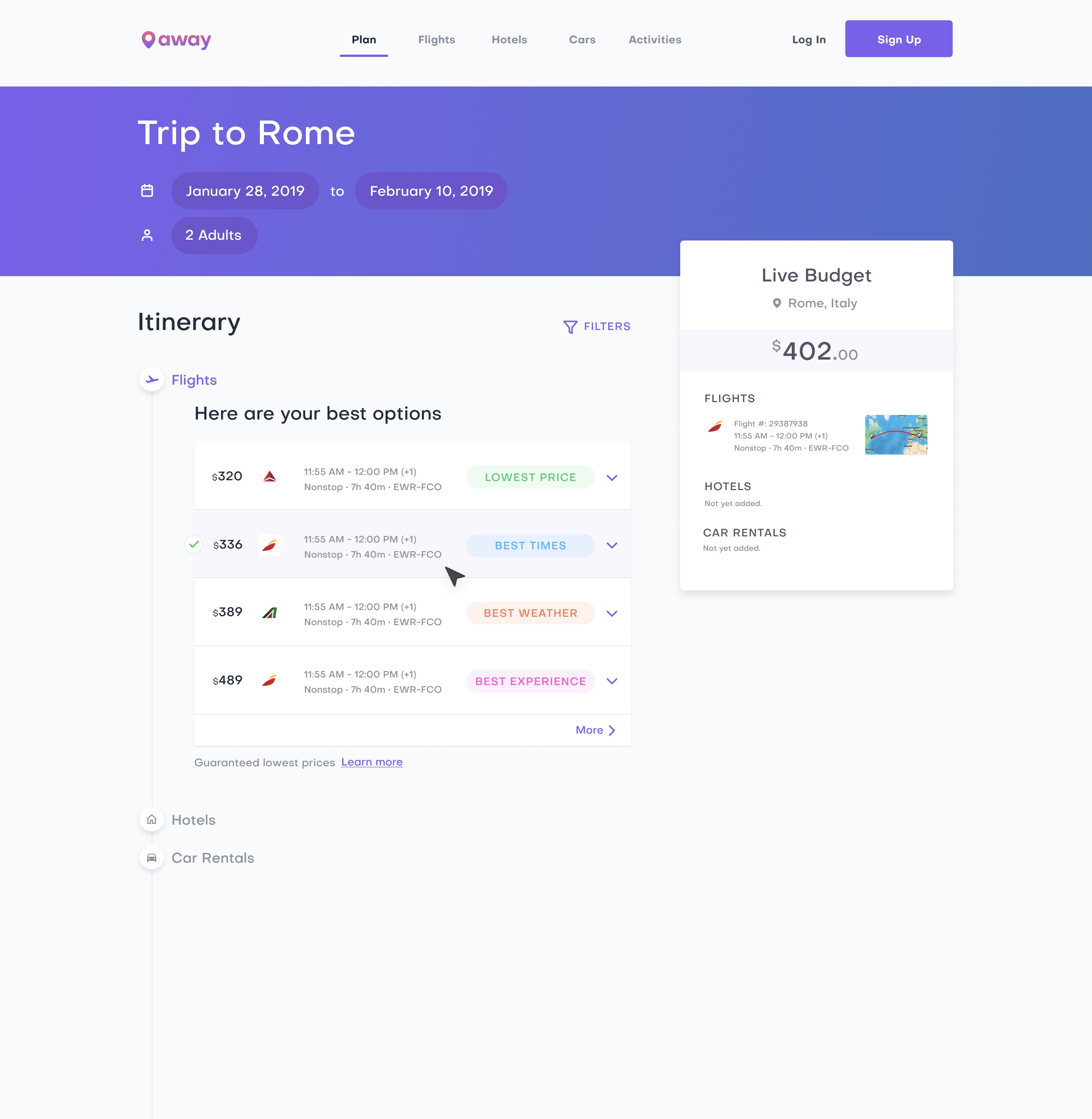

Onboarding Design

Treasure Finance

Landing Page Design

Glide

Graphic Design

Sounding Capital Partners

Concept Design

Common

+364%

Conversion Rate

Acquired by Apex Group

Redesign of the alternative investment platform, Context 365.

End-to-end Redesign

Context 365

Read Case Study

Application Design

Clarivate Analytics

Mobile App Design

Safehouse

Pitch Deck Design

Story Capital

Pricing Page Design

Linode

My Journey

Sequence (acq. Salesforce)

Interaction Designer

The only thing that would make this experience better is if it included Chipotle smells!

-Actual customer feedback

B2C

E-Commerce

Media

Agency

ADP

UX Designer

B2C

Human Resources

Enterprise

Watch Video

Infor

UX Architect

ConsenSys

Product Designer

B2C

B2B

Sports

Industry

Enterprise

Enterprise

Startup

Crypto

Finance

B2C

Watch Video

View Website

View App

Clarivate Analytics

Product Designer

Enterprise

Academic Research

B2B

B2C

View Website

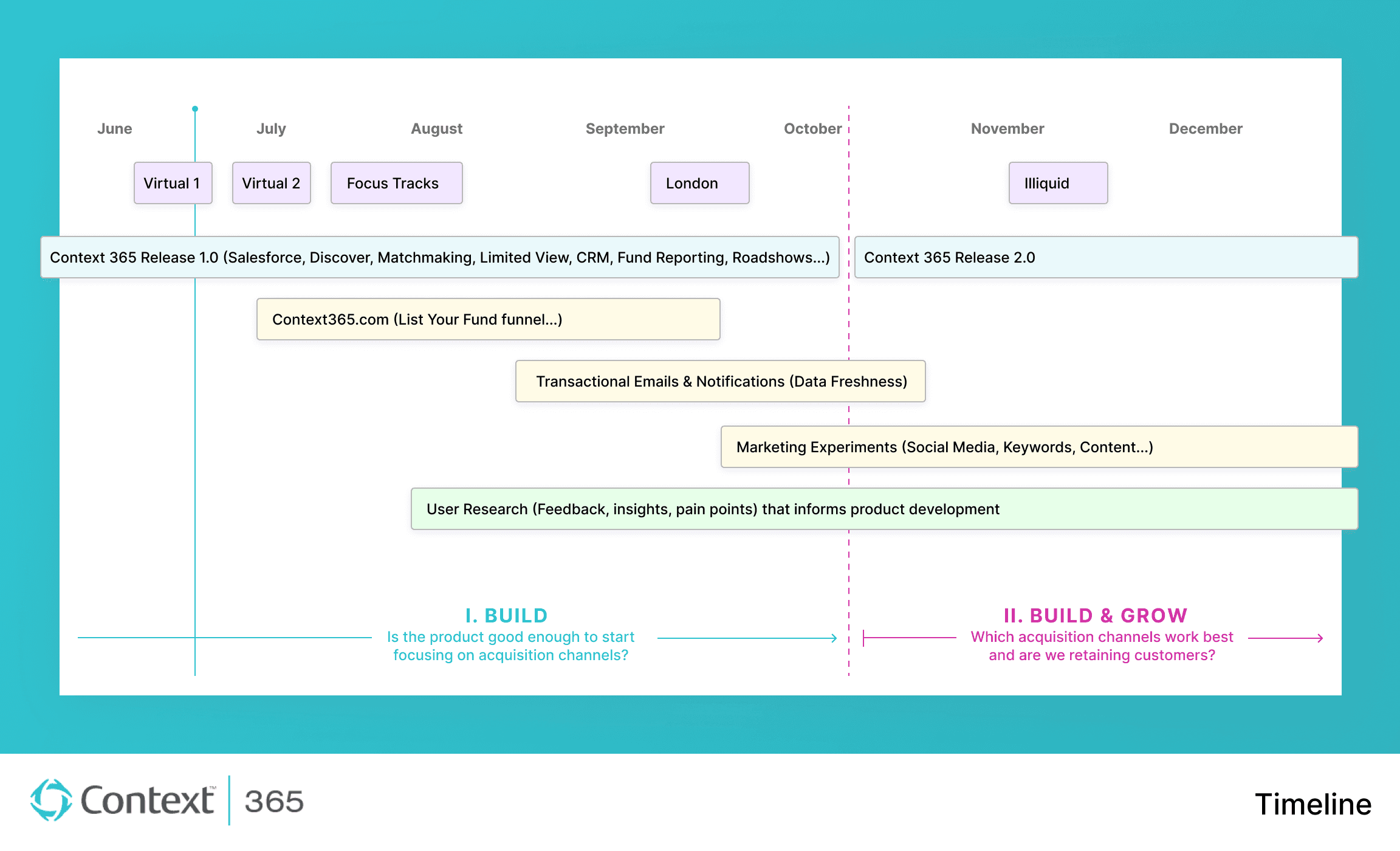

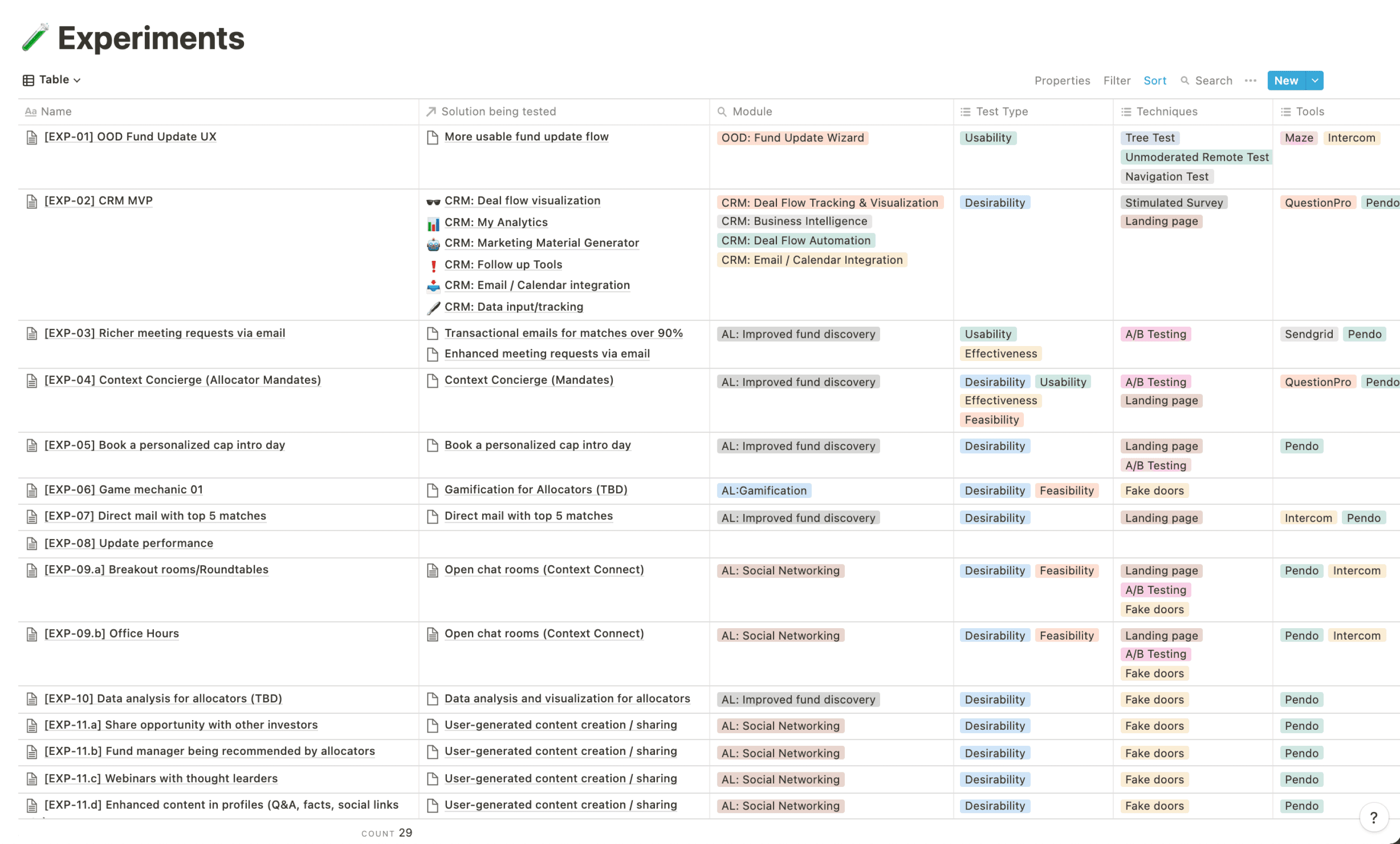

Context 365 (Acq. Apex Group)

Context 365 (Acq. Apex Group)

Director of Product & Design

Director of Product & Design

Enterprise

Startup

Finance

B2B

B2C

View Website

👋

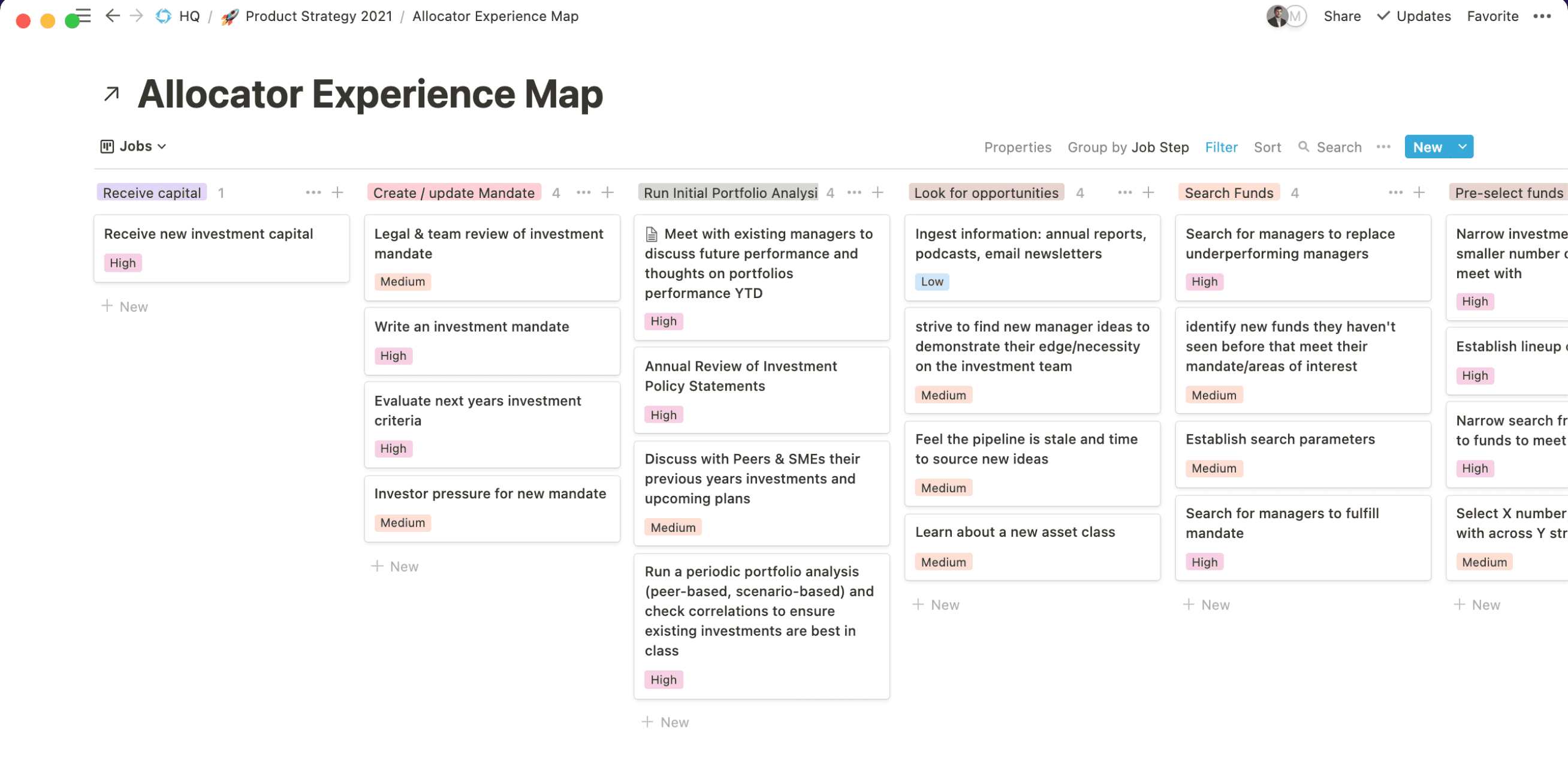

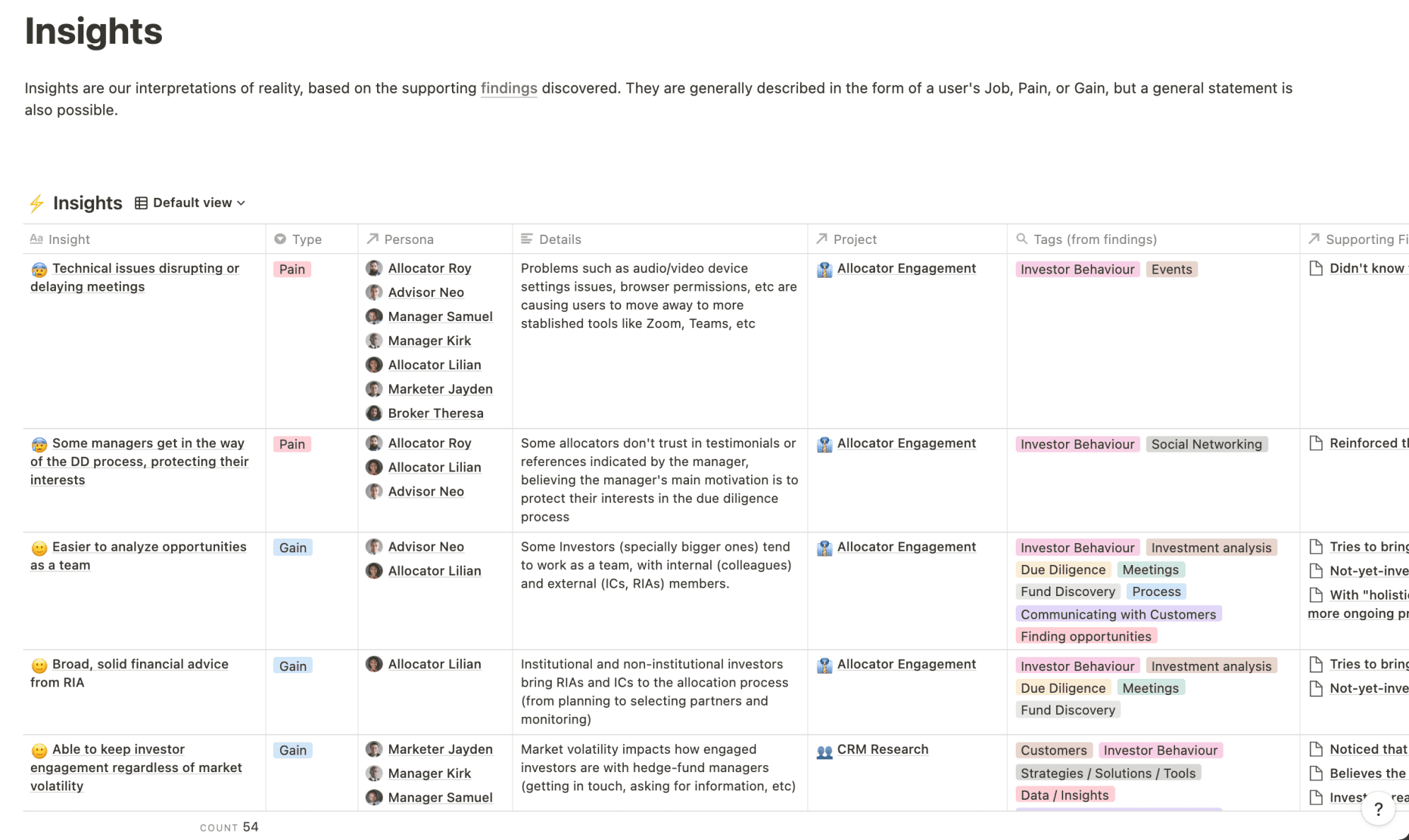

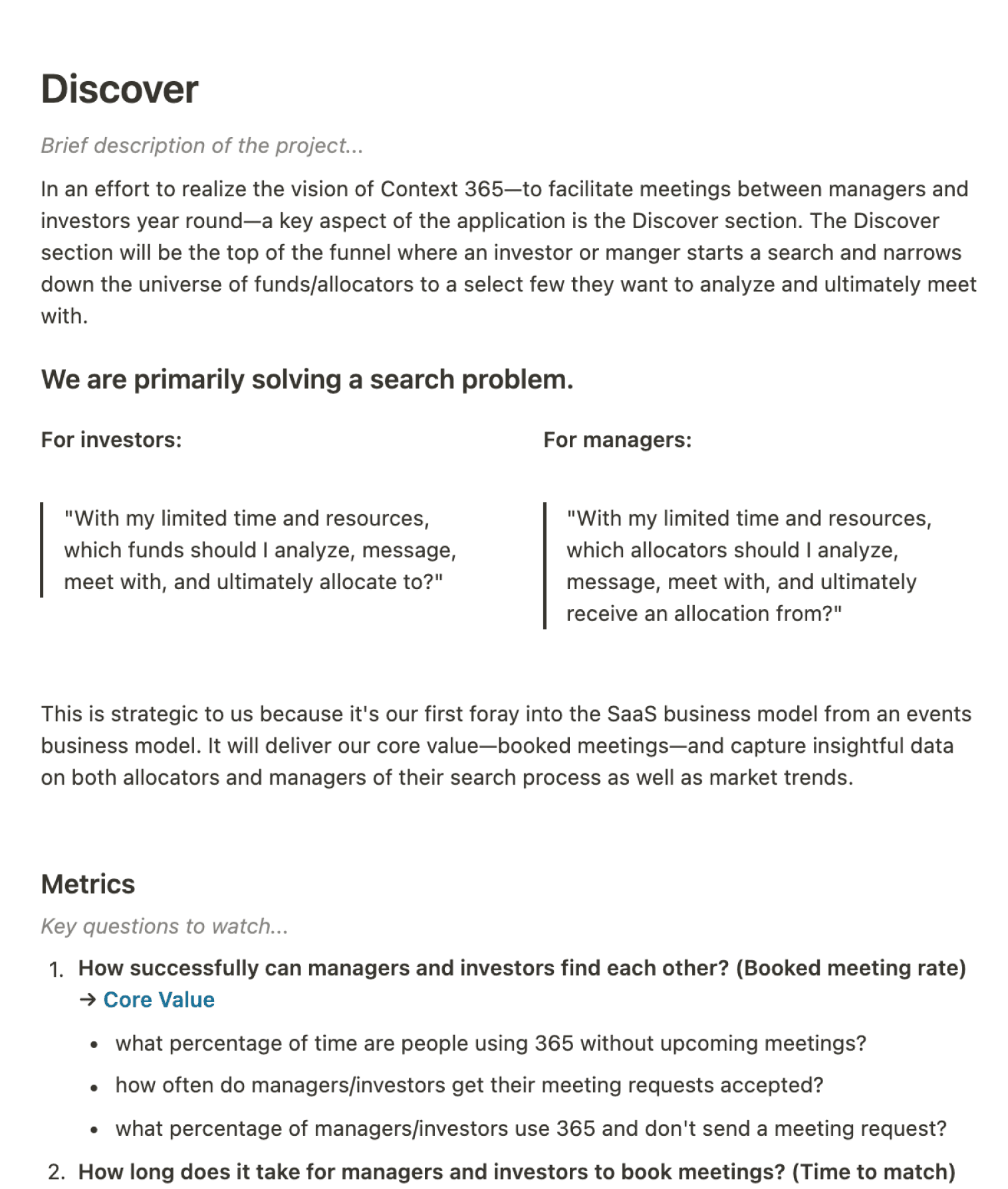

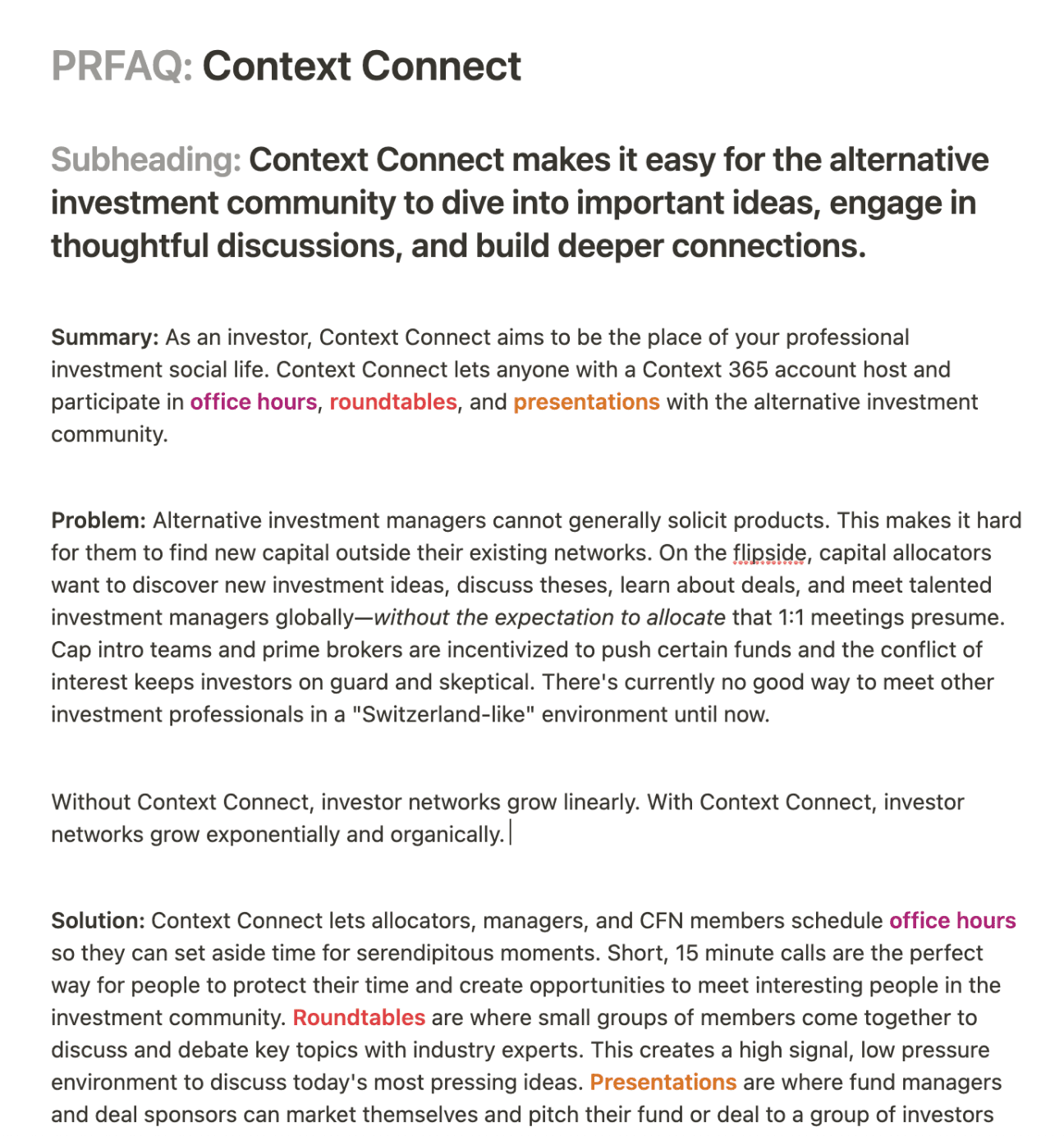

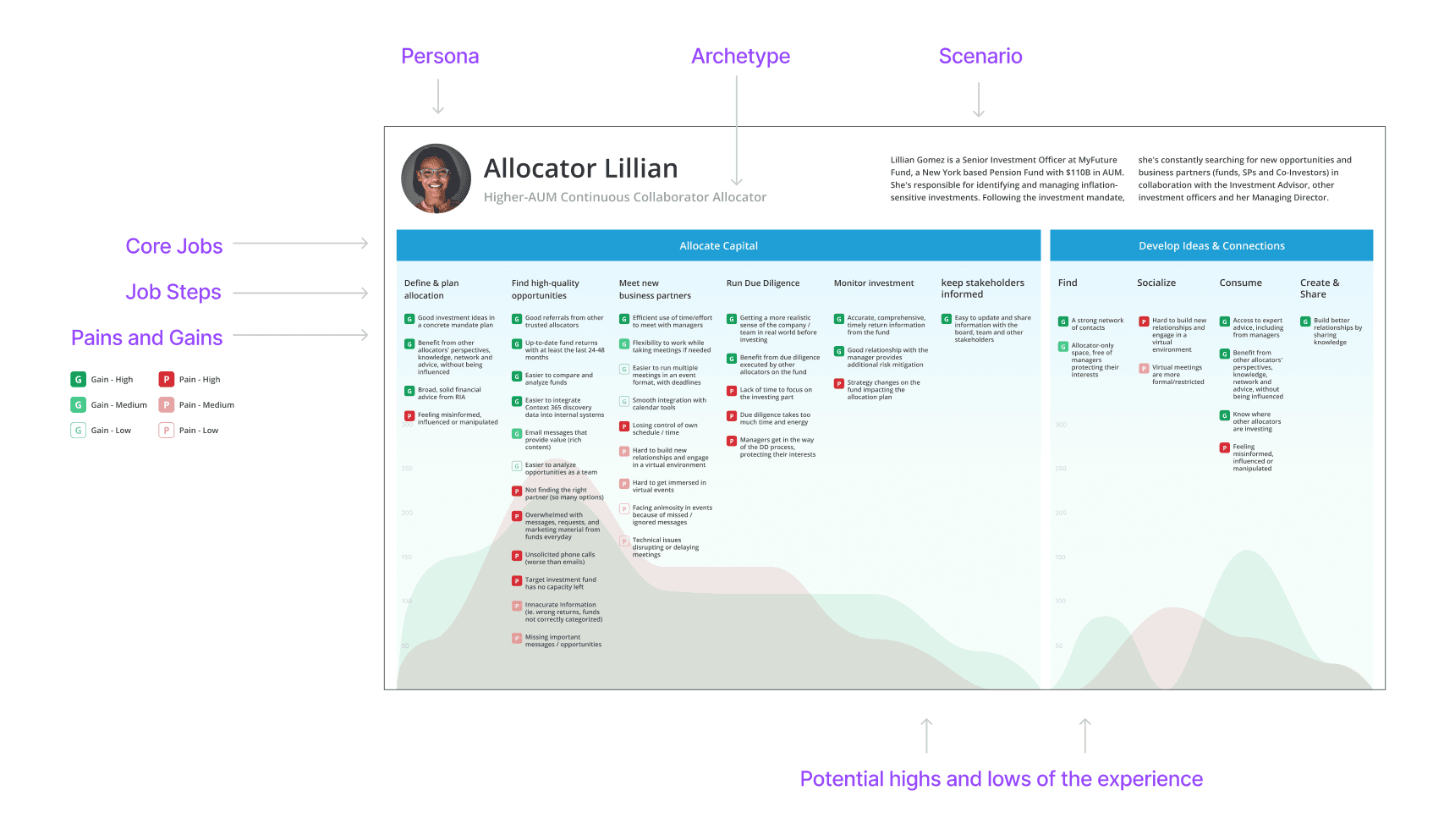

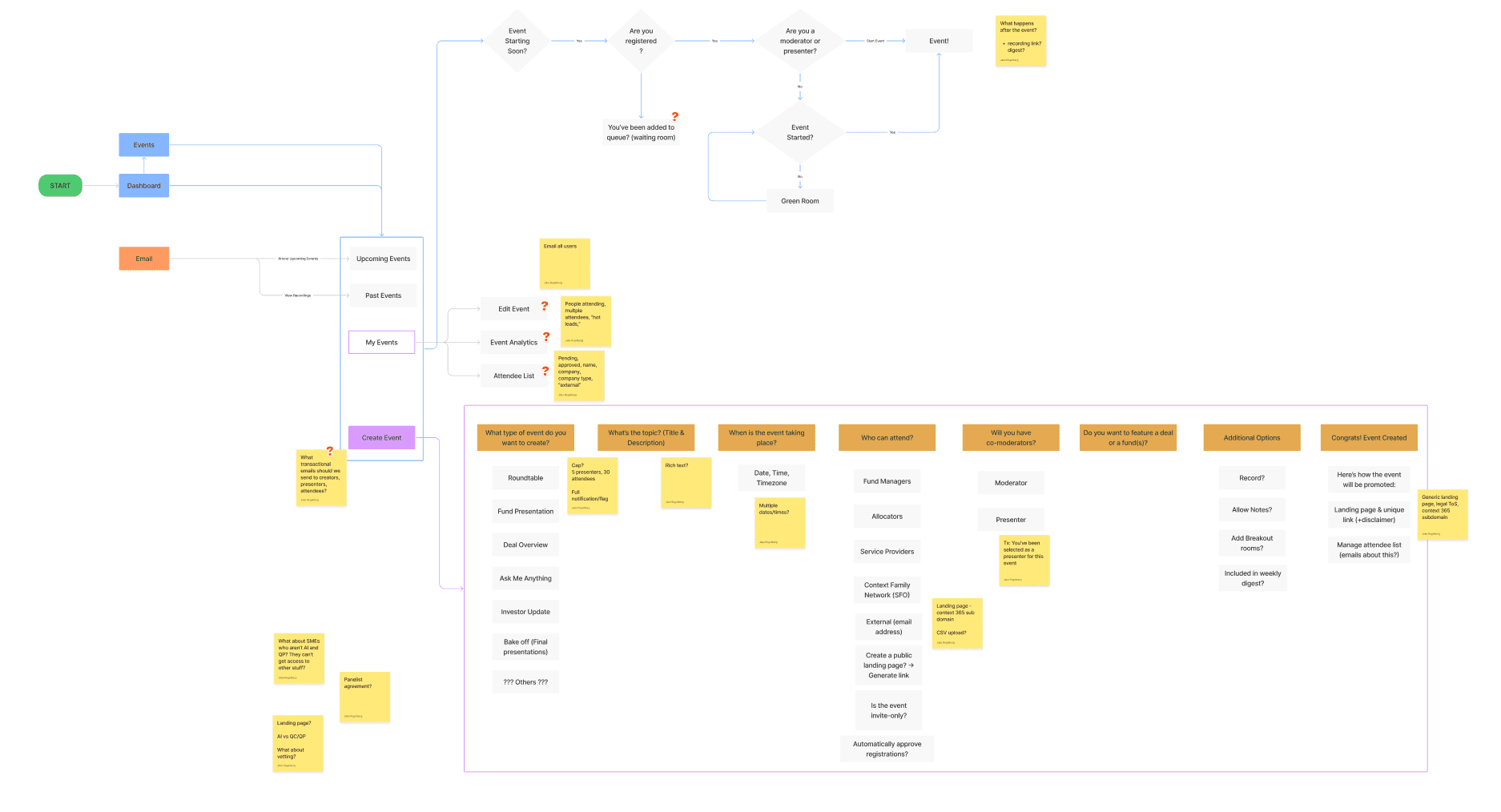

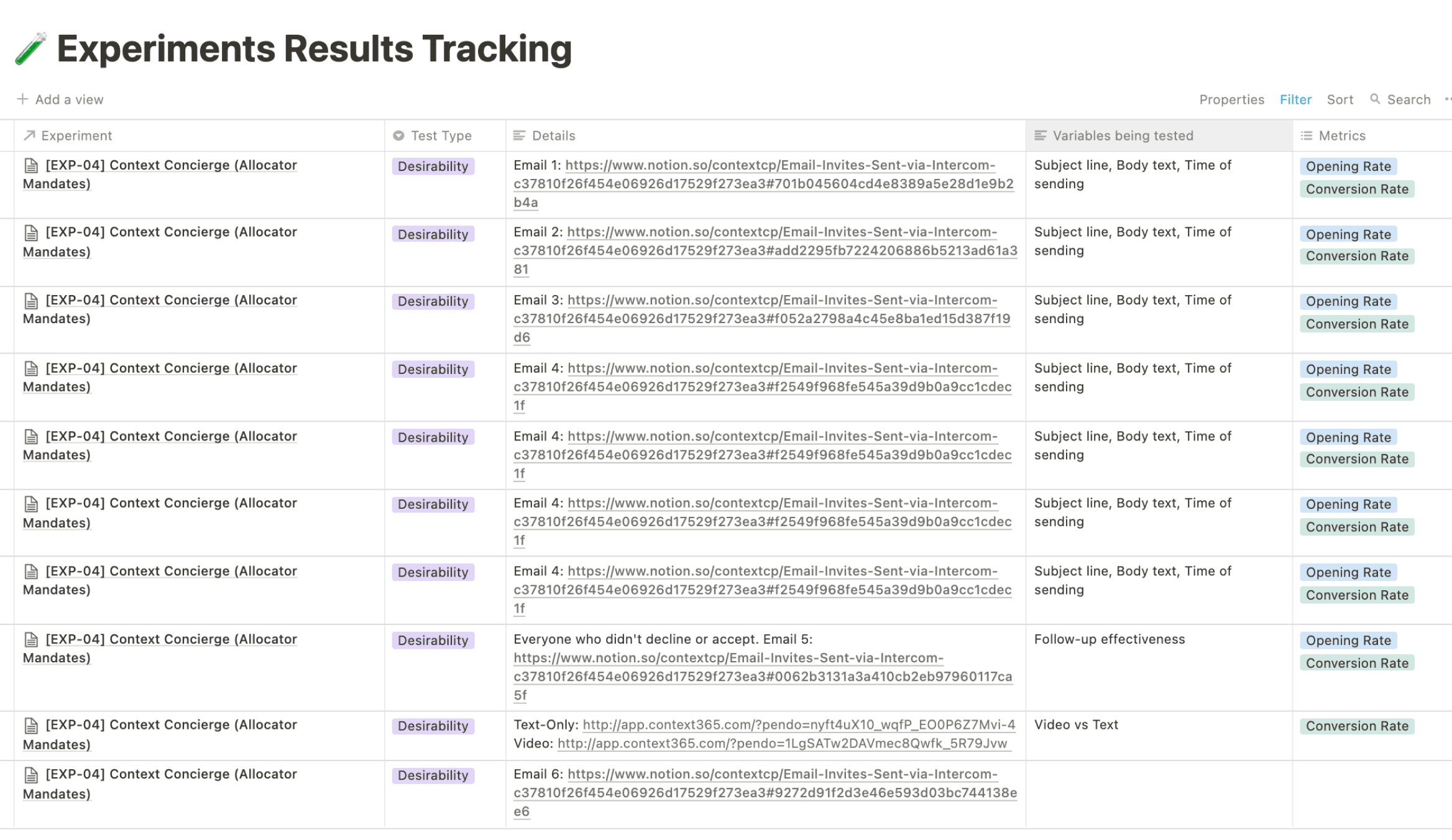

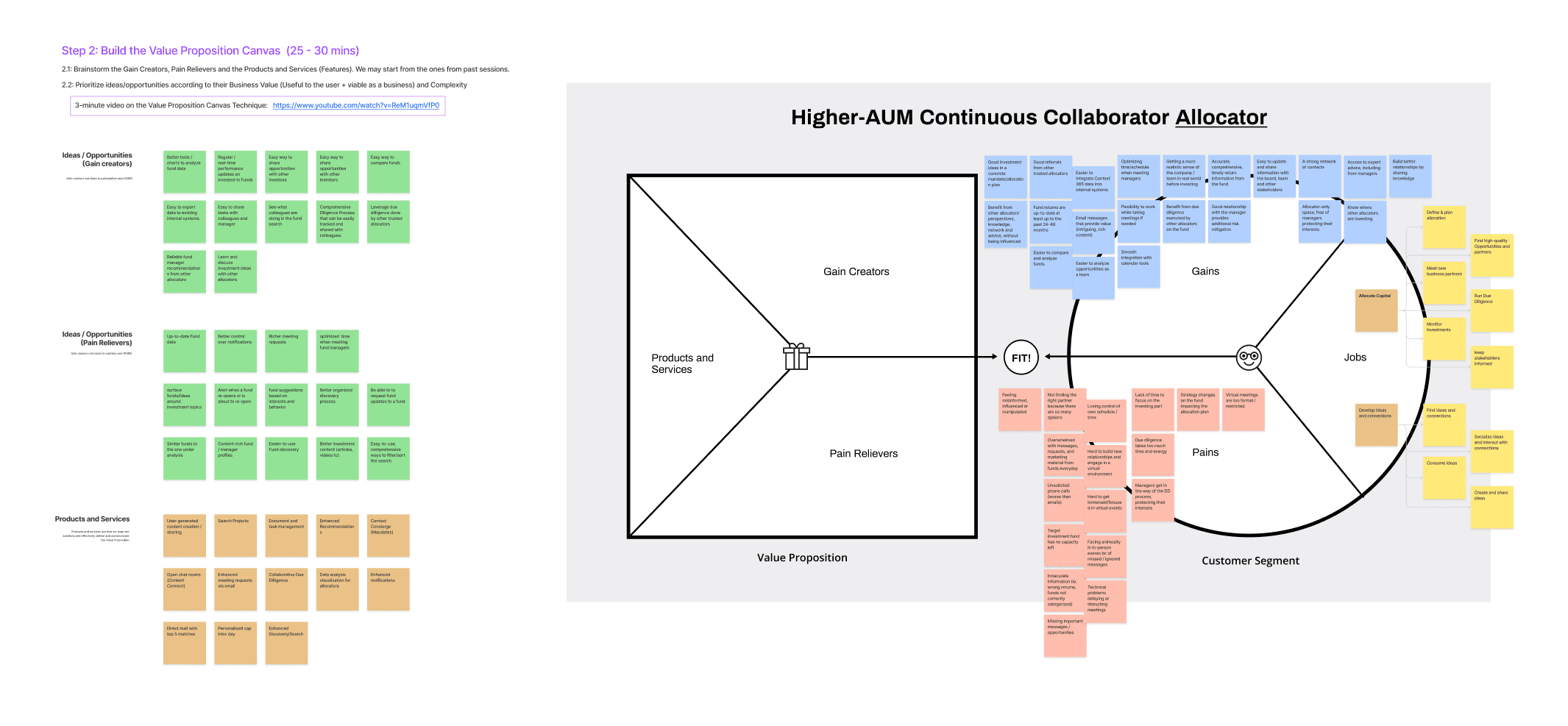

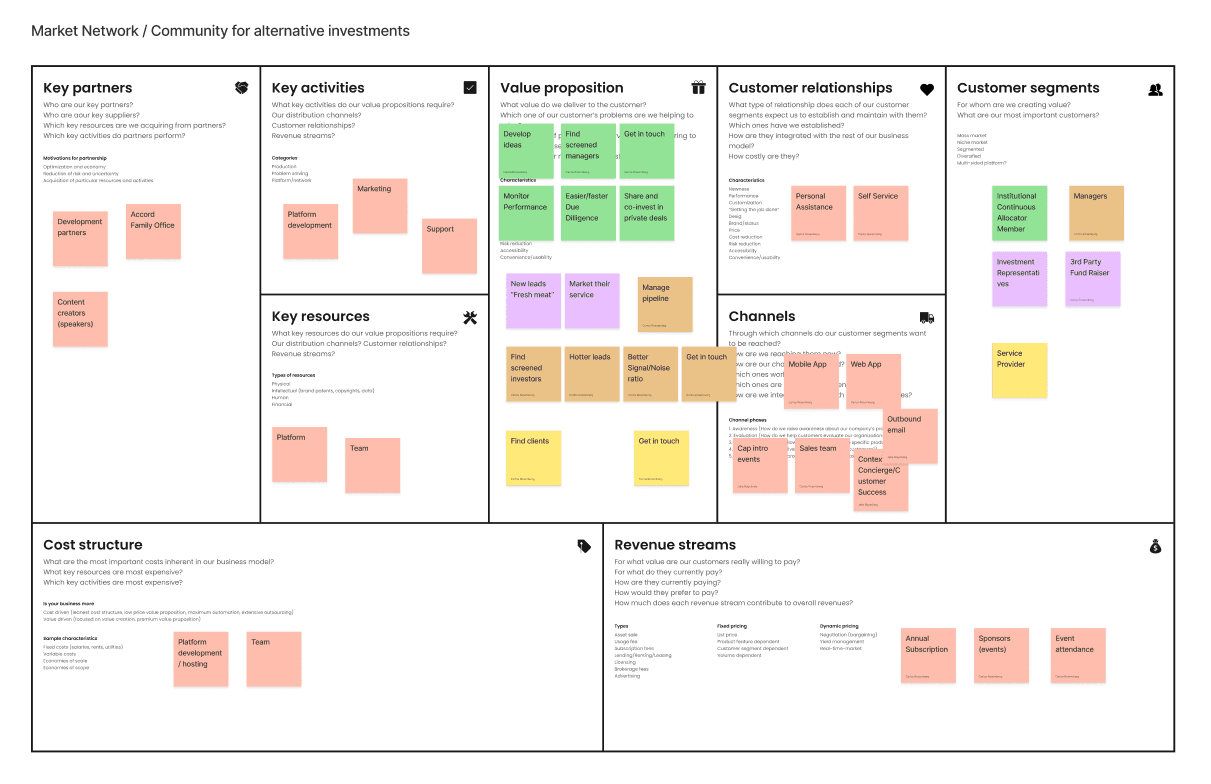

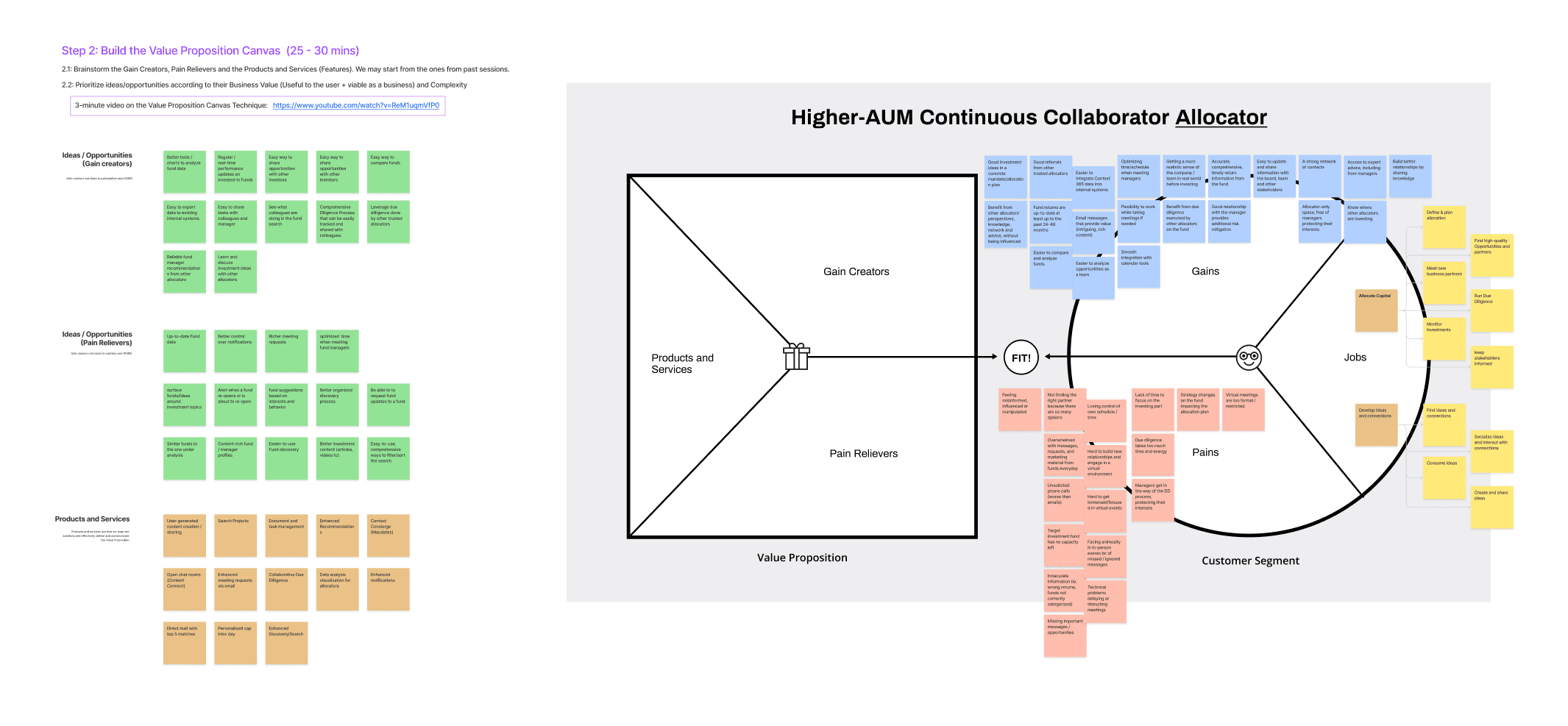

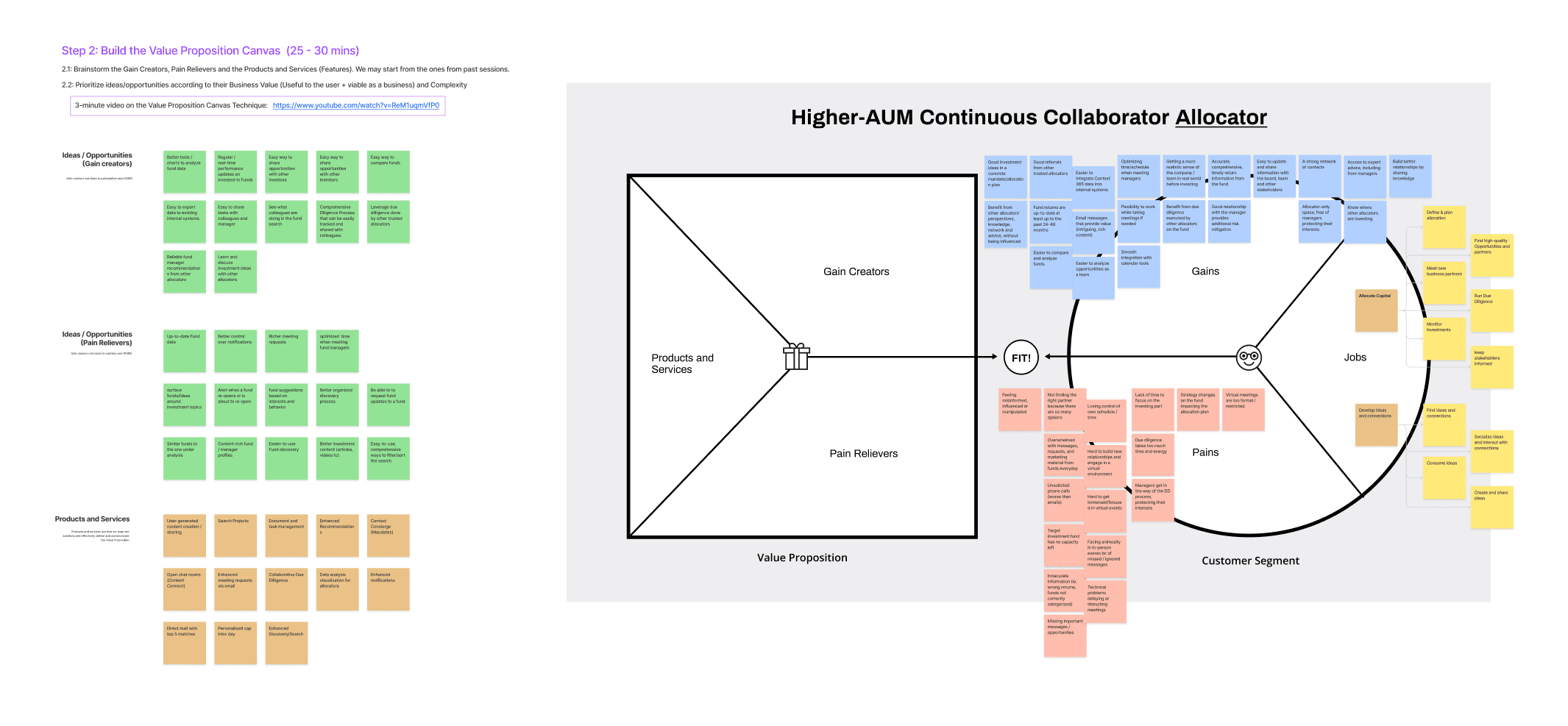

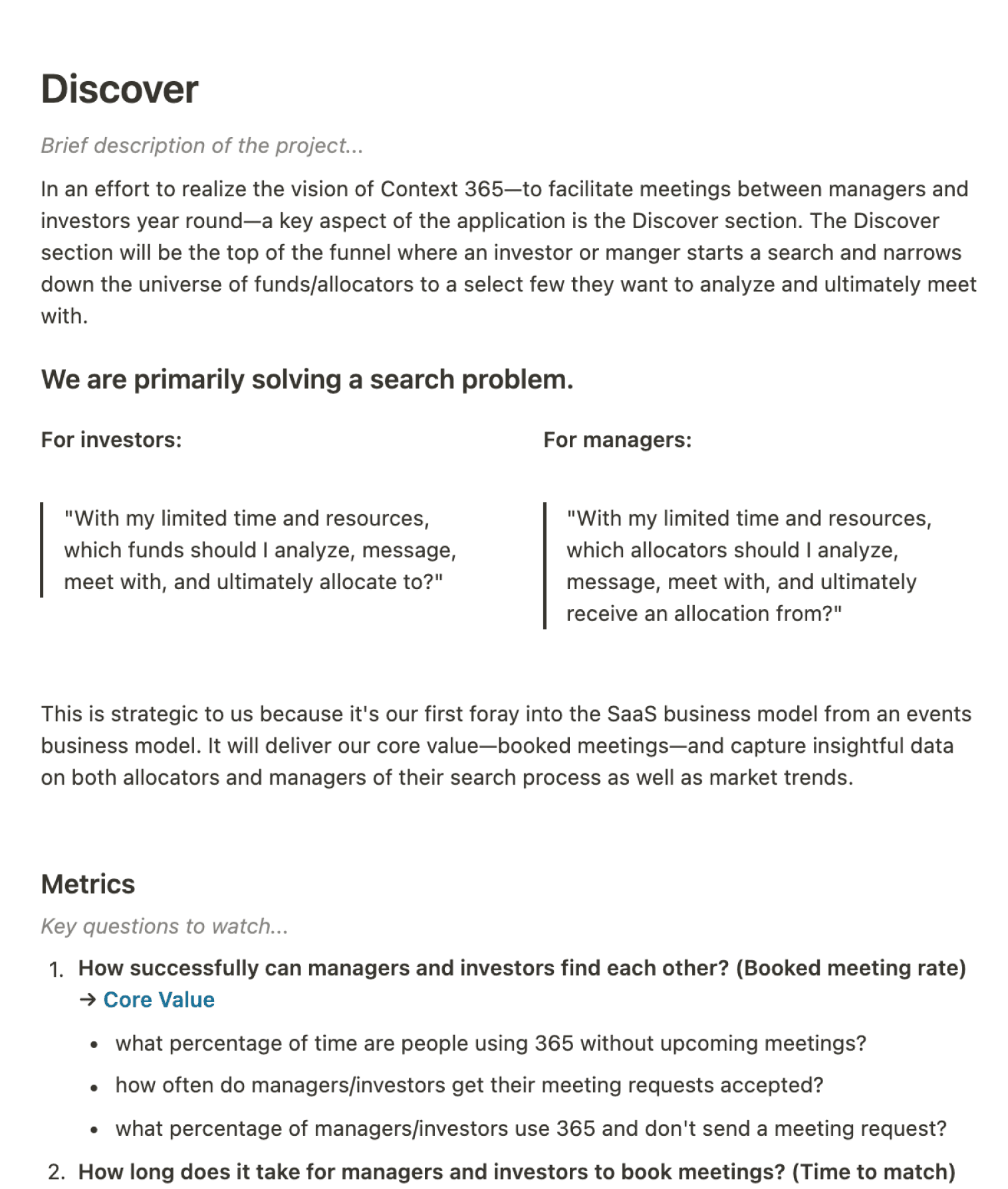

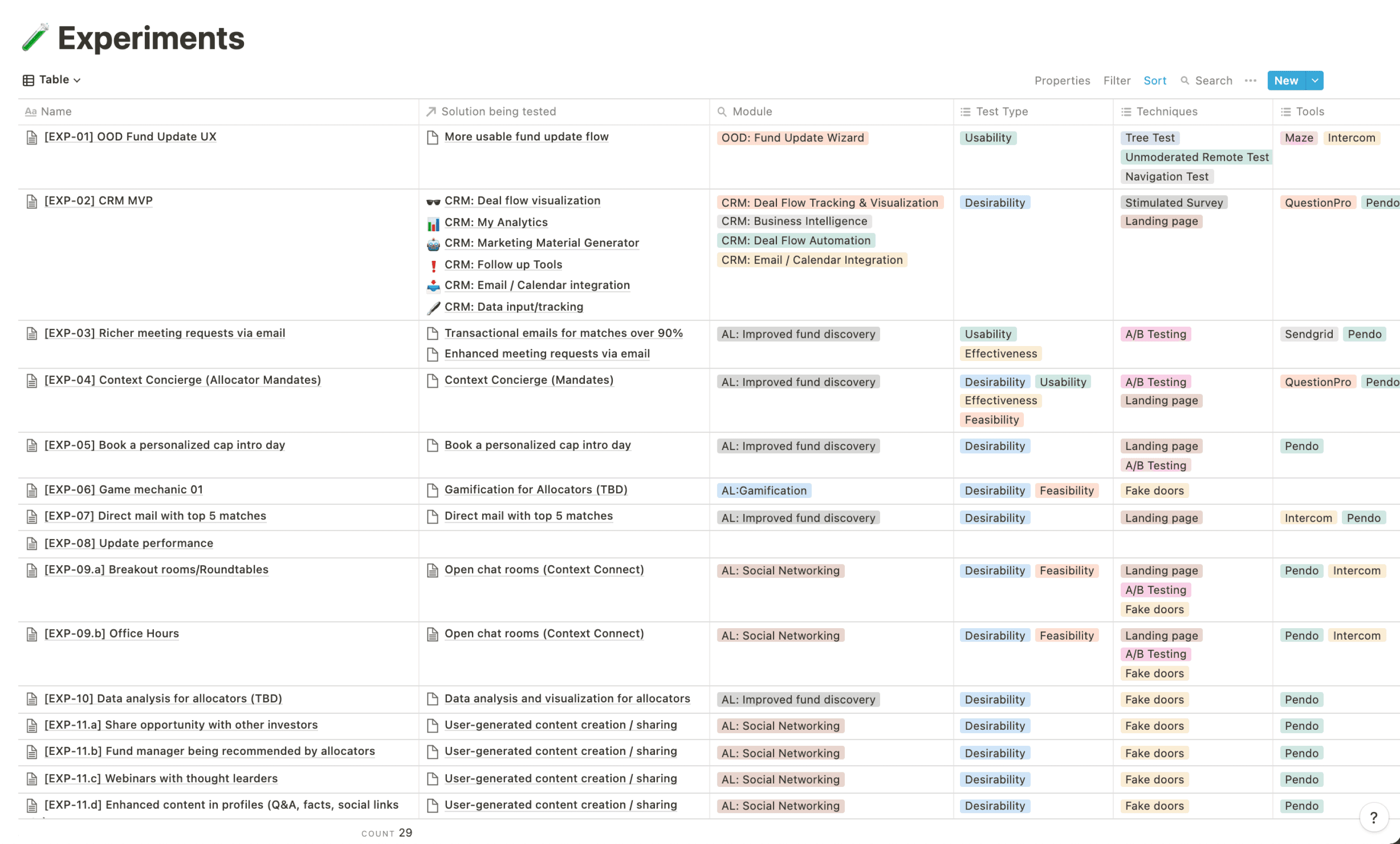

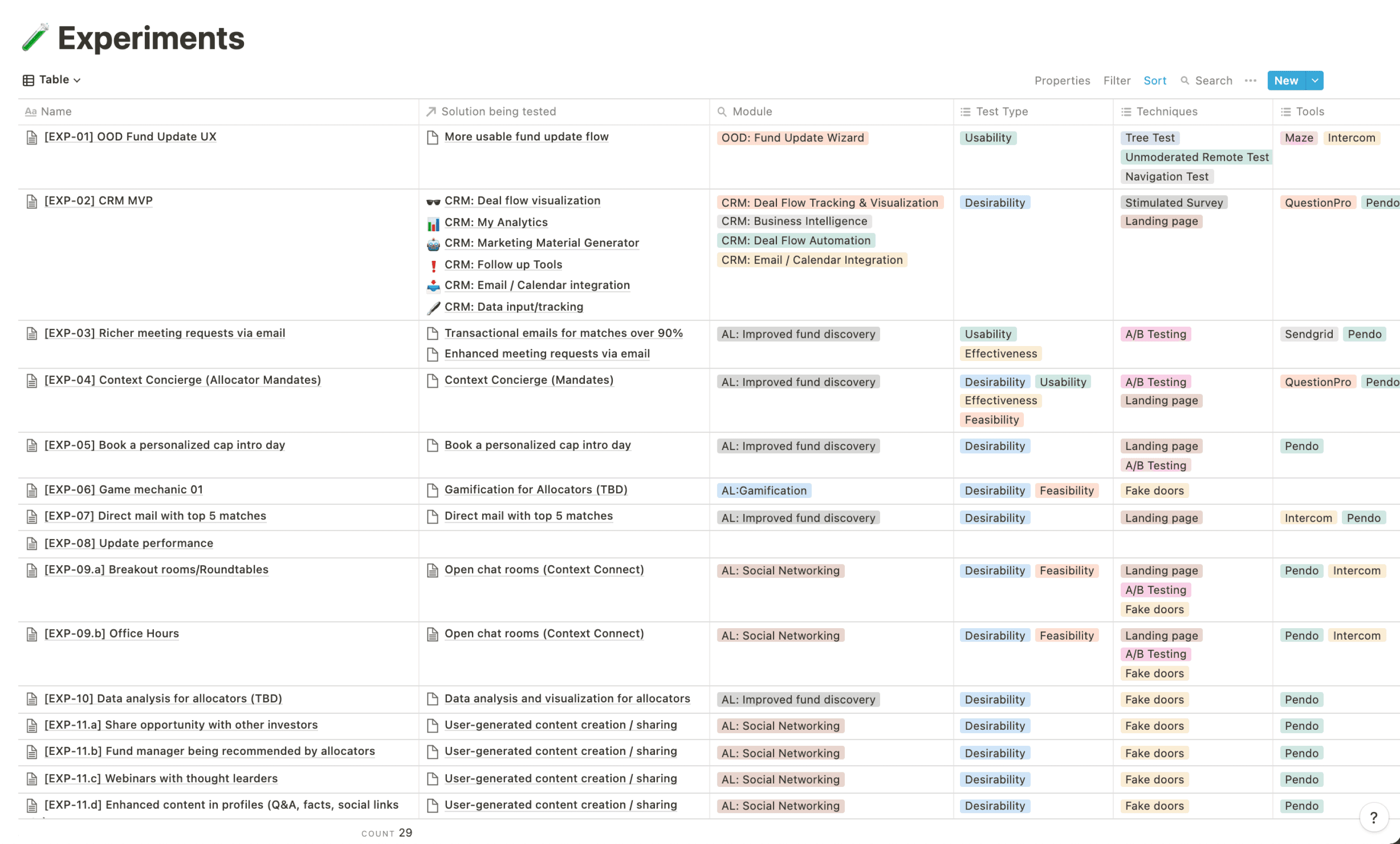

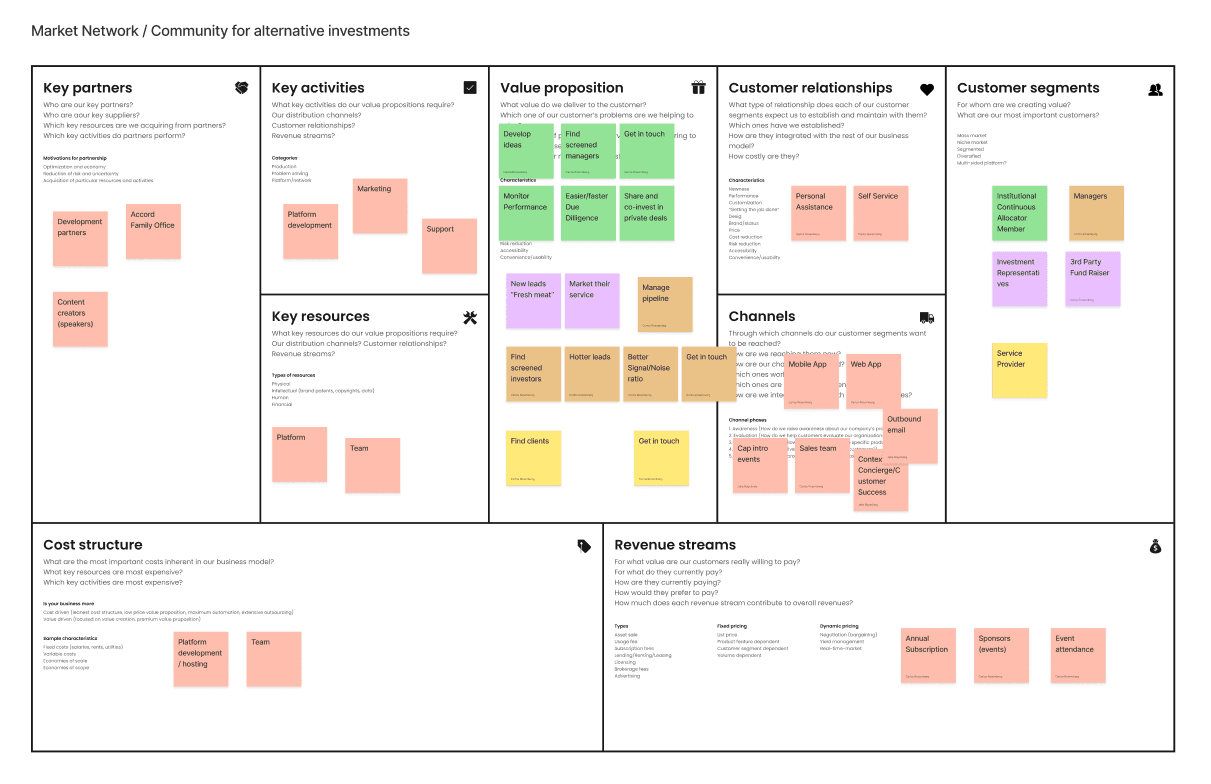

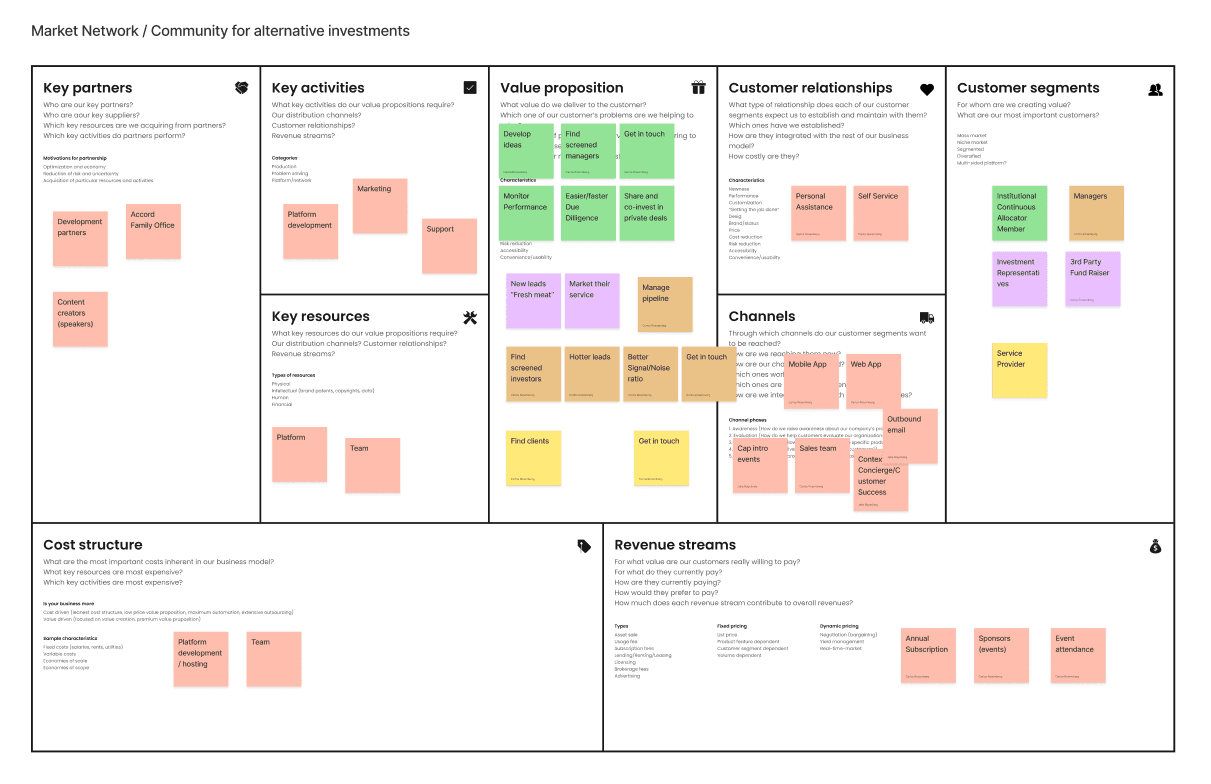

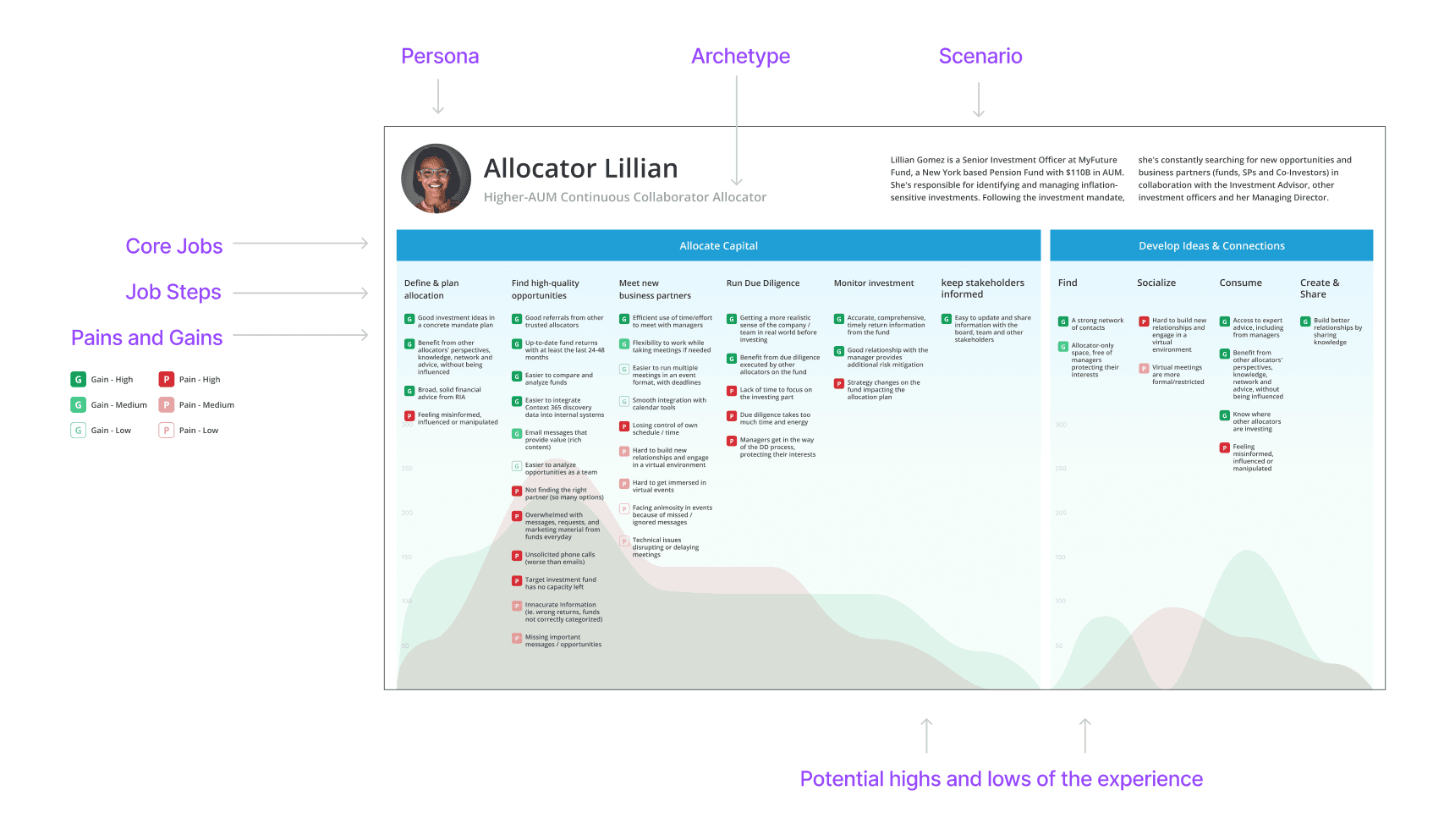

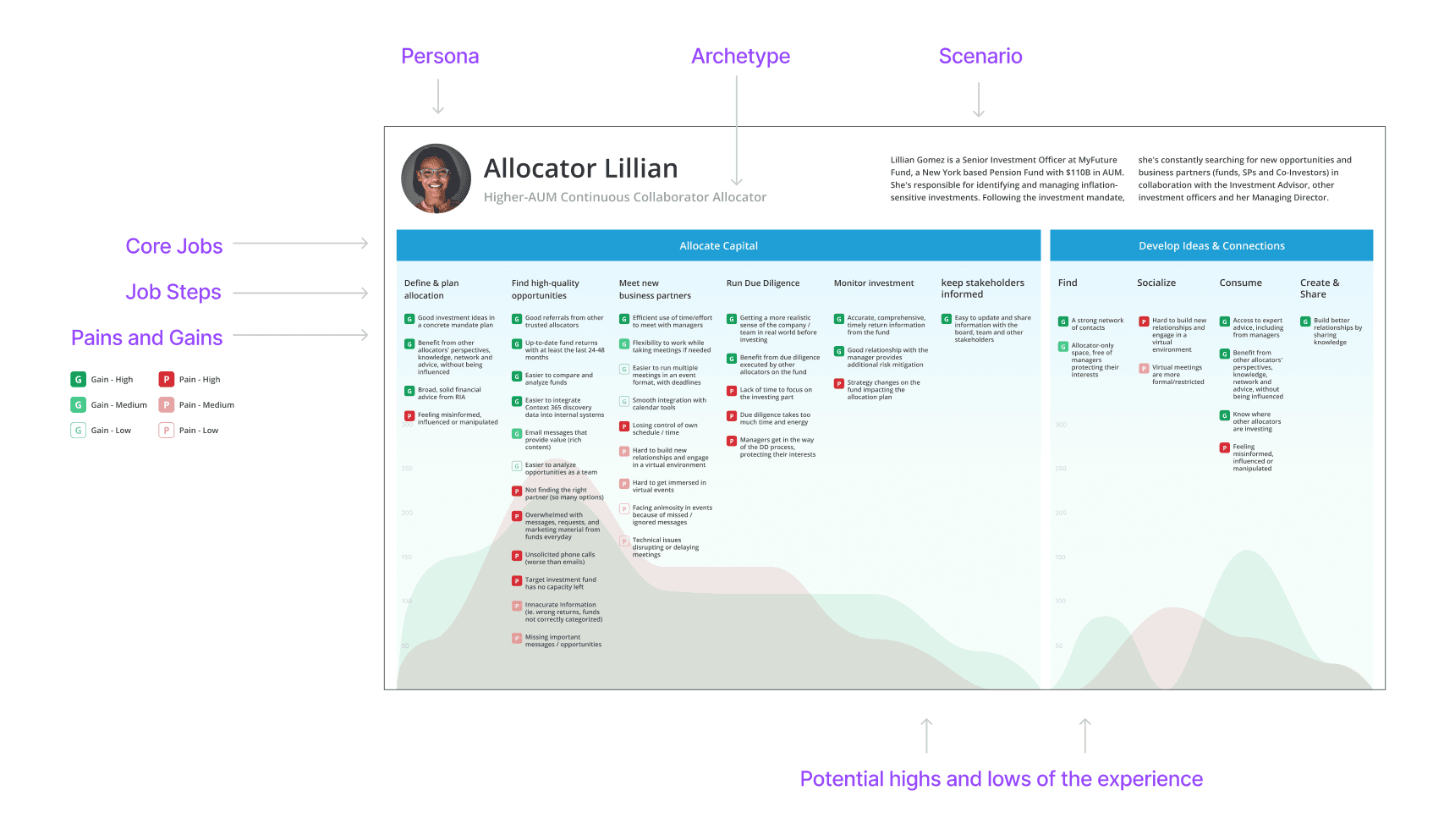

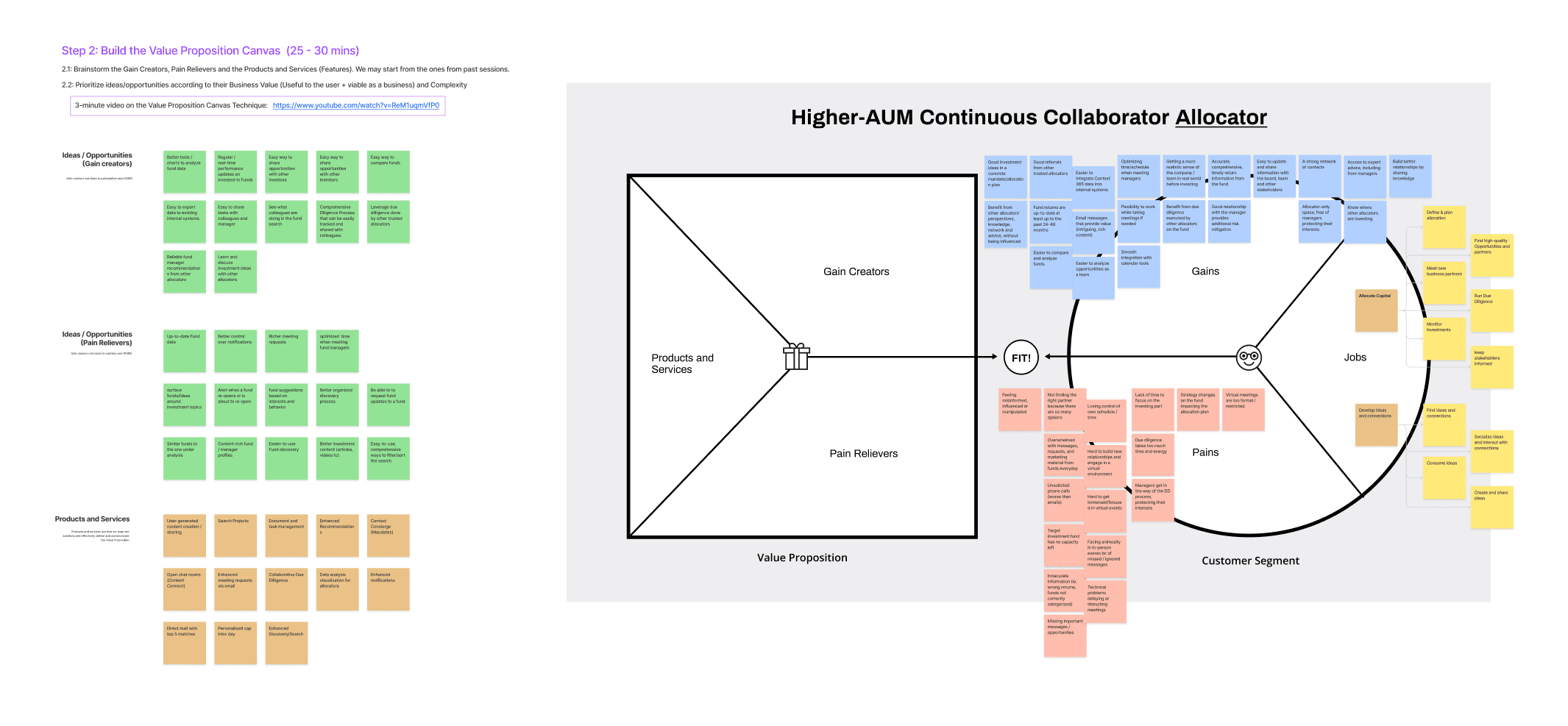

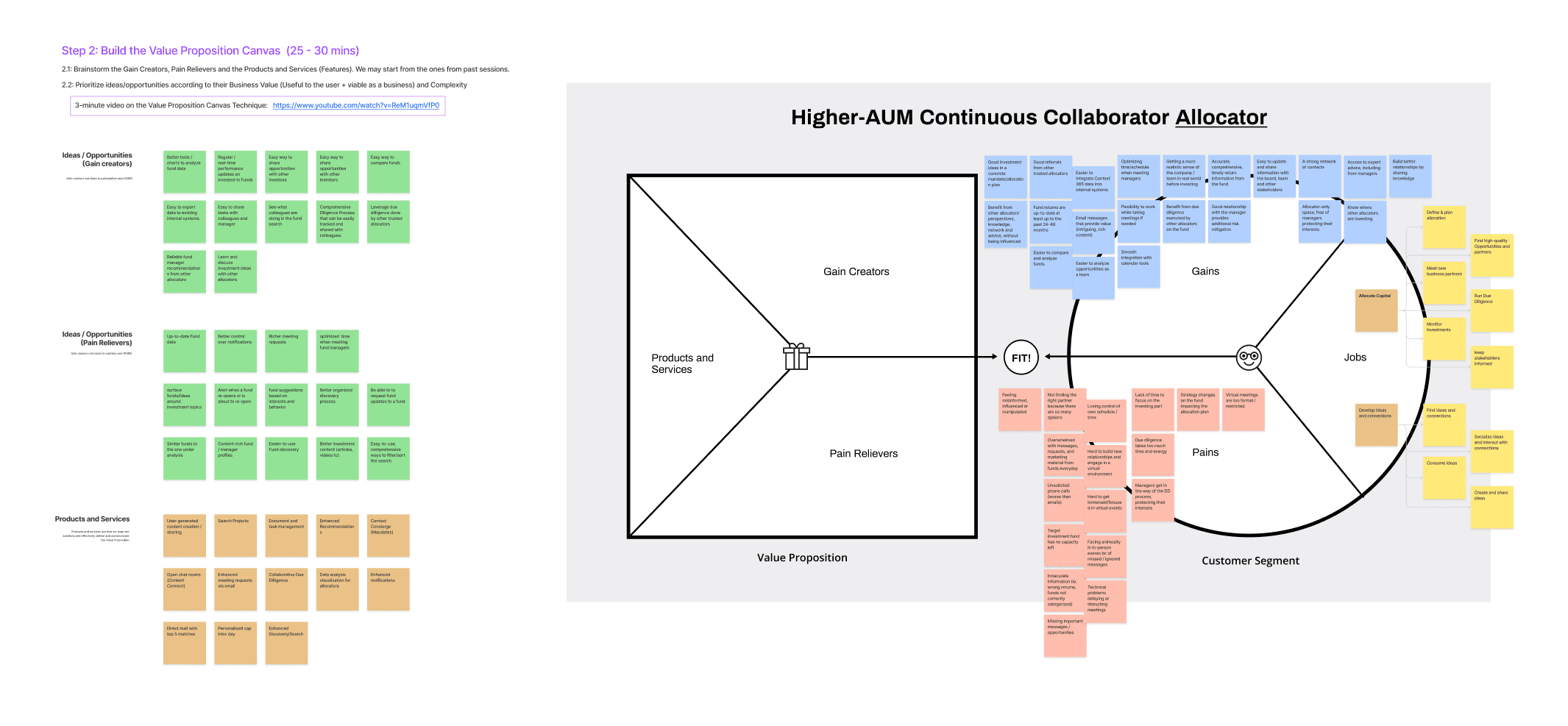

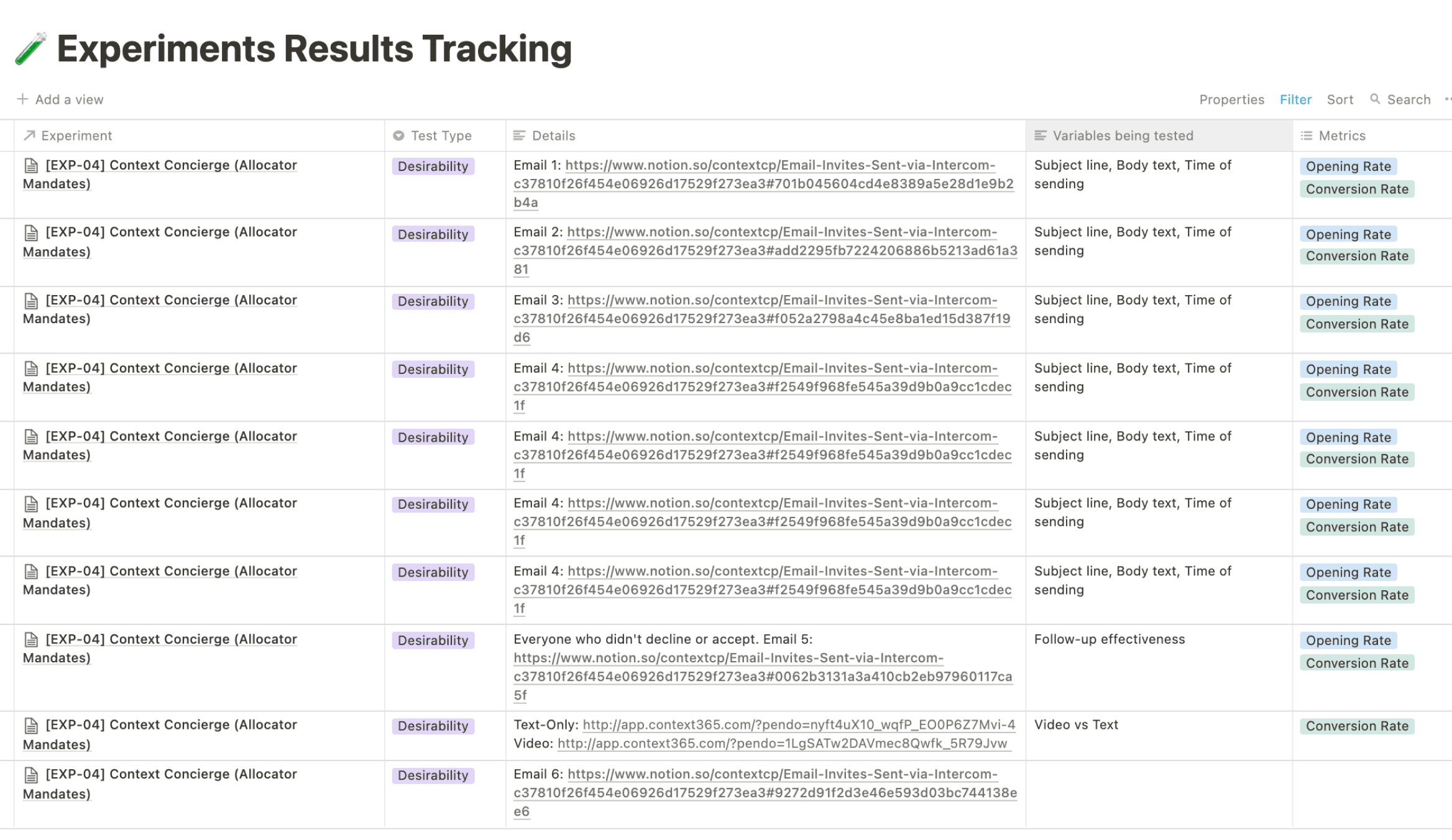

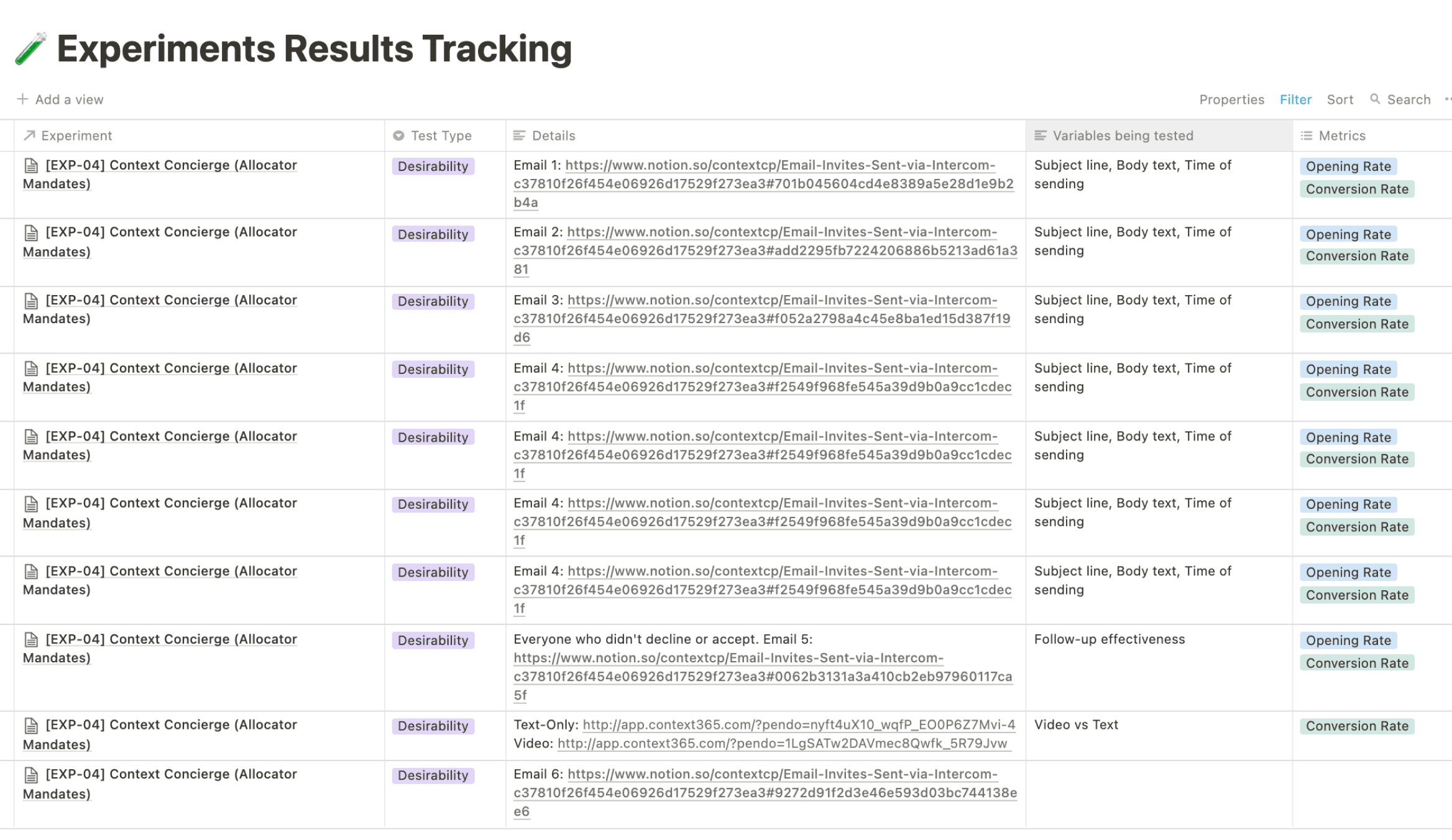

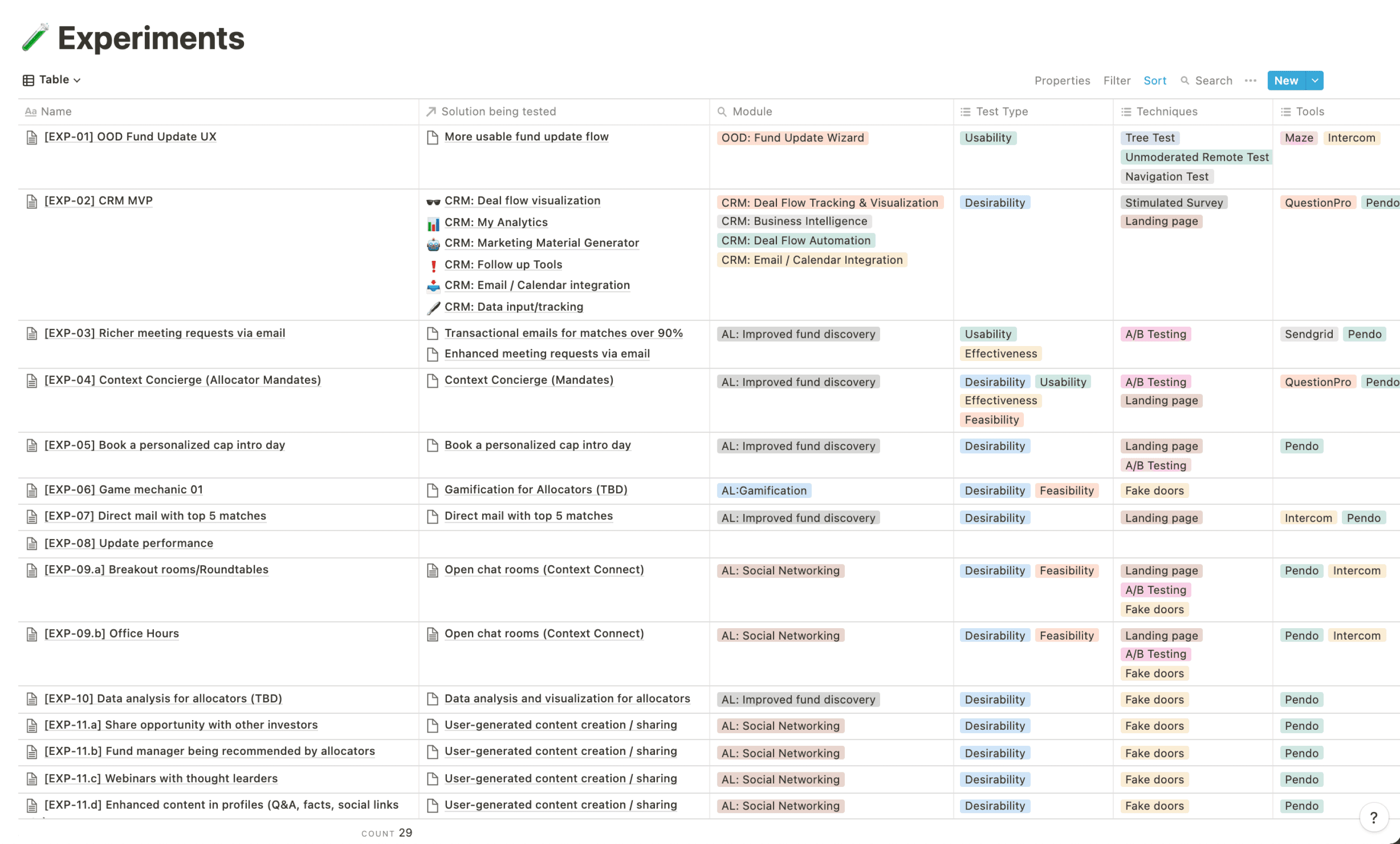

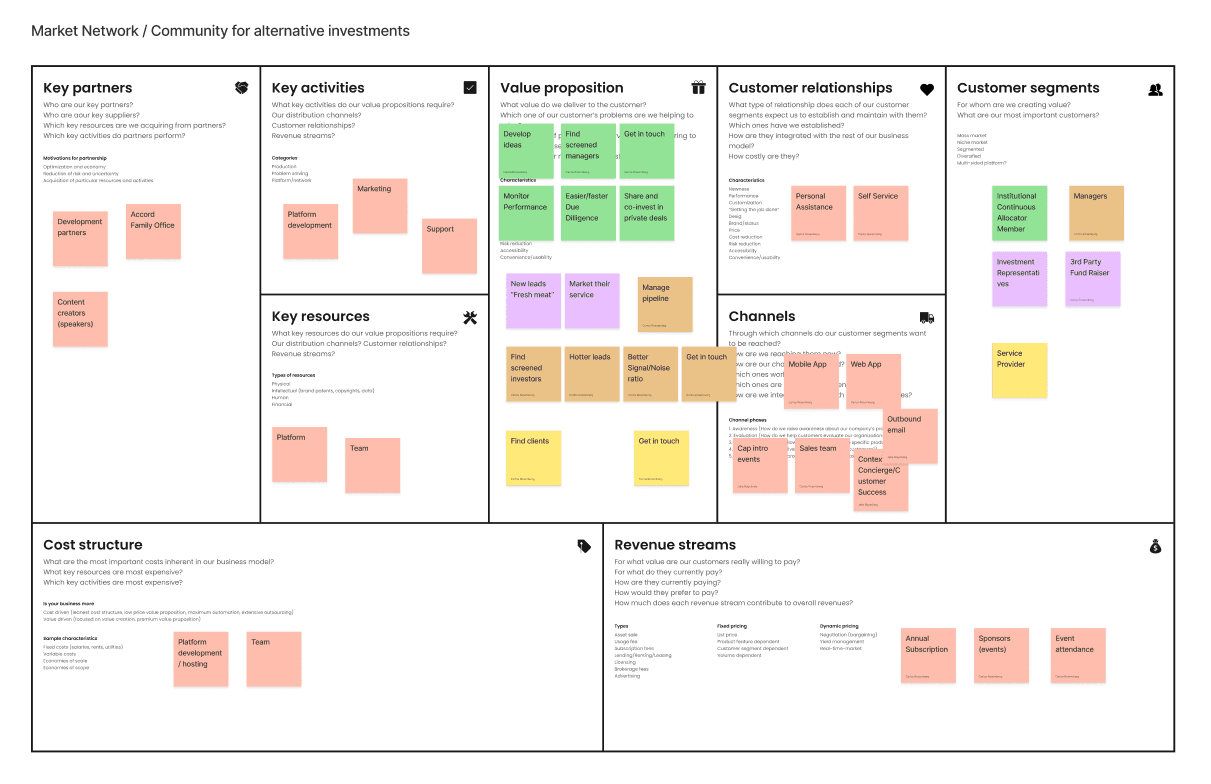

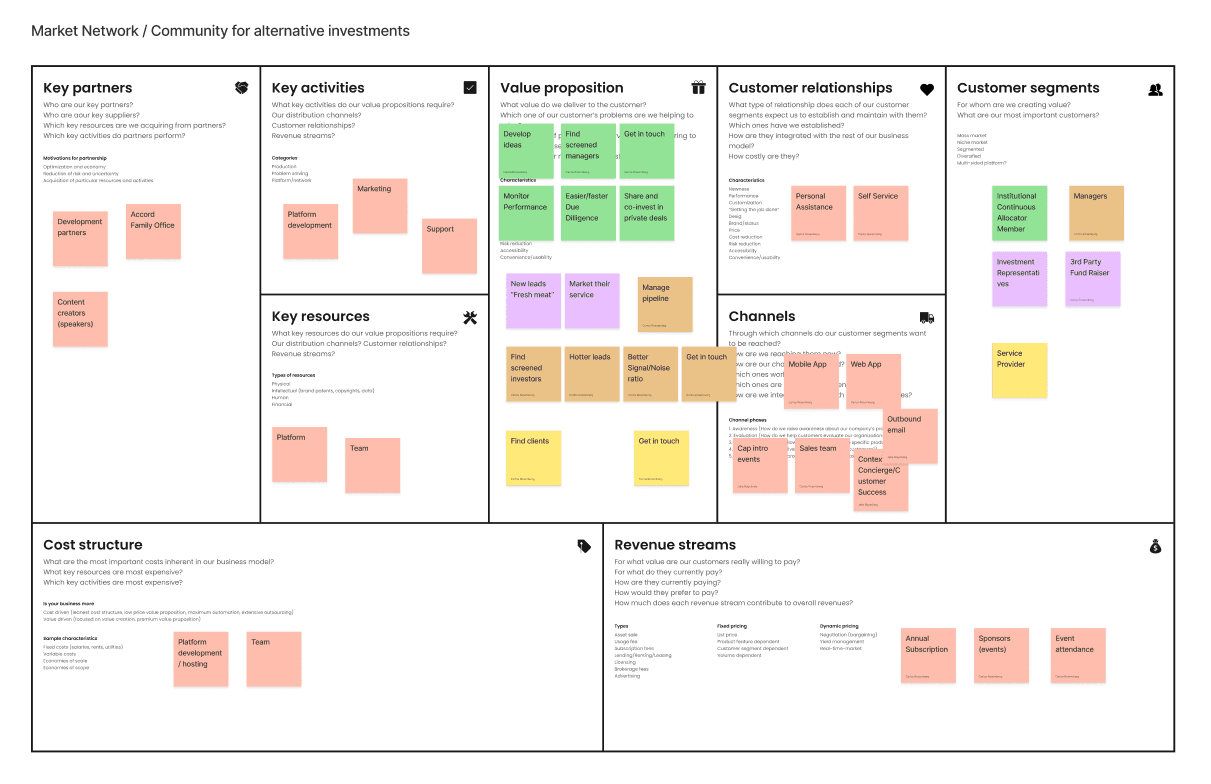

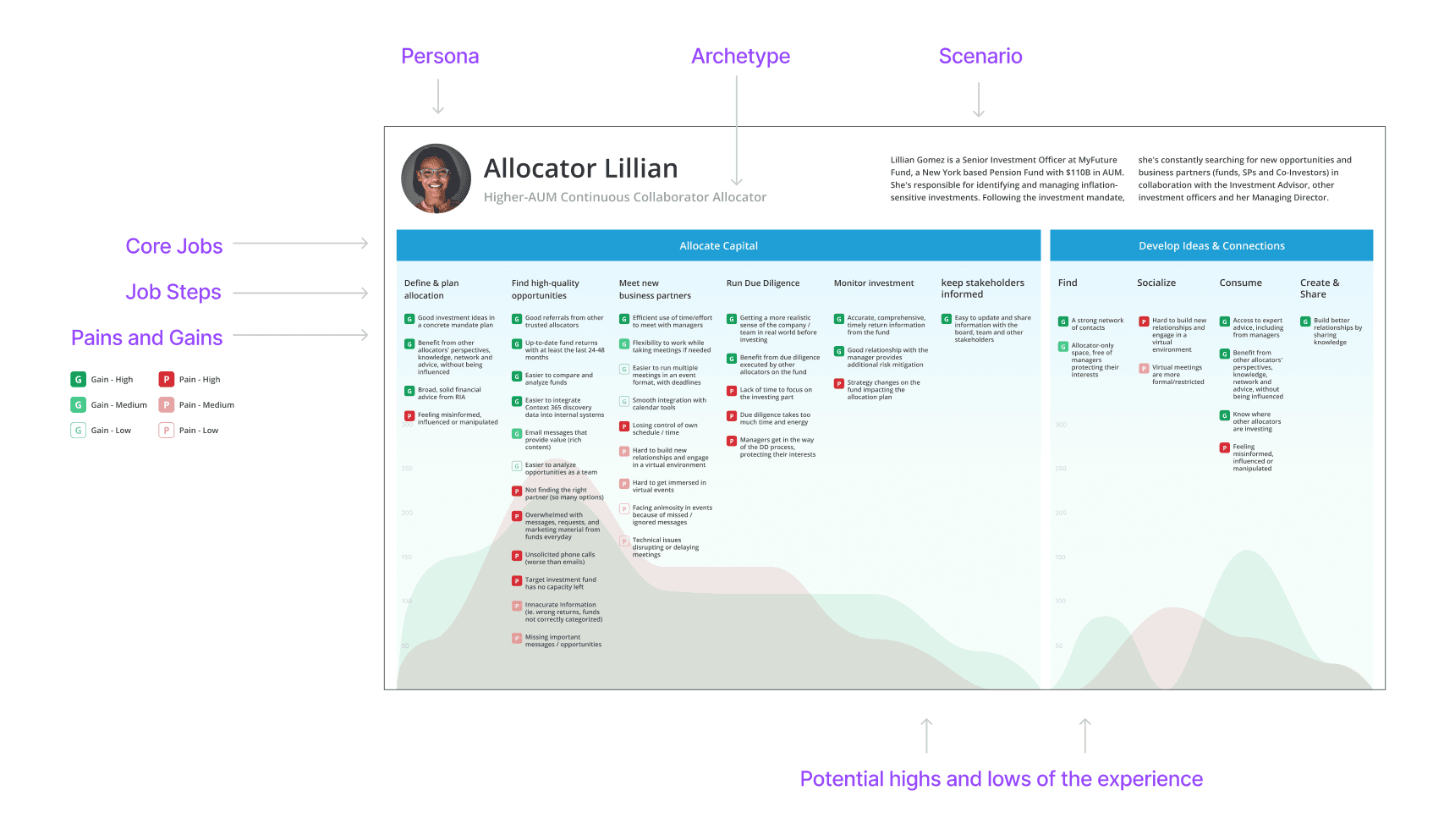

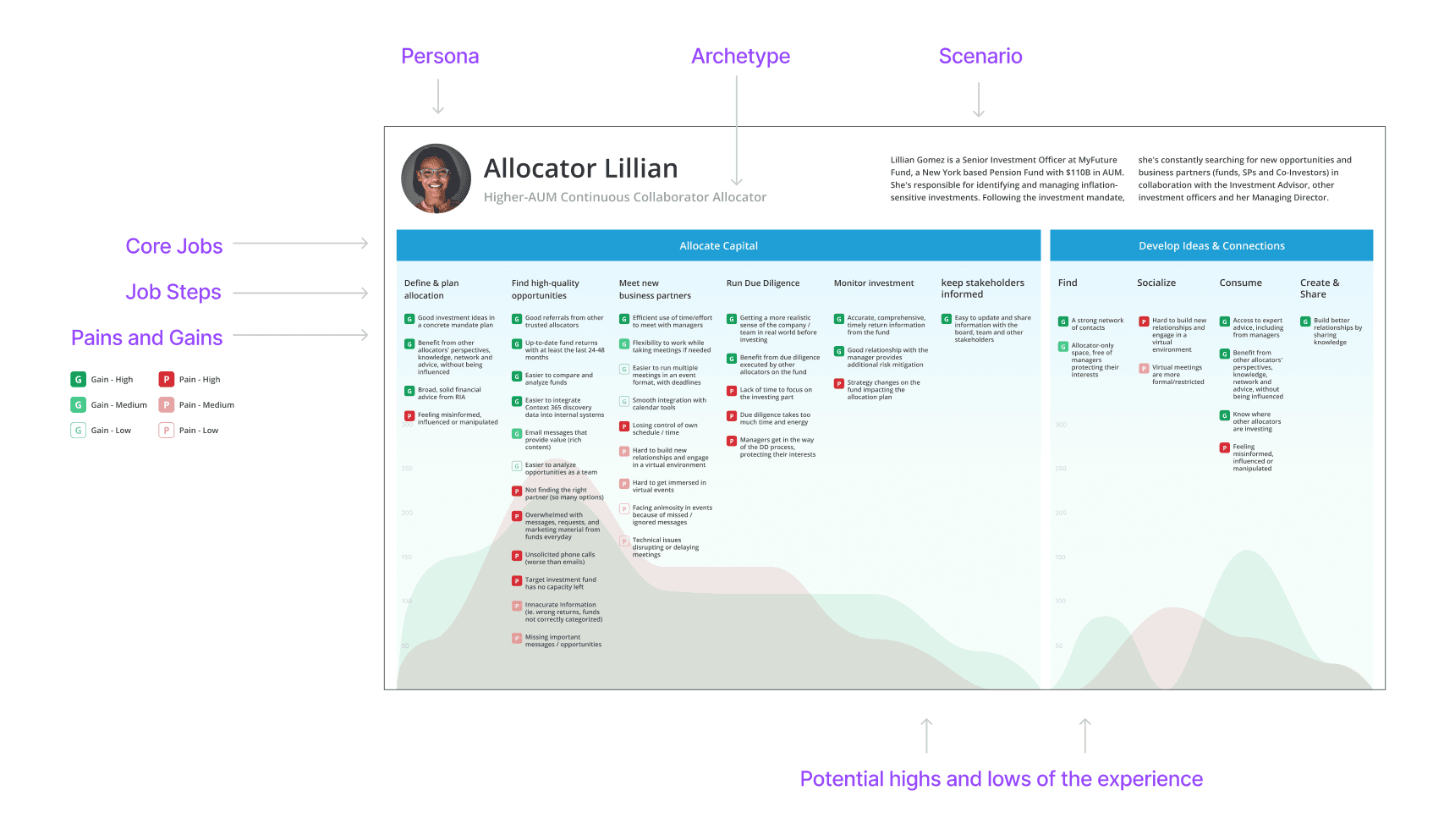

I’ve utilized persona archetypes, journey maps, flowcharts (*my favorite), interactive prototypes, business model canvases, jobs to be done, experience maps, roadmaps, PRDs, PRFAQs, design research repositories in my product development process.

Leveraging a variety of research methods and frameworks, I collaborate with colleagues to gather data, identify insights, and design effective solutions for customers.

Design Research & Strategy

jake

Let's collaborate.

jacobrogelberg [at] gmail.com

you

GUIDING PRINCIPLES

I help teams and clients design end-to-end

cross platform digital experiences that drive

revenue and smiles

I help teams and clients design end-to-end cross platform digital experiences that drive revenue and smiles

Move fast without

breaking things

Insane attention

to detail

Effective collaboration

and communication

Outcomes driven and

data-informed design

“

Carlos Rosemberg

UX Researcher, AI at IBM

Working with Jake was an absolute pleasure and a privilege. He possesses a rare combination of skills in product design, research, and product management, being able to navigate and handle end-to-end project responsibilities with ease in those areas. That is amplified with his extensive knowledge of the SaaS industry, and I was always impressed with his ability to connect small details in the user experience with high-stakes product strategy. On top of that, he is a natural leader with a genuine empathy for his team members, and his strong communication skills make working with him a breeze. If you're looking for someone who can take charge, build great products, and inspire a team, look no further, Jake is the perfect choice!

Kenneth Tsuji

Data Scientist, Cybersyn

I worked with Jake for three years and I wouldn’t hesitate to work with him again. He was a force multiplier on the development team by carefully scoping client needs, coordinating engineering work efficiently, and guiding us through several successful major feature launches. He empowered my own work as a data scientist by ensuring that the SAAS platform always collected clean data to beget even more data driven features.

Selected Work

Led implementation and maintenance of Context 365’s React design system.

Idea to production in

3 months

100% Usage across

designers and developers

Design System

Context 365

Case Study In-Progress

Onboarding Design

Treasure Finance

Landing Page Design

Glide

Graphic Design

Sounding Capital Partners

Concept Design

Common

+364%

Conversion Rate

Acquired by Apex Group

Redesign of the alternative investment platform, Context 365.

End-to-end Redesign

Context 365

Read Case Study

Application Design

Clarivate Analytics

Mobile App Design

Safehouse

Pitch Deck Design

Story Capital

Pricing Page Design

Linode

I’ve utilized persona archetypes, journey maps, flowcharts (*my favorite), interactive prototypes, business model canvases, jobs to be done, experience maps, roadmaps, PRDs, PRFAQs, design research repositories in my product development process.

Leveraging a variety of research methods and frameworks, I collaborate with colleagues to gather data, identify insights, and design effective solutions for customers.

Design Research & Strategy

jake

Let's collaborate.

jacobrogelberg [at] gmail.com

you

jake

Let's collaborate.

jacobrogelberg [at] gmail.com

you

GUIDING PRINCIPLES

I help teams and clients design end-to-end cross platform digital experiences that drive revenue and smiles

Move fast without

breaking things

Insane attention

to detail

Effective collaboration

and communication

Outcomes driven and

data-informed design

“

Carlos Rosemberg

UX Researcher, AI at IBM

Working with Jake was an absolute pleasure and a privilege. He possesses a rare combination of skills in product design, research, and product management, being able to navigate and handle end-to-end project responsibilities with ease in those areas. That is amplified with his extensive knowledge of the SaaS industry, and I was always impressed with his ability to connect small details in the user experience with high-stakes product strategy. On top of that, he is a natural leader with a genuine empathy for his team members, and his strong communication skills make working with him a breeze. If you're looking for someone who can take charge, build great products, and inspire a team, look no further, Jake is the perfect choice!

Kenneth Tsuji

Data Scientist, Cybersyn

I worked with Jake for three years and I wouldn’t hesitate to work with him again. He was a force multiplier on the development team by carefully scoping client needs, coordinating engineering work efficiently, and guiding us through several successful major feature launches. He empowered my own work as a data scientist by ensuring that the SAAS platform always collected clean data to beget even more data driven features.

Design Research & Strategy

Leveraging a variety of research methods and frameworks, I collaborate with colleagues to gather data, identify insights, and design effective solutions for customers.

I’ve utilized persona archetypes, journey maps, flowcharts (*my favorite), interactive prototypes, business model canvases, jobs to be done, experience maps, roadmaps, PRDs, PRFAQs, design research repositories in my product development process.

jake

Let's collaborate.

jacobrogelberg [at] gmail.com

you

jake

Let's collaborate.

jacobrogelberg [at] gmail.com

you